What is a Santa Claus Rally? And Should Investors Care?

December 12, 2022

It has been a tough year for long-term investors in global stock markets. That’s because both inflation and interest rates are at multi-decade highs.

However, more recently, with better economic data coming out, there has been a mini-rally of sorts in the US stock market.

That’s been premised on the belief that the US Federal Reserve (Fed) will start to slow its pace of interest rate hikes as soon as December and may “pause” in its hiking cycle in the first half of 2023.

So, on the back of that, many commentators have taken the opportunity to highlight a historical stock market phenomenon called the “Santa Claus rally”.

But, what exactly is it and should long-term investors really take much notice?

Santa’s coming to…Wall Street

A “Santa Claus” rally is a broad term that’s used to describe positive performance in the US stock market in the week leading up to Christmas Day (25 December) and the week after.

There is some disagreement in the investment community about the precise timescale. Yet, most investors can take a Santa Claus rally as a positive spin on stock market returns in the month of December.

That’s because there’s a level of historical precedence for it. In a similar vein to the “Sell in May and Go Away” adage, there’s both a level of truth and some misleading aspects to the Santa Claus rally.

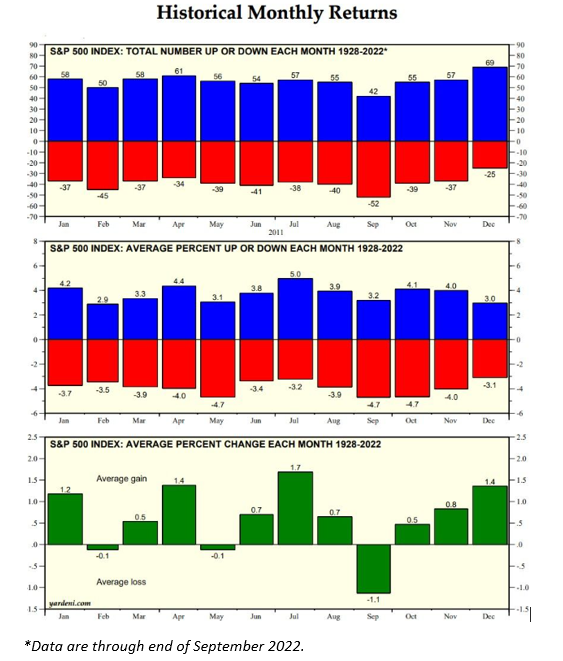

If we take a look at the chart below, readers can see that in the month of December the S&P 500 Index (for 1928-2022) has had more positive months than the rest of the year.

In terms of the number of negative months over that period, December also had a substantially lower number than January to November.

Sources: Yardeni Research, Standard & Poor’s, Haver Analytics

Sources: Yardeni Research, Standard & Poor’s, Haver Analytics

Meaningless over the long term but short-term movements possible

However, if readers look closer and see the averages for the up and down months during December, they can see that December is neither the best nor the worst.

More importantly, the overall average return during that timeframe is level with April (1.4%) and is actually outperformed by July’s average return.

Having said that, a confluence of events this month has had the market talking about it once more. With inflation data in recent months showing a slowdown in the US, sentiment in stock markets has improved.

That’s particularly true as the market believes the Fed will stop hiking in 2023 and may even cut interest rates in the second half of next year.

Focus on the long-term returns

While the current macroeconomic picture might suggest a Santa Claus rally is on the cards, it’s not something that investors should put too much stock in.

That’s because the “feel-good” factor of December is more illusory than anything. It makes for great headlines in the press but the overall impact on your portfolio in the long term will be negligible.

Instead, investors should focus on buying great companies with consistently expanding cash flows.

By continuing to stay invested over the long term in these kinds of stocks, whatever happens from month to month won’t matter that much.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.