1 Clean Energy Stock to Buy That Gives You a 6% Dividend Yield

April 13, 2023

For the world to cut down on carbon emissions and reach the “Net Zero by 2050” goal, it’s going to require up to US$10 trillion in annual infrastructure investment – according to McKinsey.

That’s a lot of money. So, for investors, it might make sense to try to be a part of this transition.

How would we do that? One of the best ways would be to buy and hold the actual owners and operators of these clean energy assets.

That’s because they benefit directly from the low costs of generating renewable sources of energy – like solar or wind power – which they can then sell on to companies.

As a result, many of these clean energy firms have stable cash flows and are able to pay out consistent dividends to shareholders.

With that, here’s one clean energy stock that’s riding the tailwinds of this renewable energy transition and which also provides investors with a 6% dividend.

Global clean energy portfolio powering growth

For investors, Atlantica Sustainable Infrastructure PLC (NASDAQ: AY) is an owner and operator of global energy-generating assets.

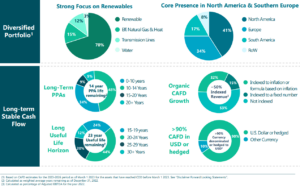

It owns assets that generate 2.2 gigawatts (GW) of power from renewable sources. The firm also owns 1,230 miles of transmission lines, 398 megawatts (MW) of efficient natural gas power and 17.5 million cubic feet (Mft3) per day of water assets.

Yet its business is geared towards sustainable solutions, with around 75% of its total revenue in 2022 stemming from renewable sources.

In terms of its geographic split, 85% of Atlantica’s overall revenue in 2022 came from North America and Europe, with the remainder coming from Latin America.

Visible cash flows

The great thing about companies like Atlantica is that they have what’s called “power purchase agreements”, known as PPAs for short.

These give corporate offtakers of the power – basically large companies that buy the clean energy for use in their buildings or premises – the flexibility and visibility on pricing.

As for the providers, like Atlantica, they know exactly what they’re going to earn from customers. As you can see below, for Atlantica’s portfolio nearly two-thirds of its PPAs are in the range of 10-20+ years.

Source: Atlantica Sustainable Infrastructure Investor Presentation, March 2023

Meanwhile, growth is built into these contracts by having nearly half of the PPAs either indexed to a fixed number or indexed to inflation.

As for its results in 2022, FX-neutral revenue (and excluding non-recurrent projects) was up 2.9% year-on-year to US$1.1 billion.

Meanwhile, its cash available for distribution (CAFD) – a key metric for utilities in clean energy – was up 5.5% year-on-year to US$237.9 million.

As for operating cash flow in 2022, that was even better with a 16% year-on-year increase to US$586.3 million.

For 2023, management is forecasting CAFD of US$235-260 million, implying 4% year-on-year growth of CAFD at the mid-point of guidance.

Structural tailwinds behind it

While the company has the assets to be profitable, it’s also working on its development pipeline.

Basically, these are the assets currently being developed that are not fully operational and earning money just yet.

On that front, Atlantica has 2 GW in renewable energy projects in development with another 5.6 GW hours (GWh) of storage capacity.

Indeed, the company has said it’s concentrating on North America for its future development plans given the passing of the Inflation Reduction Act (IRA) in the US last year.

The US$433 billion spending act is not that much to do with inflation. That’s because it earmarks US$369 billion of that amount for energy security and climate change – done through a mix of subsidies and tax credits.

Out of its 2 GW renewable energy in development and 5.6 GW storage capacity in development, 1 GW and 4.1 GW is in the US, respectively.

Stable debt profile and preferable dividend

On the liquidity and debt front, Atlantica has a lot of flexibility. For corporate liquidity, the company has US$446 million available – plenty of funds to expand further (see below).

Source: Atlantica Sustainable Infrastructure Investor Presentation, March 2023

Meanwhile its corporate debt is well spread out. This is key because clean energy asset owners – similar to REITs – use debt to grow and expand their portfolios.

In this sense, the average maturity of Atlantica’s debt is 4.2 years and there are no sizeable chunks of debt that need to be refinanced until 2026.

Moving to Atlantica’s dividend, it pays out a quarterly dividend per share of US$0.445. That has grown at a compound annual growth rate (CAGR) of around 7% over the past eight years.

However, more recently, its dividend growth has been slower – around 3.7% CAGR over the past five years.

It makes up for that slower dividend growth with a higher dividend yield. Currently, Atlantica Sustainable Infrastructure shares give investors a 6.4% yield.

Finally, because Atlantica is domiciled and headquartered in the UK, the dividend withholding tax will be preferable (versus the 30% imposed on US-domiciled stocks) for individual investors.

Growing sustainable income

Overall, Atlantica Sustainable Infrastructure offers investors a great way to both get exposure to the clean energy transition and earn a decent dividend.

With revenue coming from multiple sources and a preferable dividend withholding tax, this stock could fit nicely into any long-term portfolio focused on quality growth and income.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.