5 Reasons to Buy Apple Stock After Its First Earnings Miss Since 2016

February 7, 2023

The world’s largest company by market capitalisation, Apple Inc. (NASDAQ: AAPL), reported disappointing Q1 FY2023 results last week.

They not only missed analysts’ expectations but it was also the company’s first decline in sales since 2019.

Revenue fell 5.0% year-on-year (yoy) to US$117.2 billion while earnings per share (EPS) came in at $1.88, which fall short of Wall Street’s expectations of $1.94.

It was the first time Apple missed consensus estimates since 2016 and the largest decline in revenue since 2016 as well.

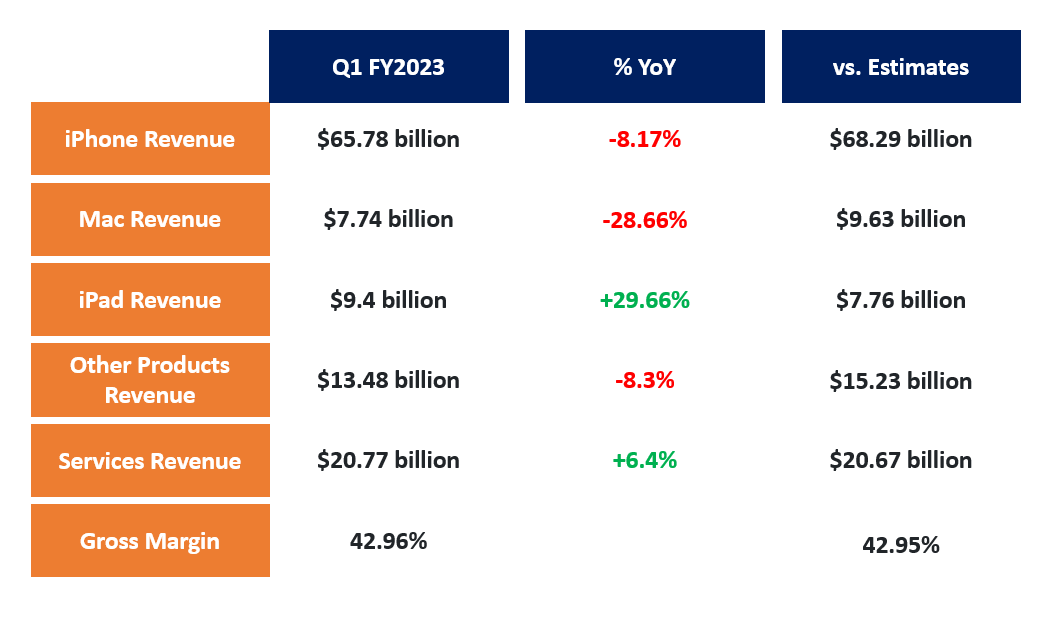

In fact, most of Apple’s business segments – with the exception of iPad and services revenue – had a bad start to FY2023.

Source: ProsperUs, Apple Inc’s Q1 FY2023 Financial Results

However, I believe investors should ignore the short-term noise given Apple’s long-term fundamentals.

So, here are five reasons why long-term investors should buy into Apple amid its first earnings miss in seven years.

1. Earnings miss mainly due to supply chain and strong dollar

One of the main reasons for the earnings miss in the Q1 FY2023 was due to the massive disruptive supply chain constraints.

With the reopening in China, the worst from the supply challenges is likely behind us.

Meanwhile, the strong US Dollar has severely affected performance of the iPhone maker.

Apple makes over half of its sales outside of the US so currency headwinds would have a significant impact on its financial performance.

To put it into perspective, the strong dollar weighed on the top line by around 8% in Q1 FY2023, meaning that Apple would still have reported slight revenue growth on a constant revenue basis.

Going forward, the impact of the strong dollar should diminish.

2. Positive guidance on iPhone sales and services

Apple has provided positive guidance for its March quarter with iPhone and Services expected to record growth.

Services revenue is expected to grow yoy but digital advertising and mobile gaming will continue to see weakness.

Meanwhile, with the supply chain issues now improved, Apple expects to see iPhone sales accelerate sequentially, although both iPad and Mac sales could still see double-digit declines on a yoy basis.

Another key factor to look at is that Apple expects to improve its gross margin to between 43.5% and 44.5%.

3. Apple’s growing customer base with more than 2 billion active devices

Apple has surpassed 2 billion active devices, including an estimated 1.2 billion iPhones.

This speaks to the enormous strength and growing customer base of the company.

During Apple’s earnings call on Friday, Apple’s CEO, Tim Cook, responded to a question in regards to the sustainability of the increase in iPhone prices.

Cook said that the iPhone has become “integral” to people’s lives, with everything from debit cards to health data to access to smart homes, and that people will “really stretch” to pay for the technology.

The strong customer base that surpassed 2 billion active devices reflects the loyalty of consumers towards the Apple brand.

4. Services revenue hit a record high

In line with the strong customer base, services revenue hit a record high of US$20.8 billion.

Apple shared that the number of paid subscribers for its various services topped out at 935 million users, represents an increase of 150 million compared to a year ago and four times as many as recorded five years ago.

Apple has been pushing its services growth for years and with the business now raking in US$20.7 billion in Q1 FY2023, it is Apple’s second-largest money maker behind the iPhone.

The high-margin services segment, which contributes about two-fifths of Apple’s operating profit in FY2022, continues to gain traction and is supported by the large customer base of Apple.

With further positive guidance provided by Apple’s management for the Q2 FY2023 quarter, this will support my investment thesis that Apple is transforming into more than just a hardware company.

In fact, the strong services revenue also reflects the loyalty of its customer base that remains in its ecosystem despite the higher pricing, in terms of devices and services as compared to other peers.

5. Looking beyond FY2023

While I expect to see a recovery in the following quarters, Apple’s earnings are not immune to a potential global recession.

In fact, given the cyclical nature of the hardware business, Apple will see a near-term impact in its earnings if the macro headwinds persist.

However, here are a few things that investors need to look at beyond FY2023 when it comes to investing in Apple.

Apple continues to grow at a rapid pace in emerging markets, such as India. The company is also gearing up to shift some of its production away from China and into India and Vietnam.

This will strengthen Apple’s overall supply chain in the long term.

Aside from that, Apple is also ramping up its plans to replace chips inside its devices with homegrown components, including dropping a key Broadcom part in 2025.

This will help to boost earnings over the long run, further improving Apple’s margin.

Buy Apple shares for its ecosystem and loyal customer base

In short, the near-term headwinds such as a strong dollar, supply chain issues and even a potential recession could hurt Apple’s earnings.

However, investors who are investing in Apple should look beyond FY2023.

Apple has successfully taken advantage of customers’ loyalty towards its brand, especially for the iPhone and has improved its services business.

The company has managed to replicate its success in various markets, including India (the latest).

With such a strong track record and robust financial position, investors should take advantage of the near-term market weakness to buy into the world’s largest company.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.