Dollar Index (DXY) declined after disappointing employment data, Fed cut in September is raised

August 5, 2024

- The US Dollar declined after July’s disappointing jobs report, leading to heightened expectations of a rate cut in September. The Federal Reserve has signaled its willingness to respond to any signs of economic weakness if data continues to indicate progress. According to the CME FedWatch Tool, there is a 90% probability of a rate cut in September.

- The likelihood of a 50-basis point has increased from 25-basis points after the weaker than expected job report.

- The Yen continue to strengthen beyond 149.00 against the dollar, which has reached beyond our target dated 29 July 24 (Read here).

- The GBPUSD managed to rebound at 1.2750 support level as expected from our last week report (Read here). We expect the strength of the Sterling to continue going forward.

Dollar dips further on 4.3% unemployment rate, the worse figure in 3 years.

The July US jobs report strongly supports the case for Federal Reserve interest rate cuts, as it reveals widespread weakness. Non-farm payrolls grew by only 114,000, with a downward revision of 29,000 for the previous two months, compared to the consensus expectation of 175,000. Private payrolls increased by just 97,000, wage growth was a modest 0.2% month-on-month, the average workweek declined to 34.2 hours, and the unemployment rate rose to 4.3%, surpassing all market forecasts. This triggers the Sahm Rule, which indicates that a recession is likely when the three-month average unemployment rate increases by more than 0.5 percentage points over a 12-month period. While three 25 basis point cuts were already anticipated for this year, the market is now likely to expect one of these to be a 50 basis point cut. Treasury yields are dropping, and the dollar is weakening as the likelihood of a 3% Federal Funds rate next year becomes more plausible).

The 10-year U.S. Treasury yield surpassed the significant 4% mark for the first time since February, reflecting increasing pessimism about the U.S. economy. Initial jobless claims rose from 235,000 to 249,000, significantly exceeding the expected 236,000. The Federal Reserve had recently forecasted an unemployment rate of 4.0% by the end of the year, but given these figures, the risks appear more tilted toward 4.5% or higher by December. Amid the bond market rally, expectations for Federal Reserve rate cuts in 2024 have increased to 75 basis points, indicating that markets anticipate three 25 basis point cuts this year. With the first cut likely happening next month, the 2-year Treasury yield is expected to trend toward 4.0%, thereby reducing the inversion of the 2s10s curve. The accumulation of negative economic surprises in the U.S. suggests that lower yields remain the path of least resistance.

