Digital Core REIT’s Inaugural Earnings: What Investors Need to Know

April 25, 2022

For those of us who like to invest for dividends, Singapore real estate investment trusts (REITs) are one of the best ways to generate a passive income.

Recently, I wrote about the relatively downbeat earnings of data centre operator Keppel DC REIT (SGX: AJBU).

At the end of last week, the latest data centre REIT to go public in Singapore – Digital Core REIT (SGX: DCRU) – released its first earnings update as a public entity.

For investors who are bullish on data centre REITs over the long term, it was an interesting opportunity to compare Digital Core REIT’s quarter to Keppel DC REIT’s reported quarter just a few days prior.

So, here’s what investors should know about Digital Core REIT’s inaugural earnings update.

Solid revenue and profit generation

For Digital Core REIT’s first-quarter 2022 business update, management said that distributable income was 2% above its forecast (which was made when the REIT IPO-ed).

Revenue came in at US$26.5 million for the first quarter, broadly in line with management’s prior guidance.

However, property expenses came in around 12% below its guidance, at US$8.6 million for the period versus an expected US$9.8 million.

That fed down to the bottom line, which allowed distributable income attributable to unitholders to top US$12.1 million – 2% ahead of management’s Q1 guidance of US$11.9 million.

Stable portfolio metrics

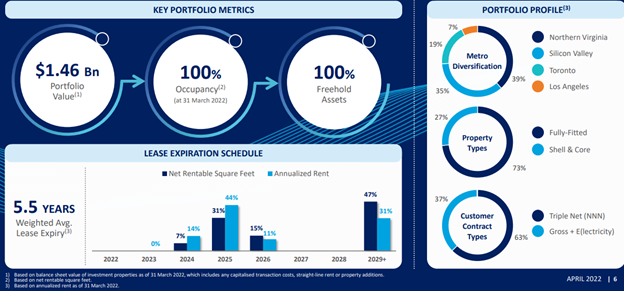

Meanwhile, on the portfolio side, Digital Core REIT maintained its strong profile. As of 31 March 2022, the REIT’s portfolio occupancy rate was 100% while its portfolio had a weighted average lease expiry of 5.5 years.

Even better, none of the REIT’s leases are up for renewal either this year or 2023, and only 14% of its leases (as a percentage of annualised rent) are up for renewal in 2024 (see below).

That gives Digital Core REIT investors an enviable amount of visibility in terms of the rental pipeline in the next few years.

The REIT has a gearing ratio of only 26% (well below the MAS cap of 50%) and that gives it ample headroom to make future acquisitions.

Source: Digital Core REIT Q1 2022 business update

Things to watch

While the majority of the latest metrics were undoubtedly impressive, investors should be cognisant of the fact that Digital Core REIT does possess a certain level of tenant concentration.

The REIT has a total of only 16 customers and the top two – listed as a Fortune 50 Software Company and a Global Colocation and Interconnection Provider – together make up 60% of its annualised rent.

Obviously, with only 10 data centres in its portfolio, Digital Core REIT will be looking to grow further by acquiring any of the 270+ data centres that its parent – Digital Realty Trust Inc (NYSE: DLR) – owns.

Having a global right of first refusal (ROFR) on these assets means Digital Core REIT can potentially expand into other markets besides where it’s concentrated right now (North America).

Finally, this should allow the REIT to both drive distribution per unit (DPU) growth and help reduce the tenant concentration risk of its current portfolio.

Digital Core REIT shares were down around 2% on Monday, at US$0.96, and based on its projected FY 2022 DPU payout of 4.18 US cents, the REIT is currently yielding 4.4%.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.