4 Reasons Inflation is Rising Now

February 9, 2022

Inflation is quickly emerging as a key risk for this year and market participants will pay attention to the upcoming US Consumer Price Index (CPI) inflation report on Thursday.

In December, the CPI data climbed 7% Year-on-Year (YoY), the largest increase since 1982. This has led to a big change in the tone for the US Federal Reserve (Fed).

Throughout most of last year, the Fed chairman, Jerome Powell, and other Fed officials have called inflation as “transitory” but has since ditched the term towards the end of last year.

What is Driving US Inflation Now?

Here are some of the four key factors that have kept inflation high so far.

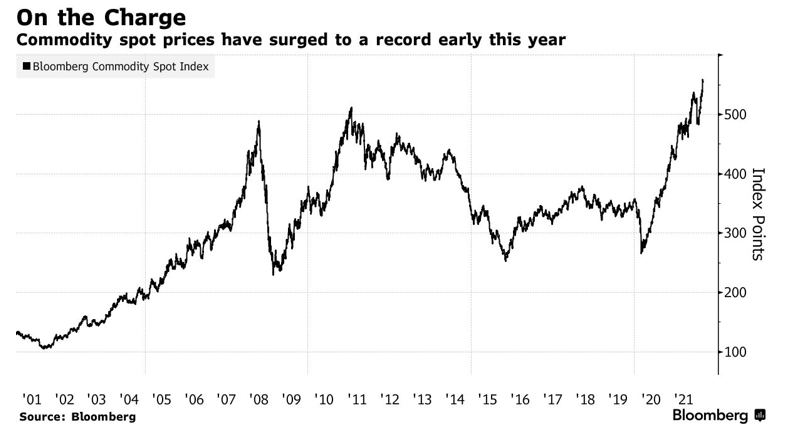

1) Rising Commodity Prices

One of the key factors that have kept inflation high is the rising commodity prices. The Bloomberg Commodity Spot Index (below), which tracks 23 energy, metal and crop futures, has touched a record this year.

The increase has been driven in part by surging oil prices, which have hit their highest level since 2014. Oil prices have breached the USD90 level this year. A lack of production capacity and limited investment in the sector has led to the sharp increase in oil prices.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, are gradually relaxing output cuts implemented when demand collapsed back in 2020.

However, many small suppliers would require longer gestation period to restore production while others remain wary of the renewed COVID-19 setbacks.

2) Supply Chain Disruptions

The supply chain issues continue to drive prices higher. Let’s look at the automotive industry as an example. In 2020 when the world economy went into recession, used cars and trucks have become more expensive instead of cheaper.

This is mainly due to the limited supply as production was affected. While production has resumed since 2021, the ongoing chip shortage has led to delay in deliveries.

Meanwhile, on the demand side, there is a sudden surge for automobiles today, led by people who have put off buying cars last year. A similar situation seen in other industry as businesses gradually adjust to the reopening of the economy.

3) Base Effects

Base effects are more intuitive as the reopening of borders would push prices higher in certain industries that have been severely affected by the pandemic.

For example, airfare costs, hotel rates and the services prices.

In 2020, airfare costs plummeted by close to 50%. By 2021, we saw a jump of 21% Year-on-Year (YoY) prices just because we saw some people buying tickets.

As the world gradually reopens, this will keep prices higher on a YoY basis in 2022. The pace of increase on the base effect however would not be as significant as what we saw in 2021.

4) Labour Issues

The shortage of labour in America is another factor that has led to higher prices in US. During the COVID recession, tens of millions of Americans lost their jobs.

While employment has picked up recently, more Americans are reluctant to return to the workforce. Part of this is due to the concern over the emerging Omicron variant in US.

Businesses continue to have a difficult time hiring enough workers to satisfy demand in 2022 although the latest data showed improvement. This has however led to a surge in wages.

Average hourly earnings rose 0.7% in January, the most since the end of 2020, and 5.7% from a year ago.

Return to Normal Requires Inflation to be Higher for Longer

While ongoing supply chain shortages, labour issues, and rising commodity prices will continue to keep inflation higher for longer, I believe it is a case of adjusting towards normalisation.

The world has been severely disrupted by the impact of COVID-19 pandemic on all front and it will require inflation to remain higher for longer as we return to normal.

Reopening of international borders would keep services prices higher while spending would shift from goods to services, allowing supply chain issues to gradually resolve.

While the higher inflation would fan concerns among investors over the pace of tightening by the US Fed, it could also open opportunities for investors to unwind some of their risky bets into value stocks.

One thing is certain: the upcoming CPI data on Thursday will be vital to see how quickly the world can adapt to the new normal.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.