Broadly speaking, stocks have had a rough time in 2022.

The US S&P 500 Index fell to a new closing low for 2022 while the Dow Jones Industrial Average slipped into a bear market as interest rates surged and the unrelenting surge of the US dollar raises worries over corporate earnings.

The sell-off in the stock market is also happening in other parts of the world. Markets in Europe were mostly lower while the Asian stock market is mostly in the red.

There is a concern among investors that the central banks could push economies into a recession as they try to cool the stubbornly hot inflation.

The US Federal Reserve (Fed) has raised its benchmark rates by another 75 basis points (bps) recently, and is now at the range of 3.00% to 3.25%. It was virtually at zero at the beginning of this year.

The Fed has also released a forecast suggesting its benchmark rate could reach 4.4% by the end of this year.

Our Chief Investment Strategist, Say Boon, has shared in his recent article on the 3 disturbing messages from the Fed to investors.

However, despite the volatile market and uncertainties on the global economy in the near-term, this is an opportunity for those in their 20s to start investing.

Why is it a good time for young investors to buy the dip?

While the recent volatile stock market has been scary for investors especially for new investors who are just dipping their toes into the market, the bear market and selloff in the stock market actually presents an opportunity for young investors to buy into good companies at attractive valuations.

Since young investors have a longer time horizon to plan for their retirement, the market downturn today provides an opportunity for them.

The longer time horizon allows young investors to take on more risk since they can hold onto their investment for many years to come.

As an example, during the 2008 recession, half of the value of the Dow Jones Industrial Average was wiped off over the span of 1.5 years before the market started to stabilize.

It took the market another 2 to 3 years to reach the pre-recession levels.

Since the stock market is likely to remain volatile in the near-term, young investors can enter into the market with the goal of investing long-term.

The short-term dips won’t necessarily set you back in the long run.

However, given the uncertainty in the market, young investors should start investing with small, specific dollar amounts regularly, a technique known as dollar-cost averaging.

