What is a Share Buyback? And do Singapore Companies Use Them?

March 23, 2022

In Singapore, as investors we are used to hearing the words “dividends”, “banks” and “REITs” when we buy stocks.

That’s because companies listed in the Lion City are renowned for paying out their profits to shareholders in the form of dividends.

However, over in the US, in addition to dividends there is another very common way that companies return excess cash to investors; share buybacks.

That’s a very different structure versus, say, Singapore REITs – that are set up to pay dividends consistently.

But what are share buybacks and do they provide any benefits to shareholders? Plus, do many Singapore companies carry out share buybacks themselves?

Form of capital allocation

Essentially, the act of a “share buyback” will see a company allocate a certain amount of excess cash to buying back – and then cancelling – its own shares on the open market.

Share buybacks have multiple consequences. First, they reduce the share counts of companies that carry them out. Second, by cancelling shares, this enables specific financial metrics to improve immediately.

Primarily, this refers to earnings per share (EPS) as this critical number will improve given the total earnings amount of the company will be applied to a lower number of shares post-buyback.

The bottom line, and the ultimate goal of share buybacks, is for the company’s share price to be supported – and hopefully boosted – by the recurring act of purchasing and cancelling shares.

Sometimes, management of companies also prefer to carry out share buybacks as they believe that their company’s stock is undervalued.

Yet whereas dividends offer “cold, hard cash” in shareholders’ pockets, share buybacks are often seen as the less preferable method of returning cash to shareholders given it’s a more indirect route.

Buybacks can be cut, dividends can’t

There are some caveats to this perception, though. Share buybacks are carried out on a large scale in the US because of their tax-deferred status.

In essence, investors in the US are only taxed on their shares when they are sold. In contrast, dividends are taxed when they are paid out so investors have a definite return – in the form of a dividend – that will be taxed during that year.

Furthermore, for most companies share buybacks are intermittent programmes that are announced every so often.

This is in stark contrast to dividend payments, with many stocks in the US market having their whole reputation predicated on consistent dividend increases.

That’s particularly true of the 67 “Dividend Aristocrats” in the US. These are companies that have paid out a rising dividend for at least 25 consecutive years.

With some stocks having paid out rising dividends over the past 50-60 years, “defending” this dividend is much more important to management (and shareholders alike) than using excess cash to carry out a share buyback.

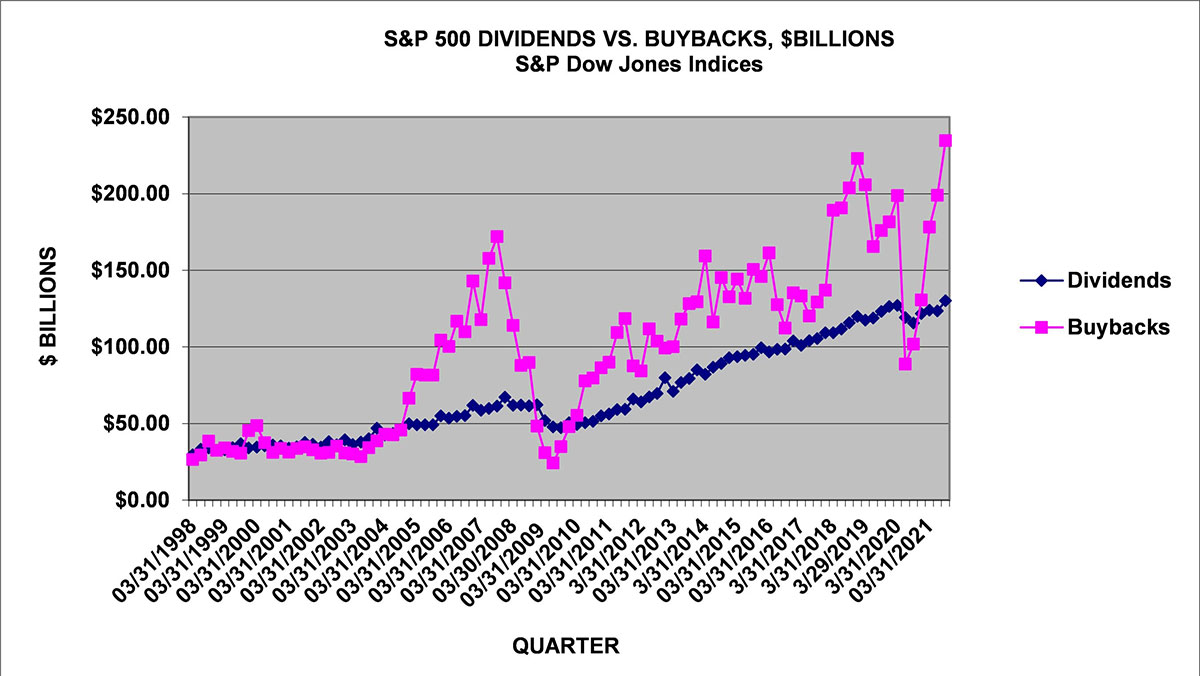

This has been very obvious with the consistent rise in dividend payouts of S&P 500 Index companies over the past two decades versus the vicissitudes of share buybacks (see below).

Source: S&P Dow Jones Indices, December 2021

Source: S&P Dow Jones Indices, December 2021

For example, during the market crash of March 2020 during the global Covid-19 pandemic, previously-announced share buybacks were the first thing to be cut by many companies in an effort to preserve cash.

That’s in stark contrast to the absolute level of dividends that were paid out, which didn’t see that much of a dip in the first half of 2020 before starting its climb higher once more.

How about Singapore buybacks?

Here in Singapore, given the tax-free status of dividend payments, cash in investors’ pockets is clearly the preferred option.

However, that doesn’t mean that share buybacks aren’t carried out. In 2021, according to the Singapore Exchange (SGX), 85 primary-listed Singapore stocks carried out share buybacks worth a total of S$1.19 billion. That was a three-year high.

But that pales in comparison to dividends paid out. According to the Janus Henderson Global Dividend Index 2021, Singapore made up 4% of the US$163.3 billion paid out in dividends by Asia Pacific ex-Japan companies last year.

That means Singapore companies paid out US$6.53 billion (S$8.8 billion) in dividends during 2021.

Tech buybacks all the rage

Where investors have witnessed a lot of share buybacks, and will likely see a lot more of them in the coming years, has been in the technology sector.

That’s because the tech giants generate boatloads of both profits and free cash flow, all of which can be returned to shareholders.

For example, Apple Inc (NASDAQ: AAPL) is renowned for its cash flow-generating abilities. This has allowed the company to use US$85.5 billion to repurchase shares in fiscal 2021, as well as paying out US$14.5 billion in dividends during the same period.

Over the last decade, the iPhone behemoth has spent a whopping US$467 billion on share buybacks alone. That has obviously helped boost both its EPS and share price over the past 10 years.

At the end of the day, investors need to realise that share buybacks are merely a form of capital return to shareholders.

While dividends may be the preferred method for a lot of us to receive cash back from companies, share buybacks can deliver benefits to shareholders in many different situations.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.