2 Healthcare S-REITs That Continue to Grow

August 21, 2023

In these uncertain times, many investors in Singapore like to be in more defensive sectors. One of those sectors is healthcare.

Within the Singapore REITs space, healthcare tends to be viewed as defensive because nursing homes, hospitals, and other healthcare facilities will continue to be in demand – no matter what the economic outlook.

Singapore’s healthcare REIT market continues to be relatively focused, with only two pure-play healthcare REITs listed on the Singapore Exchange (SGX).

However, both of them recorded solid H1 2023 share price returns in a rising interest rate environment.

According to SGX Research, Parkway Life REIT (SGX: C2PU) saw its shares fall just over 25% in 2022 but so far in 2023, its total return has been 5%.

The other healthcare S-REIT – First REIT (SGX: AW9U) – fell 6.4% in 2022 but so far this year it has delivered a total return of 4.9%.

Here’s what investors need to know about these two Singapore healthcare REITs and their growing portfolios.

Parkway Life REIT – Growing in Japan

Parkway Life REIT has been determined to continue growing its nursing home footprint in Japan, as evidenced by the five Japanese nursing homes it acquired in September 2022.

The REIT recently reported its H1 2023 results, which showed that new contributions from its Japan acquisitions, as well as better Singapore rental income, resulted in net property income (NPI) of S$70.1 million, which was up 25.1% year-on-year.

But what about that key figure; distribution per unit (DPU)? Well, thankfully for investors, that also saw a gain in H1 2023.

Parkway Life REIT’s H1 2023 DPU of 7.29 Singapore cents was a 3.3% increase from the same period a year ago.

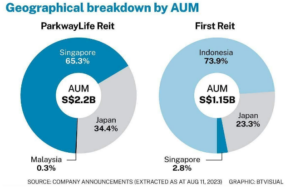

As readers can see from the below, the majority of Parkway Life REIT’s assets under management (AUM) remains in Singapore (65.3%) but Japan punches above its AUM weight with about 37% of the REIT’s revenue coming from the country.

First REIT – Developed markets growth focus

Meanwhile, Indonesia-focused First REIT (SGX: AW9U) has been proactively trying to shift towards more developed healthcare markets via its 2.0 Growth Strategy.

The REIT had no exposure to Japan as of the end of 2021 but its maiden acquisition of 12 freehold nursing homes in Japan – which was completed in March 2022 – kicked off consistent expansion in the country.

Today (as of 30 June 2023), First REIT has 14 nursing homes in Japan and in March 2023 it completed the acusition of local asset manager FRM Japan Management Co.

Management says this deal will support existing portfolio and future growth in Japan.

In terms of earnings, First REIT grew its H1 2023 rental income by 0.4% year-on-year to S$54 million. However, its DPU fell 6.1% year-on-year to 1.24 Singapore cents on the back of higher financing costs, currency translation impact, and a one-off increase in the unit base.

Yet management is committed to its shifting focus as it continues to aim to grow its developed markets portfolio to more than half of AUM by FY 2027.

Ageing populations and healthcare demand for S-REITs

In the Asia region, it’s no coincidence that both Parkway Life REIT and First REIT are focusing on growing their Japan portfolios given the rapidly-ageing population and lack of stay-at-home care available there.

Meanwhile, both REITs also have reasonable gearing ratios (both under 40%) which gives them ample headroom to grow their portfolios.

One other factor that isn’t widely discussed is how cheap debt remains in Japan, as it’s one of the largest economies globally that has relatively low interest rates.

With the supportive backdrop in Asia, that will continue to require care homes, both Parkway Life REIT and First REIT look well positioned to continue to grow their portfolios in the years ahead.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Parkway Life REIT.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.