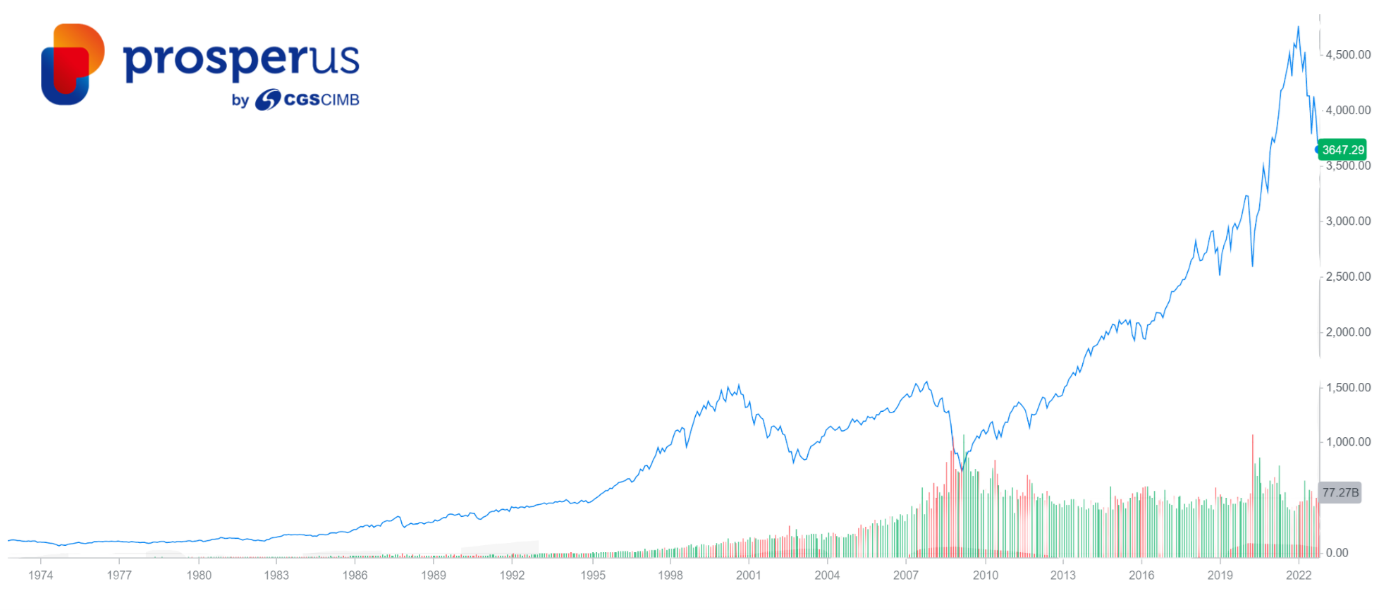

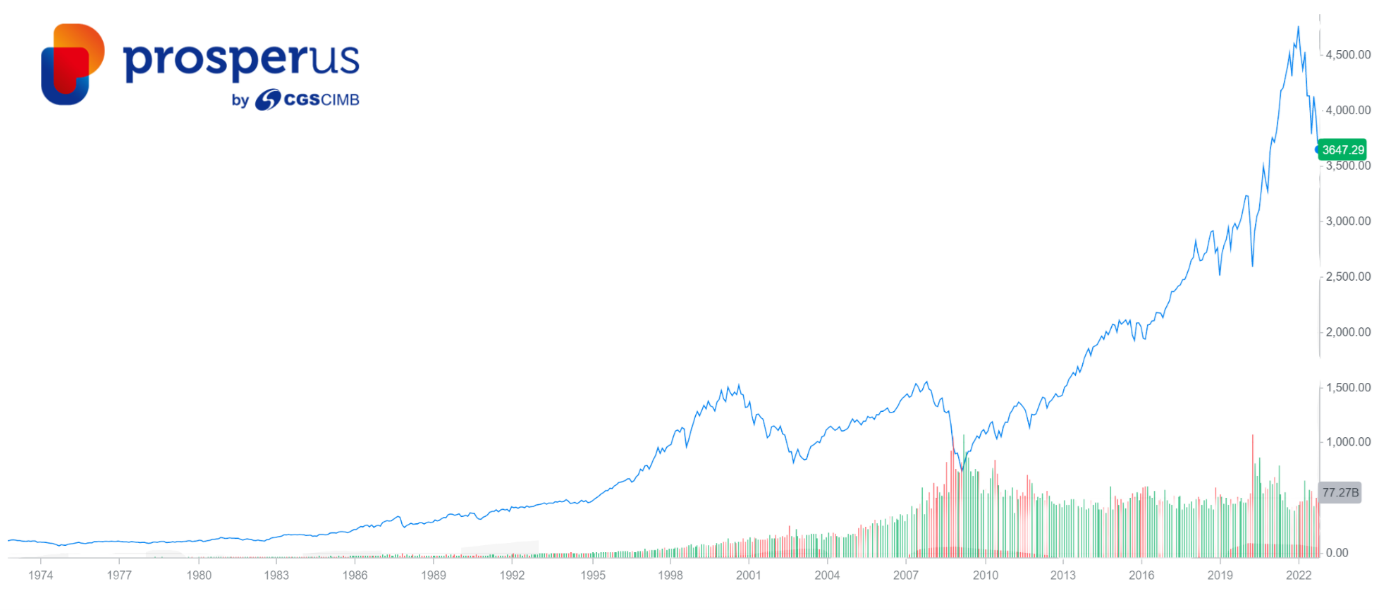

Historically, stocks provided the highest return among most asset classes. The average return of the S&P 500 over the last five decades is more than 10% annually.

Source: Yahoo, ProsperUs

Source: Yahoo, ProsperUs

Take advantage of the compounding effect

The power of compounding interest is positively correlated with time, which is why investors who start early will have an advantage.

Regular investments made right from an early age can reap huge benefits at the time of retirement. Moreover, early investment facilitates your entry in the world of finance early. Your money grows with time.

As someone who started investing at the age of 19, young investors who buy into the current pullback in the market will be the biggest beneficiary of the market recovery in the future.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Source: Yahoo, ProsperUs

Source: Yahoo, ProsperUs