2 Singapore Healthcare REITs to Consider Buying in 2023

December 13, 2022

High inflation. Rising interest rates. Falling stock markets. It’s been an ugly 2022 for Singapore investors.

While Singapore’s broader stock market has held up relatively better than other indices, the city state’s REITs have suffered on the back of higher rates.

Having said that, there has been a dispersion between the performance of various REITs in Singapore.

While office and retail REITs have performed alright amid reopening demand, logistics and industrial REITs have underperformed on fears of a coming recession.

Speaking of recession, one of the best stock sectors to be in during times of uncertainty is healthcare – given its defensive qualities.

But what about healthcare REITs? Here are two healthcare S-REITs that have been acquisitive in Japan recently – given the country’s fast-ageing population – and which investors can consider buying for 2023.

1. Parkway Life REIT

The owner of the Gleneagles and Mount Elizabeth hospitals in Singapore, Parkway Life REIT (SGX: C2PU) has been a solid REIT performer over the past decade or so.

The REIT also owns a collection of nursing homes in Japan and has been adding to its portfolio there recently.

Parkway Life acquired five nursing homes in September of this year, with three in the Hokkaido region and two in the Greater Tokyo area.

The total purchase price paid for the Hokkaido properties was ¥2.56 billion (S$26.1 million) while those in Tokyo were acquired for ¥2.88 billion.

After the deal, the number of Japan nursing homes it owns will rise to above 60, with its tenant base spread across more than 30 nursing home operators.

All the Japan properties acquired have an overall net property yield of between 5.2-6.5% and a weighted average lease expiry (WALE) of 12.4 years.

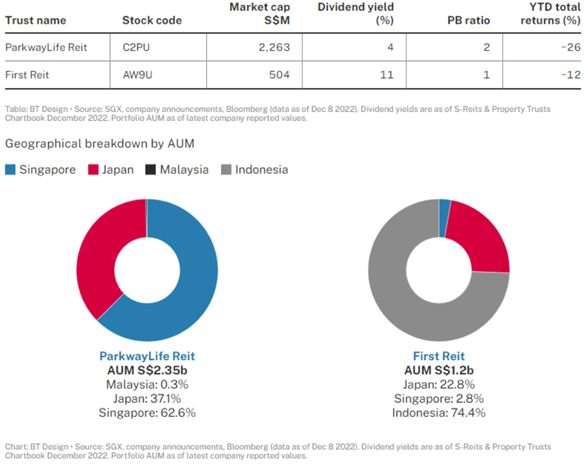

As readers can see below, Parkway Life REIT has a substantial portion of its assets under management (AUM) located in Japan. Investors should expect to see this grow over time.

2. First REIT

Second up we have previously Indonesia-focused First REIT (SGX: AW9U), which has tried to reinvigorate itself via its 2.0 Growth Strategy.

Part of that strategy has entailed looking at overseas markets in Asia for growth. Indeed, in March of this year, First REIT bought its first-ever property in Japan with the purchase of 12 freehold nursing homes.

It acquired these from its sponsor, OUE Lippo Healthcare. Then in September, it bought another two freehold nursing homes in Japan.

Currently, First REIT has 14 of its 32 healthcare assets in Japan and investors can also expect this number to rise.

That’s because management has been clear that it wants to target future acquisitions in developed markets, globally, with further potential acquisitions in Japan in the short term.

Longer term, other developed markets in Asia (like Australia) could have potential targets for First REIT.

With low debt funding costs (given low inflation in Japan) and a rapidly-ageing population that needs looking after, the country is a prime spot for further acquisitions by First REIT.

Following on from these deals, First REIT now has over 25% of its AUM in developed markets and it has stated to reach its ambition of over 50% of AUM in these markets by 2027.

Look to healthcare dividends

Singapore REITs in all sectors are facing headwinds as interest rates rise. However, even in this environment, it’s possible for REITs in specific sectors to still grow their portfolios profitably.

In the healthcare REITs space in Singapore, both Parkway Life REIT and First REIT are looking to grow their portfolios by riding structural trends that will play out over the next few decades.

Parkway Life REIT’s share price has fallen more this year than First REIT’s but its dividend and unit price have both been more stable over the years.

That goes some way to explain the higher dividend yield that First REIT offers (versus Parkway Life REIT) in order to compensate for the perceived higher risk.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Parkway Life REIT.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.