5 Reasons to Buy Disney Stock After Earnings

February 10, 2022

Companies in the US have started releasing their latest quarterly earnings results. As confidence in the overall stock market is still fragile, it’s more important than ever for investors to focus on the fundamentals of businesses.

With that, the latest earnings from Walt Disney Co (NYSE: DIS) for the first quarter of its fiscal year (FY) 2022 has shown the resilience of its brand. Both sales and earnings easily beat analysts’ forecasts.

The earnings surprise was led by return of theme parks, an indication of how the reopening of international borders could boost its earnings going forward.

Another positive surprise was the surge in new subscriptions to its flagship streaming service, Disney+.

Is Disney on sale?

Depending on who you ask, you will get different answers, but Disney was the worst-performing Dow Jones component stock in 2021 – recording a loss of 13.9%.

This shows the lack of interest from investors to consider the Mickey Mouse company amid a surge in other growth companies at the time.

Undoubtedly, there are plenty of uncertainties that remain, given the highly infectious Omicron COVID variant. For example, Hong Kong’s Disneyland’s closure has now been extended to February 23.

Investors in Disney would probably have felt left out of 2021’s rally but to quote one of Disney’s acquired brands, Star Wars’ favourite character, Darth Vader:

“I find your lack of faith disturbing.”

Despite the uncertainties hanging over the reopening of the world, I believe Disney will eventually adapt to the “New Normal”, which is reflected in its latest earnings.

Here are five reasons why I think Disney stock is a good buy now.

1) Hybrid of growth and value

There are not a lot of companies that could say they can offer both growth and value but Disney is one of them.

The value is seen in its strong brand franchise and the sustainability of its Parks, Experiences and Products business segment.

The strong return to Disney’s theme parks, even when international borders remain closed, is a sign that the company is adapting.

Aside from that, its streaming efforts are only beginning to take off.

One of the big surprises in its latest earnings results was the number of new subscribers to Disney+, which came in at 11.8 million. That was well above the 8.17 million that Wall Street expected.

Disney+ has recently just confirmed 42-country summer launches across Europe, Africa and West Asia.

With the expansion into new geographies, where it already has a very strong brand name, I think this should generate ongoing strong growth in subscribers.

2) King of content

It is often said that “content is king”, and I think when one buys Disney, one has to look beyond the quarterly earnings.

Disney is about Mickey Mouse & Friends, Pixar, Marvel and Star Wars. It is a company that brings magic into reality for children and adults.

In the past, it was always the children but with the acquisition of Marvel and Star Wars, the company has captured the attention of adults too.

3) Return to theme parks

Personally, I’m a fan of Disneyland so that’s where my bias comes into play. But the recent earnings results do show attendance trends are getting stronger for theme parks.

In fact, it was up by double digits against the previous quarter at both Disneyland and Walt Disney World, and per-capita spending was up 40% year-on-year, amid higher spending on food, beverages and merchandise.

It has exceeded the pre-pandemic level and it’s impressive considering Disney is still struggling to manage attendance and park capacity due to the COVID-19 pandemic.

While it is too early to call for the end of the pandemic, governments around the world have shown a willingness to live with COVID.

It is worth noting that the latest earnings results continue to rely on domestic demand and better performance from international markets will be an additional bonus to the company.

4) Return to cinemas

The box office is coming back and the release of “Spider-Man: No Way Home” shows that Disney’s Marvel strategy works.

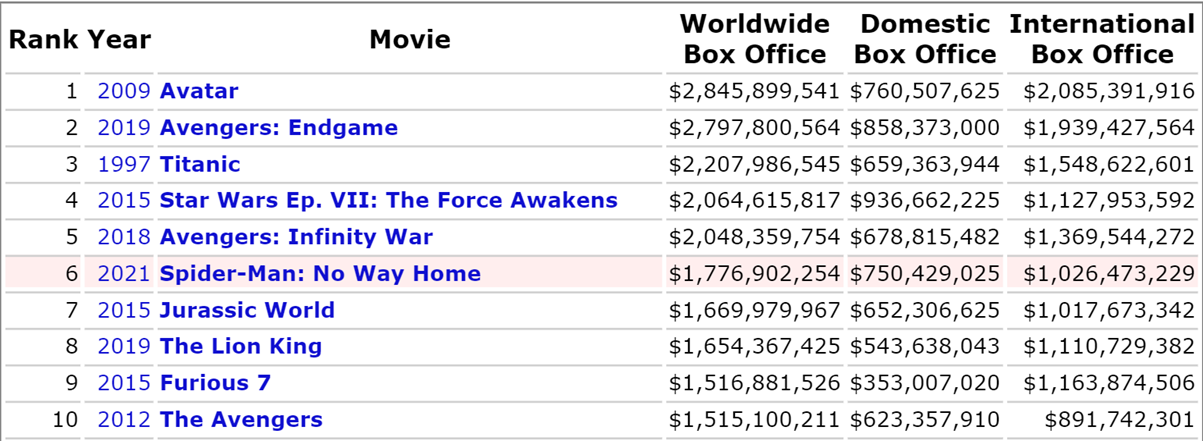

Despite the ongoing pandemic, “Spider-Man: No Way Home” raked in US$1.78 billion in the Worldwide Box Office and is in the top 10 of the highest-grossing movies of all time (see below).

Up next will be Marvel film, “Doctor Strange in the Multiverse of Madness”, which kicks off this summer.

Source: The Numbers, Nash Information Services

5) Disney+ has plenty of magic up its sleeve

The Disney franchise was late to the streaming business but Disney’s latest release of exclusive “Encanto” on its streaming platform, is proof that the company is following through its plan.

Encanto became the fastest title to hit 200 million hours streamed on Disney+.

There is also a list of upcoming releases including “Star Wars Obi-Wan Kenobi” series. Then there’s “Ms. Marvel”, “She-Hulk” and live-action “Pinocchio”, starring Tom Hanks.

While the streaming efforts were late, its content is catching up.

Focus on Disney’s greatest asset: Content

The upcoming second quarter earnings results could see a dip in its streaming business as 2022 could see heavy losses. This is as the content in the year ahead will require heavy spending.

While 2021 has not quite worked out for Disney, I believe a different story is set for 2022.

A shift towards “normal” would benefit Disney and with the foundation of its streaming platform setup during the pandemic, I suspect the Magic will be reflected in its share price.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.