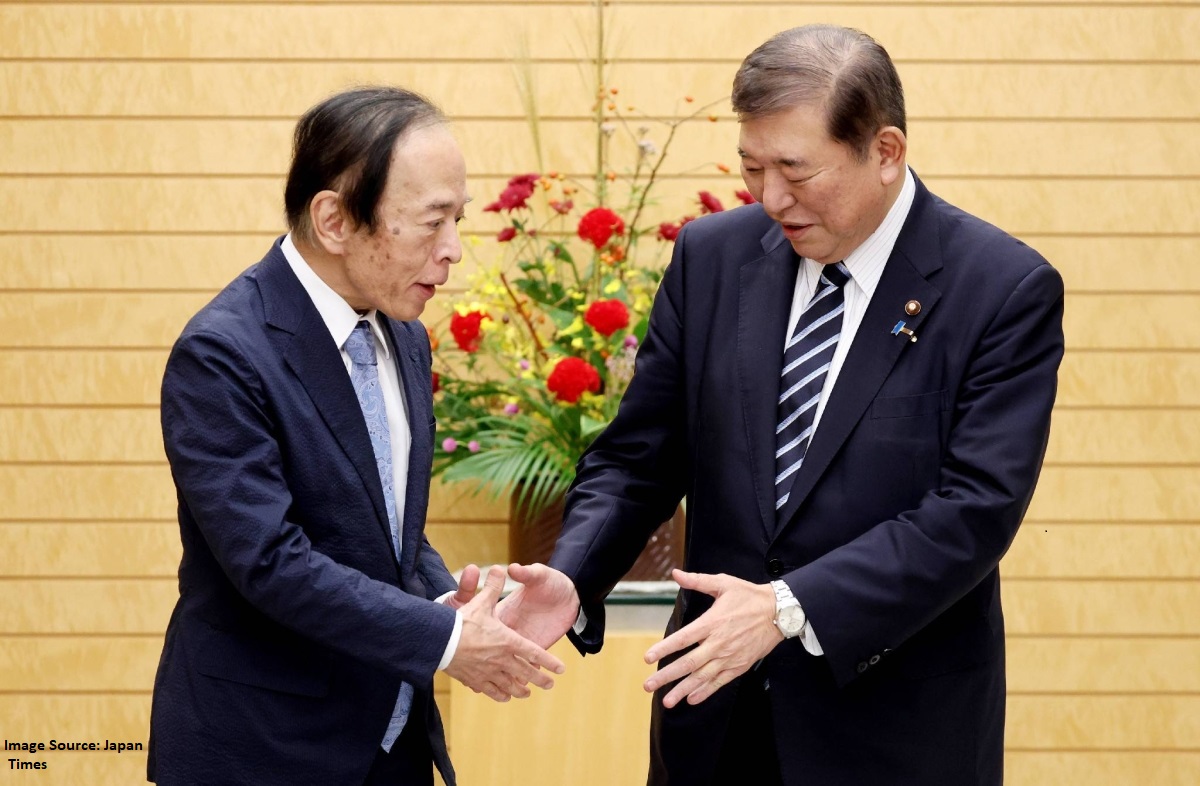

Bank of England – Rate cut expectation has come to past

The Bank of England has reduced interest rates by 25 basis points to 5%, marking the first cut of the current cycle, though it remains cautious about further reductions. Markets are expecting another 40 basis points of cuts this year, indicating the possibility of one to two more cuts. We believe the BoE has room for two more cuts as services inflation and wage growth are likely to improve. The most significant impact on the yield curve was at the short end, with the 2-year Gilt yield decreasing by approximately 13 basis points on the day. Compared to a week ago, markets now anticipate an additional cut over the next 12 months, reflecting a decline in yields similar to that seen in the US. However, the additional rate cuts being priced in contrast somewhat with the UK’s economic data, which has been more favorable compared to the US and the eurozone.

Technical outlook on DXY – In a bearish short-term trend, mid-term remain in a large consolidation between 101.00-106.00

The Dollar Index (DXY) has trended below 103.86 and given the momentum, we believe that the DXY will likely falls through and continue its downside move. Mid-term trend will consolidate, tilting towards the bearish trend based on the technicals. Below are the key pointers:

- Ichimoku has formed the three bearish death cross in sequence.

- Long-term MACD is showing a clear bearish signal over the longer-term period as the histogram has turned negative. The MACD/Signal line has performed a crossover at the top

- The stochastic oscillator continue to decline.

- 16-period directional movement index has confirmed the bearish trend.

Next likely support will be at 101.31 as the bearish pressure continue to be intensified.

Technical outlook on GBP/USD – Corrective stance, may see short term neutral price action, 1.2681 support to be watched

The GBP/USD has reached and rebounded at our previous outlook dated 29 July 24. However, price action indicate a neutral structure and there is a possibility that the sterling may have another round of correction targeting the lower bound support at 1.2681. Below are the key pointers to note:

- Ichimoku is showing signs of slight weakness after the leading Span A is attempting to cross below the Span B.

- Long-term MACD remain bullish

- The stochastic oscillator shows an overbought cross and has yet to dip below the 80-line, hence, we maintain a outlook of correction is a sign to buy on rebound.

- Directional Movement index is trendless at the moment..

Hold on to a buy at 1.2681 to 1.2750. The target will be at 1.3200 over the longer-term period. The trade will be invalidated should it dip below 1.2520.

Figure 3: Unemployment rate hits above key natural rate of unemployment at 4.3%

Sources: CGSI RESEARCH, CEIC

Please refer to the disclaimer here.

Chua Wei Ren, CMT

With over 12 years’ experience, Wei Ren is a market strategist who specialises in Technical Analysis and Macro Economics. Leveraging core price action trading strategy with classical technical analysis to spot market movements for entries and exits, he believes that historical data plays a pertinent role in how market prices would impact future trades. Wei Ren also writes for CGSi Trendspotter, a daily market outlook report that aims to identify trading ideas in Singapore, as well as China and Hong Kong’s equity markets. A seasoned presenter, he has been hosting live webinars since the start of his career as a market strategist and has been featured on various mainstream media platforms including The Business Times ‘Chart Point’ and Capital 95.8.

Stay ahead in the FX market.

Don't miss out on exclusive weekly insights and expert analysis. Subscribe now and be in control!