Exchange-Traded Funds (ETFs) have become increasingly popular among investors due to their low costs, transparency, and flexibility. Combining the benefits of stocks, unit trusts, and index funds, ETFs offer a compelling investment option.

Growth of Retail Investors in the ETF Market

According to a study published in “Retail ETF Investing” by academic and researcher David Gempesaw and his team, retail investor trading volume in ETFs more than doubled from 2010 to 2021, averaging $5.8 billion per day over the full period. This trend highlights the increasing preference for ETFs among individual investors.

The daily dollar volume of retail‐identified ETF trades more than doubled from 2010 to 2021

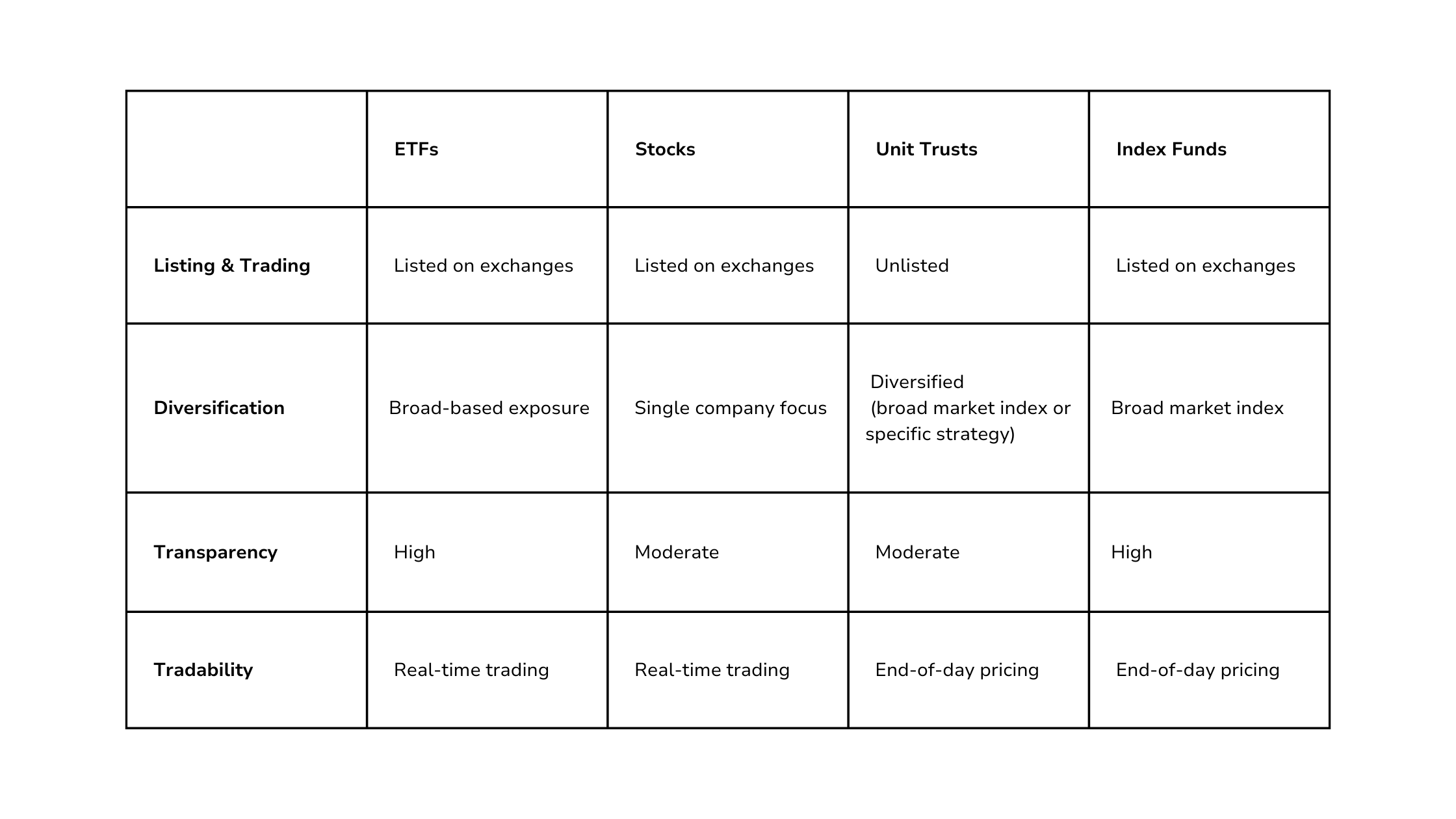

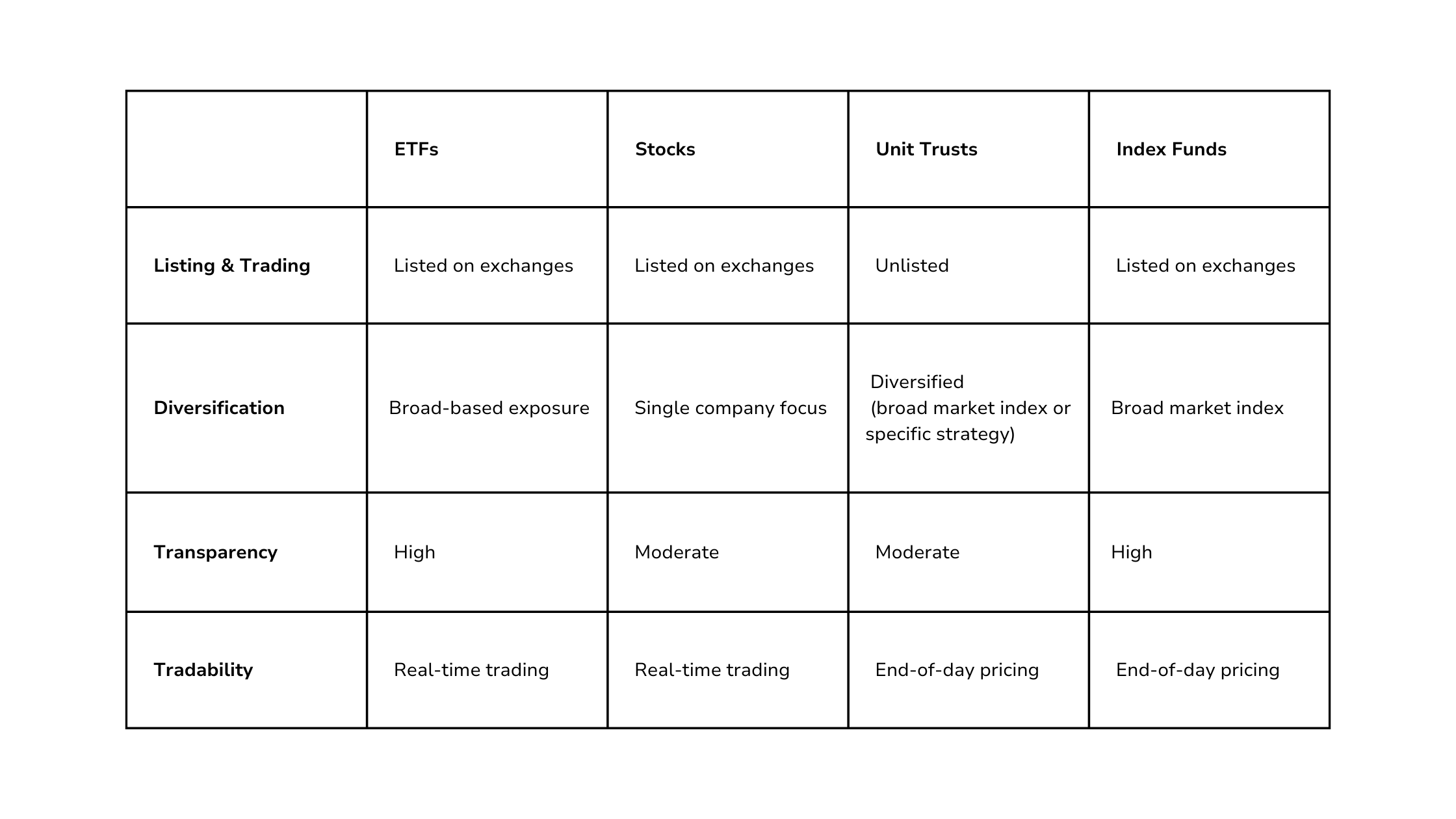

Key Differences Among Investment Vehicles

ETFs vs. Stocks

Both ETFs and stocks are traded on stock exchanges, allowing for familiar trading techniques like stop-loss orders, limit orders, and margin purchases. However, ETFs provide diversification by holding a basket of securities, such as entire indices or specific sectors, through a single trade. On the other hand, buying shares of individual companies provides exposure only to those specific companies.

For example, an ETF tracking the Straits Times Index (STI) includes constituent stocks from various sectors, providing efficient diversification in a cost-effective manner. This makes ETFs accessible to investors with smaller amounts of capital who seek diversified investments.

ETFs vs. Unit Trusts/ Mutual Funds

ETFs and unit trusts (or mutual funds) are both managed by professional fund managers and offer similar levels of diversification. However, ETFs provide greater transparency by publishing their holdings daily, allowing investors to see exactly what they own.

