■ The Dollar Index (DXY) continues to see decline after rejecting the 160.00 resistance level.

■ Despite a strong reversal, the DXY is likely to be supported at 103.86-104.10. Long-term targets remain at 109.49.

■ Sterling is the next winner after the Aussie dollar which saw strong upside against the US dollar. Both the Sterling and Aussie will continue to maintain upside.

■ The UK Election saw little changes to Sterling’s trajectory but may be reassessed in time to come. We remain bullish for the short-term for GBPUSD.

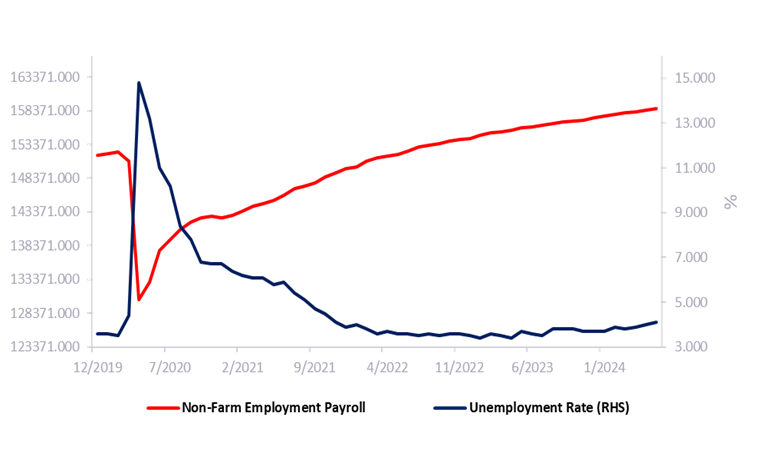

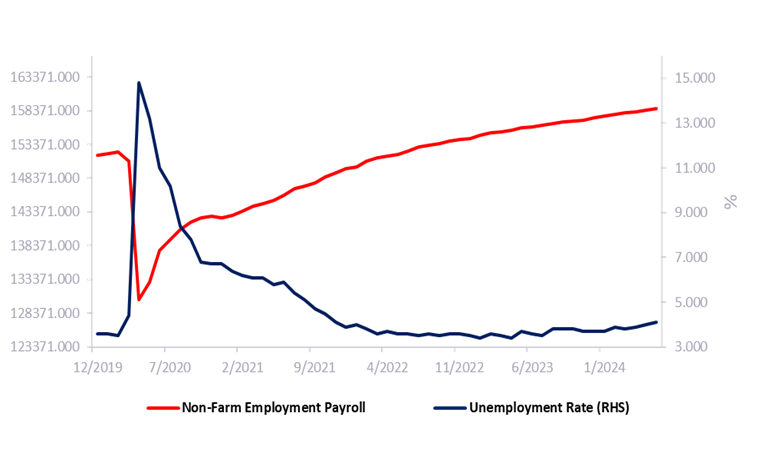

Dollar Index soften on overshadowed NFP and unemployment data

Nonfarm Payrolls (NFP) in the US rose by 206K in June, exceeding the market expectation of 190K but below May’s revised 218K (originally 272K). The Unemployment Rate increased slightly to 4.1% from 4%, and the Labor Force Participation Rate inched up to 62.6% from 62.5%. Average Hourly Earnings grew 3.9% year-over-year, down from 4.1%, matching market expectations. These figures have led the Fed swaps market to price in two rate cuts by year-end, though final decisions will depend on further labor market and inflation data.

Despite disinflationary pressure, Powell remains tight on possible rate cut

During Powell’s speech at ECB forum last week, he acknowledged the fact that the US’s inflationary pressure is making progress, and this cheers the market on Fed possible rate cut in September. However, Powell gave his usual answer on “we need more data to support a rate cut decision” This statement is in unison with most of the FOMC members. Nonetheless, the market sentiment is looking at a possible two rate cut before the end of 2024. While this may hold, our view is that the rate cut in September is likely to be 25bps if any and is only a symbolic cut to test the market reaction and support the looming theory of a presidential election.

Dollar Index technical outlook

We continue to maintain our view of a strong dollar over the longer period despite a failure to cross above the 106.00 resistance level. Near-term outlooks suggest that the bearish pressure will likely see further correction down toward our key support at 103.86-104.10 before attempting a strong rebound. Should the rebound come in strong, then the dollar is likely to resume its upside and target 106.80 in the mid-term. Breaking below 103.00 for two consecutive periods will signal a complete bearish reversal.

GBPUSD eyeing potential target at 1.2988 in the short-term

The GBPUSD sees some slight bullish pressure and the resistance at 1.2813 has been tested multiple times and may be weakened, increasing the probability of a break to the upside. Price action-wise saw the first confirmation signal of a bullish cup and handle formation after GBPUSD broke above the flag. Prices are trending above all Ichimoku indicators and the kumo (cloud) is bullish. Long-term MACD remains bullish and stochastic oscillator has yet to show any oversold signal. Hence, we maintain our short-term target for GBPUSD at 1.2988, and the longer-term target is at 1.3000. Key support is at 1.2515 and 1.2400. Major support is at 1.227.

GBPUSD eyeing potential target at 1.2988 in the short-term

AUDUSD has confirmed the upside after an expected break above the resistance at 0.6670 based on our previous report dated 1 Jul 24. Also, we are inching closer to our short-term target at 0.6784 and is likely to test higher target level at 0.6800. Key support remains at 0.6500 should there be any correction.

Figure 1: Dollar Index (DXY) – Bearish corrective pressure likely to continue but short-lived.

Figure 2: GBPUSD – Weakening resistance at 1.2813 suggest a further break to the upside.

Figure 3: Unemployment rate – Inching closer to 4.2% natural rate of unemployment.

Please refer to the disclaimer here.