The Singapore real estate investment trusts (S-REITs) sector faced a challenging 2023 due to high and persistent interest rates, leading to increased borrowing costs, reduced property valuations, and potentially lower distributions.

This resulted in a 9.0% decline in the iEdge S-REIT Index in the first 10 months.

However, November marked a turnaround, with the sector experiencing its best month in three years, gaining 7.4% in total returns.

This positive trend continued into December, especially after the US Federal Reserve maintained steady interest rates on December 13, sparking hopes for potential rate cuts in the future.

Consequently, the iEdge S-REIT Index rose by 3.8% on December 14, bringing its December total returns to 7.1% and year-to-date returns to 4.7%.

US office property S-REITs, particularly Prime US REIT (SGX: OXMU), Manulife US REIT (SGX: BTOU), and Keppel Pacific Oak US REIT (SGX: CMOU), demonstrated strong performance with an average of 45.2% total returns in December.

Data centre REITs, notably Digital Core REIT (SGX: DCRU) and Keppel DC REIT (SGX: AJBU), also outperformed the broader market, with significant gains.

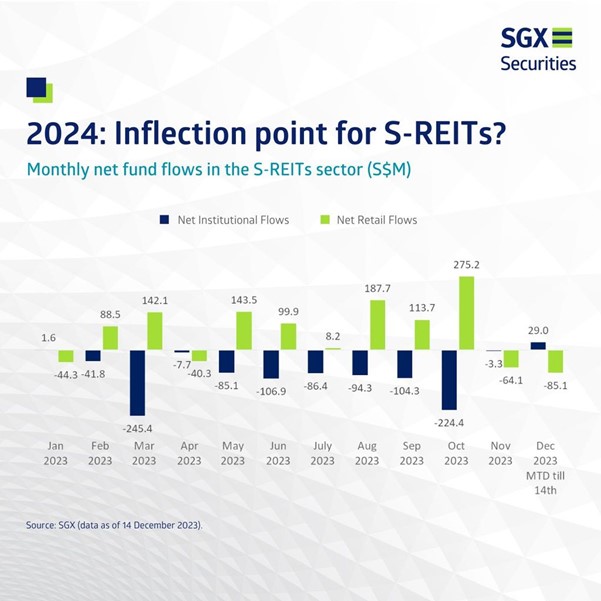

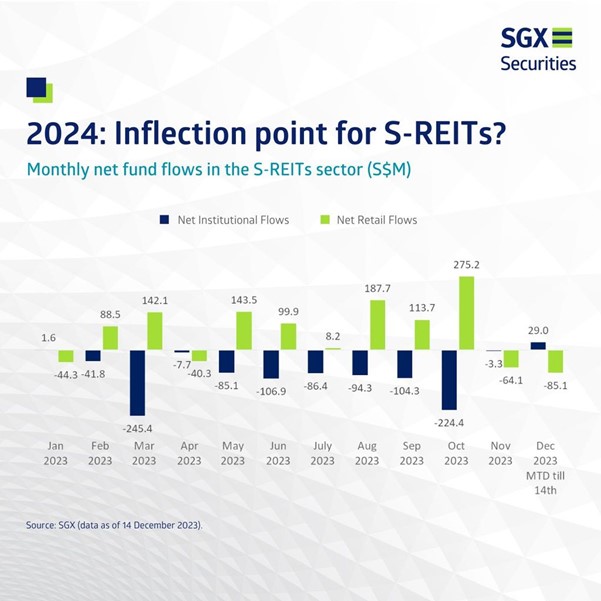

Institutional investors showed renewed interest, with net purchases of S$12 million worth of S-REITs on December 14 and over S$29 million in December, reversing a trend of net outflows since February.

CapitaLand Integrated Commercial Trust (SGX: C38U), Mapletree Industrial Trust (SGX: ME8U), and Suntec REIT (SGX: T82U) attracted the largest institutional inflows, while Paragon REIT (SGX: SK6U) and Sabana Industrial REIT (SGX:M1GU) saw inflows from both institutional and retail investors.

S-REIT managers have been actively managing balance sheet exposures amid the rising interest rates.

Seventeen S-REITs decreased their gearing ratios by an average of three percentage points, and 26 S-REITs now maintain gearing ratios below 40%.

Interested in discovering the top S-REIT investment opportunities?

Explore our selection of standout S-REITs in light of the US Federal Reserve’s pause on rate hikes. Dive into the potential and prospects of these investments. Click here to learn more and unlock your investment potential.

Disclaimer: ProsperUs Head of Content & Investment Lead Billy Toh doesn’t own shares of any companies mentioned.