2 Key Charts from Keppel REIT’s Latest Q1 2023 Results

April 24, 2023

We’re getting into the thick of Singapore’s earnings season with a slew of first-quarter numbers coming this week and next.

Last week, though, was the turn of commercial-focused Keppel REIT (SGX: K71U). The REIT owns 12 commercial properties – worth a combined S$9.1 billion – across Singapore, Australia, Japan, and South Korea.

It owns some big grade-A office properties that many of us in Singapore will be familiar with, including interests in One Raffles Quay, Marina Bay Financial Centre, and Ocean Financial Centre.

So, for REIT investors, this was a great opportunity to see how the commercial REIT sector may be faring.

Here are two key charts dividend investors in Singapore should know about from Keppel REIT’s latest earnings.

1. Positive rental reversions on strong leasing

Source: Keppel REIT Q1 2023 earnings update

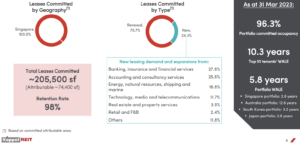

One of the most positive takeaways from Keppel REIT’s earnings was the fact that it managed to lease or renew 205,500 square feet of space.

This was done mainly in Singapore and at an attractive positive rental reversion of +9.3%. As investors can see from the above, new leases accounted for 24.3% of the demand.

Big contributors to this included banking, insurance and financial services, as well as accounting and consultancy services.

Management did say that tech tenants at its properties have not returned space at present. It also added that it’s negotiating new contracts for vacant spaces in Singapore and Australia.

If these negotiations turn out positively, then that should boost portfolio occupancy.

In Q1 2023, Keppel REIT’s net property income (NPI) was S$57.7 million, up 5.9% year-on-year.

2. Over 7% of leases expiring for remainder of 2023

Source: Keppel REIT Q1 2023 earnings update

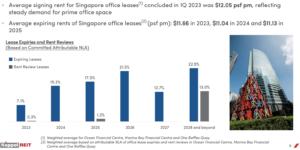

For investors in REITs, it’s important to understand their leasing profile and when leases come up for renewal.

In Keppel REIT’s case, it has around 7.4% of leases either expiring or up for rent reviews for the remainder of 2023.

For the expiring Singapore rents, the average in 2023 is S$11.66 and S$11.04 in 2024. That’s important because Keppel REIT’s Singapore properties make up just shy of 80% of the value of its portfolio (as of 31 March 2023).

Management also updated investors on its Blue & William property in Sydney, which should start contributing positively to the REIT’s income after its completion on 3 April 2023.

Solid metrics but headwinds remain

Overall, it was a relatively in-line quarter for Keppel REIT. Its gearing ratio stands at 38.7% (as of 31 March 2023) and it has an all-in interest cost of 2.86%.

Management continues to foresee the all-in interest cost to trend upwards to closer to 3%.

The company could continue to benefit from the strong demand for grade-A office space in Singapore.

Yet REIT investors should also remain wary of the financing cost for Keppel REIT as well as the dangers from a potential global recession – which would negatively impact commercial real estate demand in its markets.

Investors are being “paid” a decent premium on this front, though, with Keppel REIT shares offering dividend seekers a 12-month forward dividend yield of 6.6%.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.