Should You Buy Alibaba’s US or Hong Kong Shares?

January 12, 2021

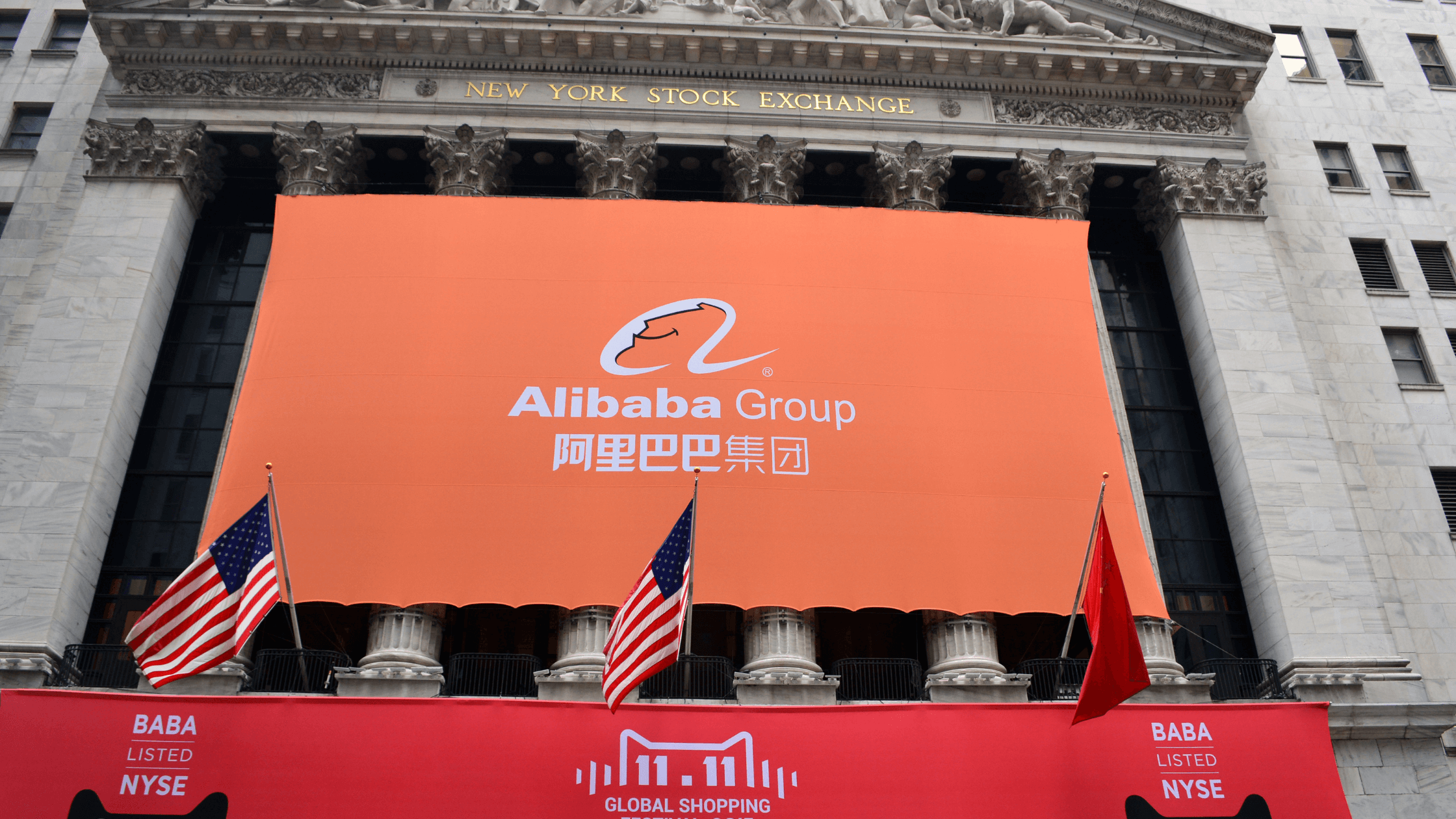

Alibaba Group Holding Ltd (NYSE: BABA) (SEHK: 9988) made a big decision back in 2014 to carry out its IPO in New York.

