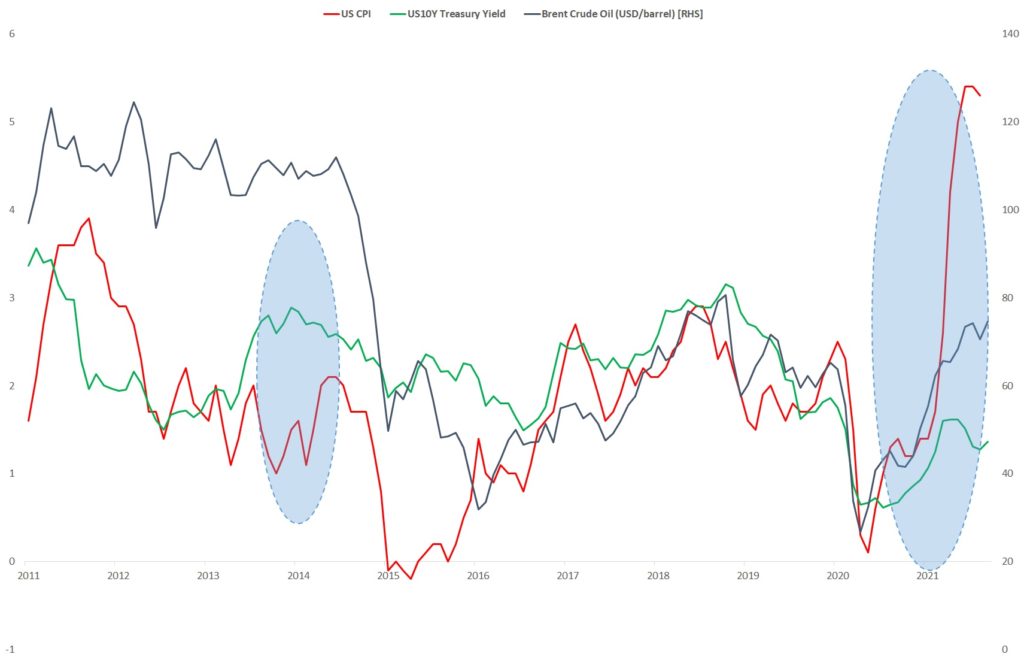

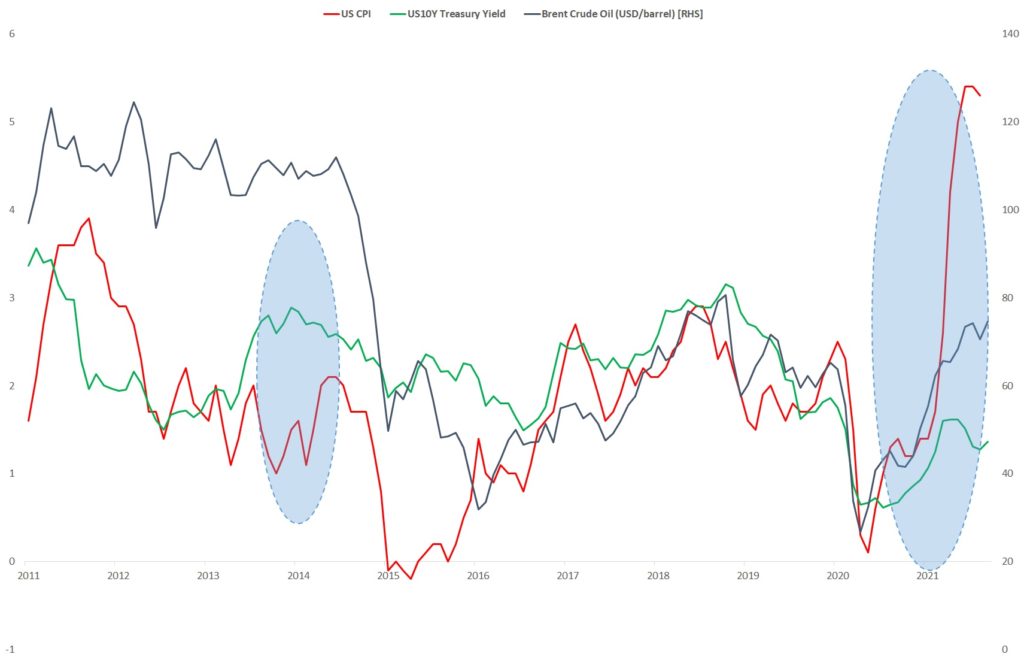

The price of Brent Crude oil has breached the US$80 per barrel level recently, hitting a three-year high in the process.

That has stoked speculation that global inflation might last longer than expected, forcing central banks to act.

The US Federal Reserve (Fed) has already signalled that it will soon unwind its bond-buying programme in November and that they are ready to raise interest rates in 2022.

The slightly hawkish tone was from a new policy statement and economic projections last week that showed nine of 18 Fed officials are ready to raise interest rates next year in response to the higher inflation seen recently.

However, unlike in 2013, the market appears to be more prepared for the tapering this time around and the “Taper Tantrum” that we saw in 2013 might not be as pronounced.

Reflationary trade back in focus

Persistent inflationary pressure (see chart) could lead to a faster pace of tightening by the Fed, which will put “reflation” investments top of mind for both traders and investors.

Cyclical sectors such as commodities, banking, energy, industrial and small-cap stocks will be the ones investors look to.

While some of these may gain momentum on the back of a rotation into “reflationary” trades, long-term investors need to bear in mind some of the structural issues these companies face.

For example, the oil & gas industry will continue to remain under pressure as the world shifts towards renewable energy.

The current surge in oil prices that we saw has more to do with the tight supply condition rather than on higher sustained demand.

Aside from that, the pandemic-hit losers, such as those in the tourism sectors, are expected to rebound as the world gradually returns to normalcy.

Meanwhile, COVID-era winners such as healthcare stocks, consumer staples and utility stocks might no longer be as attractive as they once were.

So far, tech stocks that have seen a sharp rally during the pandemic were among the biggest losers as the market reacts to the surge in the 10-Year US Treasury yield.

Uncertainty remains but focus on long term

While demand has so far been fuelled by the record amounts of fiscal and monetary stimulus, questions on whether this can be sustained will arise when government spending and the pandemic rebound fade away.

Aside from that, the risks of a resurgence of the COVID-19 Delta variant remains as developed countries with high vaccination rates are starting to see an increase of new COVID-19 cases.

It is unavoidable to experience some form of roller-coaster ride in our investments as the world adjusts to a “New Normal” in the post-COVID world.

Long-term investors need to identify the economic cycle but it is important to stay the course of their investment. The fundamentals of a company do not take a 180-degree turn simply because of an interest rate hike.

Source: Bloomberg, ProsperUs