ETFs also offer superior tradability, allowing investors to enter and exit positions at any time during trading hours at real-time market prices. In contrast, unit trusts have a fixed portfolio structure defined by the fund manager and can only be transacted at end-of-day prices through agents.

Additionally, ETFs are cost-effective due to their low expense ratios while unit trusts come with higher costs due to their active investing approach. Unit trusts often have sales charges, as well as entrance and exit fees. ETF transactions incur brokerage fees, clearing fees, and stamp duty. Moreover, ETFs tend to have lower capital gains distributions compared to unit trusts due to their passive tracking of an index.

ETFs vs. Index Funds

Both ETFs and index funds aim to replicate the performance of a specific market index, offering broad market exposure and low costs. However, they differ in trading flexibility and liquidity. ETFs are traded on stock exchanges and can be bought or sold throughout the trading day at market prices, while index funds can only be purchased or redeemed at the end of the trading day at the fund’s net asset value (NAV).

ETFs often have lower minimum investment requirements compared to index funds, making them more accessible to smaller investors. Additionally, ETFs tend to be more tax-efficient due to their structure, which allows for in-kind redemptions that minimize capital gains distributions.

Conclusion

ETFs represent a highly attractive option for building a diversified portfolio. Their combination of low costs, high transparency, and flexibility makes them suitable for both novice and experienced investors. With their real-time trading capabilities, lower minimum investment requirements, and superior tax efficiency, ETFs offer a practical and effective means of achieving long-term financial goals. While advantageous, investors should be mindful of risks such as market volatility, liquidity fluctuations, and potential tracking errors.

Disclaimer: ProsperUs Manager of Content Hailey Chung doesn’t own shares of any ETFs.