■ The Dollar Index (DXY) remains strong despite disappointing retail sales data but was supported by strong PMI.

■ USD/JPY will be key market to watch for as the best trade among the G7 major currencies.

■ The US dollar index (DXY) is likely to strengthen to 105.60 in 2H24 considering the increasing hawkishness of the Fed.

Dollar Index to maintain its strength as market prepare for PCE

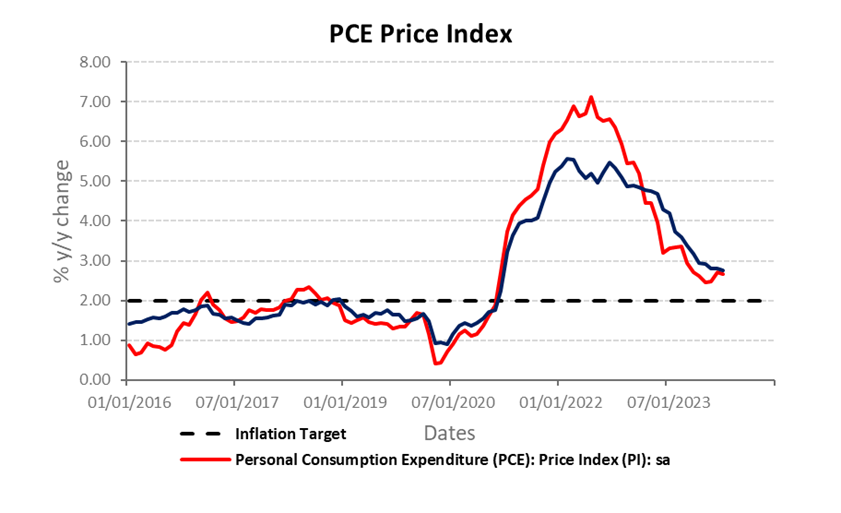

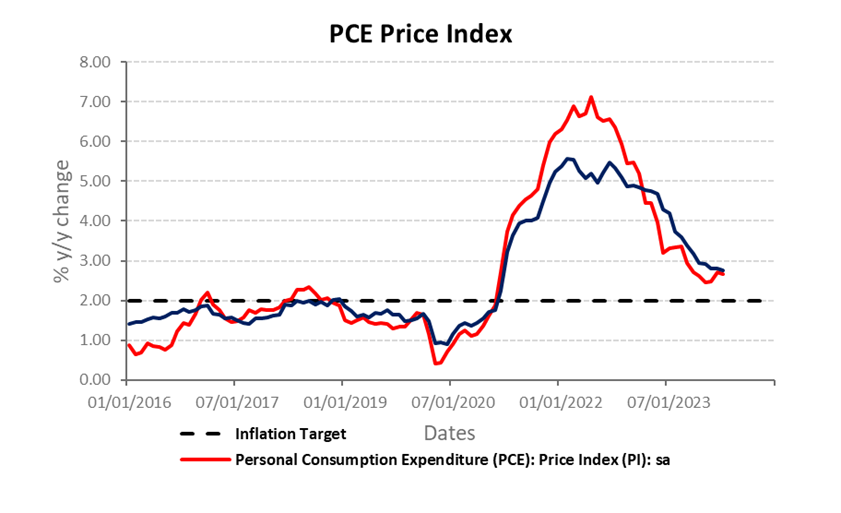

The US Personal Consumption Expenditures (PCE) Price Index for May will be released on June 28, and market participants are likely to wait for these figures before making any firm decisions regarding the direction of the USD. The Fed’s preferred inflation measure is expected to have increased by 0.1% month-over-month and 2.6% year-over-year in May, while the core annual figure is anticipated to be 2.7%, down slightly from 2.8% in April. This will cheer the dollar index to strengthen in the near to mid-term as the 2% inflation target set by the Fed has yet to be achieved. Furthermore, the Fed has been increasingly Hawkish and cited the reason to be “Need more data to be supportive”. Nonetheless, the next possible rate cut of is cited to be in September, but we believe that the probability is low given the “resilience” of the inflationary data presented and inconsistency of the employment data.