Back then, the Hong Kong Stock Exchange did not permit dual-class shares – effectively ending the prospect of Alibaba listing in the city.

Dual-class shares is a structure that is common among technology companies as it gives the founders ultimate control via special shares that carry a multiple of the voting rights of ordinary shares.

That was what Alibaba’s founder and then-CEO Jack Ma was looking for when searching for a listing destination. New York’s stock exchange fitted that bill.

Alibaba eventually listed its shares in the US. Also known as American Depositary Receipts (ADRs), which is the name for shares of foreign-based companies listing in the US, Alibaba priced its IPO at US$68 per share.

That was followed up five years later by a Hong Kong listing as the company sold shares on the Hong Kong Stock Exchange in November 2019 (after a change of the rules concerning weighted voting rights).

Now that Jack Ma is in the bad books with Beijing following the failed IPO of Alibaba-owned Ant Group, Alibaba shares have taken a beating recently.

Yet I think Alibaba will be just fine over the long term given its dominant position and integral role in the Chinese economy.

The key question is actually something different: should investors buy Alibaba’s US-listed or Hong Kong-listed shares?

Better liquidity in the US

One big issue for investors is the liquidity (or daily turnover) of a stock in the market. If it’s a large cap stock like Alibaba, this allows investors to be able to trade larger amounts at a better price than if turnover was lower.

That’s because lower turnover means the price movement of a stock isn’t as active – resulting in a vicious cycle where low turnover can often lead to a stock trading sideways over the long term (i.e. staying static).

For Alibaba, its ADRs in the US offer investors better liquidity – mainly because the majority of its public shares are there.

Only around 22% of Alibaba’s public shares are traded via Hong Kong with the remainder traded in New York.

However, that percentage is on an upward trend over the longer term and that’s down to one key reason.

Political tensions between China and the US

One risk that probably didn’t arise back in 2014 when Alibaba listed in the US was the threat of geopolitical tensions.

These have clearly risen in recent years on the back of a more aggressive stance on trade towards China, the launch of the US-China trade war and multiple sanctions from the US government on Chinese companies.

These tensions are not going away, even with an incoming US President Biden. The realisation that China is now a strategic threat (rather than partner) is one of the only issues that both political parties in the US can agree on.

What’s the upshot for investors? For those who are wary of a severe escalation in tensions, it makes complete sense to accumulate its Hong Kong shares.

Hang Seng addition and Stock Connect

One key benefit of Alibaba’s Hong Kong shares, which is less discussed, is the fact that it is now a part of both the Hang Seng Index and relatively-new Hang Seng Tech Index.

Meanwhile, given it’s such a huge stock on the Hong Kong exchange (and despite being overlooked recently), it’s also only a matter of time before Alibaba is included in the Hong Kong Stock Connect.

This is the programme that allows investors in mainland China to purchase key listed stocks in the Hong Kong stock market.

This will enable mainland China investors, who can’t access Alibaba’s ADRs due to caps on capital outflows, to invest in a piece of one of China’s leading technology companies. No doubt, this will be done via its Hong Kong-listed shares.

One thing to keep in mind for investors is that you’re able to buy just one share of Alibaba in the New York listing if you want, which costs approximately US$225.

However, in Hong Kong, due to the “lots” system of stock trading, one lot for Alibaba amounts to 100 shares, which means the minimum amount you’d have to invest is HK$22,300 (US$2,875).

Where to next for Alibaba stock?

Although Alibaba’s US ADRs offer investors better liquidity and the monetary barrier to buying them is lower, the inevitable long-term trend is for the Hong Kong shares to gain more clout as investors switch out of the US and into Hong Kong.

The opportunity for mainland China investors to also own a piece of Alibaba bodes well longer-term for its shares in Hong Kong (given the city is the natural home for Chinese listings).

Long-term stock ownership is still a relatively new concept in China and as investors become more familiar with buying and holding quality companies over the long term, Alibaba will be one of the key beneficiaries.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Alibaba Group Holding Ltd.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.