Meanwhile, the dollar’s strength has been well supported by the robust Purchasing Manager Index (PMI) figures, increasing to 55.1 from 54.8 on May 24. This suggests strength in the US Economy.

Japanese Yen back into the spotlight again after inflation data

After a dramatic “Intervention” on 29 Apr 24, the Yen is back to its path of weakening. While inflation saw a spike from 2.5% to 2.8%, the underlying inflation excluding food and energy cooled to 2.1% to 2.4%. While the data is pointing towards a delay in rate hike, we believe the BOJ is likely to carry on hiking its interest rate to 0.1% as the impact of rate hike of the BOJ is small and the USDJPY carry trade will likely to continue. Intervention result has not been yielding the desired outcome and hence, the only better choice is to hike rate. The attention will be in August where the BOJ will reduce its purchase of Japanese Government Bonds and the market will then “test” the commitment of the BOJ in its consistency to perform Quantitative tightening in 2H24.

Dollar Index Technical outlook

The longer-term outlook on Dollar Index has been on a rangebound mode between 100.00- 106.90 since rebounding from the low of 99.00 last July 23 and breaking out of the larger falling wedge. Mid and near-term outlook are seeing a strong potential of an upside continuation after higher lows are made and a strong closure above 105.00 psychological level is seen to be a strong signal for an uptrend. Meanwhile, the outbreak of the smaller falling wedge signals further upside continuation. Recent break above the cloud support of the ichimoku signals positive development for the Dollar Index.

Momentum also suggests that the upside may see a break above 106.74 and should it break, the next major target will be at 109.49 over the longer course of period. Major support is at 103.86 and 101.31.

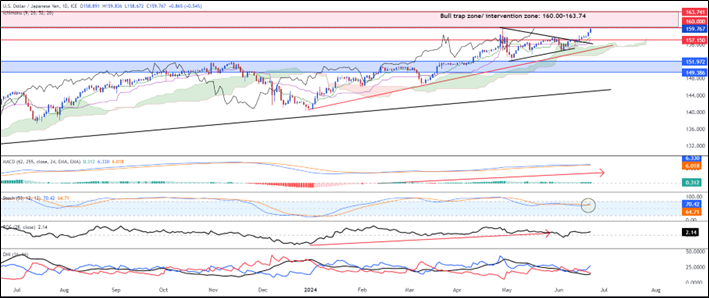

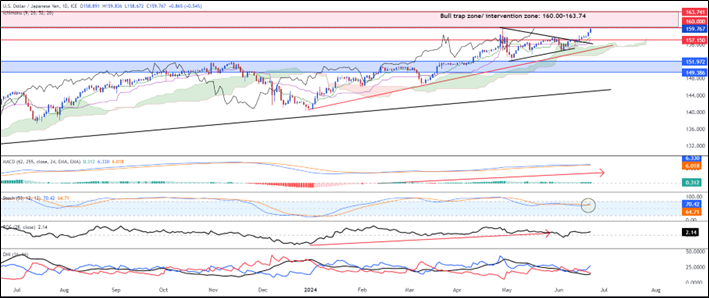

USDJPY continues to see strength going past 160.00 potentially

The best FX pair to trade in for the past 3 years has been the Yen against the dollar because of its positive carry. Furthermore, the clear uptrend for the past 3 years is also very much intact. The recent break out of the pennant suggests that the USDJPY pair will likely continue its bullish upside and break the 160.00. No doubt there may be a risk of intervention by the Bank of Japan, but intervention results have proven to be ineffective since April 24 and the previous in Nov 23. As such, we maintain buy on USDJPY with near-term target at 163.74. Should there be a reversal at 160.00-163.74 region, traders could reaccumulate at 154.70 or lower support at 151.97.

Figure 1: Dollar Index (DXY) – Dollar is in a steady short-term uptrend

Figure 2: USDJPY – Bullish trend intact, 163.74 resistance in focus

Figure 3: Personal Consumption Index – 2% Target yet to achieved

Please refer to the disclaimer here.