3 Reasons I Wouldn’t Buy CapitaLand Integrated Commercial Trust Shares

February 23, 2022

Volatility. It’s the name of the game right now for investors as they grapple with geopolitical tensions in Ukraine, rising interest rates and higher inflation.

However, as I’ve said before, Singapore’s stock market is relatively well-sheltered (and hence has held up better in 2022) given the preponderance of large banks and real estate investment trusts (REITs) that pay regular dividends here.

For long-term investors, in an inflationary environment, pricing power becomes even more important. That’s also true for Singapore REITs, many of which have recently reported their latest quarterly numbers.

One of the largest REITs – by market cap – in Singapore is CapitaLand Integrated Commercial Trust (SGX: C38U), also known as CICT, which owns a number of large retail and commercial properties in Singapore and Germany.

In late January, the REIT reported its full-year 2021 earnings. Despite its popularity as a dividend stock, here are three reasons why I wouldn’t buy shares of CICT if I was looking to generate passive income.

1. Falling or stagnant DPU

One of the biggest problems with any dividend stock (or investment) is to see its payout fall. That’s because it’s a sign that either its dividend isn’t sustainable or the business isn’t on a solid foundation.

Unfortunately for CICT shareholders, that’s exactly what happened to the REIT’s distribution per unit (DPU) in the second half of 2021.

CICT announced a DPU of 5.22 Singapore cents for the second half of last year, down slightly from the DPU of 5.73 Singapore cents it reported in the second half of 2020.

While this can be attributed to a private placement of over 125 million units in mid-December, it also happens to be an indication of CICT’s poor track record of DPU increases.

Formerly known as CapitaLand Mall Trust, before merging with CapitaCommercial Trust to become CICT, its DPU growth has been anaemic at best.

If we go back to 2003 (the first full year as a listed REIT in Singapore), CICT ended up announcing a DPU of 8.03 Singapore cents for the whole of that year.

Fast forward to today – the recently-reported full-year 2021 – and that DPU had climbed to 10.03 Singapore cents.

That gave investors who held these shares for the past 18 years a DPU that expanded at a compound annual growth rate (CAGR) of just 1.2%. That’s poor value for dividend investors.

2. Uncertainty around recovery

It’s no secret that retail REITs suffered tremendously during the early days of the Covid-19 pandemic and in its immediate aftermath.

That’s because footfall to retail malls, and discretionary spending in general, took a hit as people stayed indoors in Singapore.

However, while the recovery on some fronts is encouraging, there’s still a lot of uncertainty surrounding what the post-pandemic picture will look like for both retail and commercial properties here in Singapore.

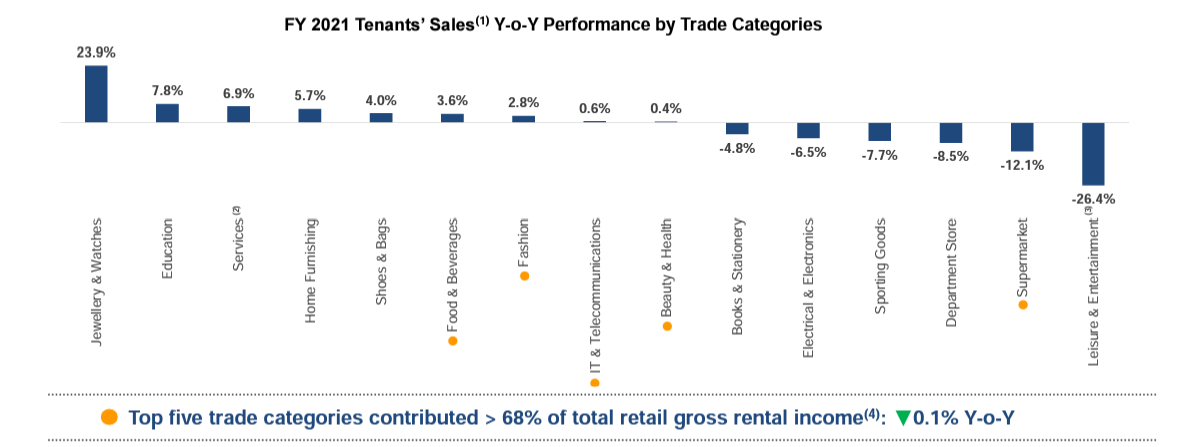

While many of CICT’s tenants saw year-on-year increases in their sales, there were also a lot of segments – such as Leisure & Entertainment – that saw big drops last year (see below).

Source: CapitaLand Integrated Commercial Trust FY 2021 earnings presentation

What’s more, CICT’s retail portfolio – which makes up 40% of its net property income (NPI) in the second half of 2021 – has a very short weighted average lease expiry (WALE) of just 1.9 years.

That provides less certainty on the level of leases renewal and income visibility for investors.

3. Poor total returns

In many ways, the best REITs are like stocks – they tend to “win” over time by providing superior long-term returns to investors.

Unfortunately, CICT has been a poor performer in both its DPU growth but also on a total return basis (i.e. share price return + dividend return).

Over the past decade, CICT units have only delivered a total return of 88%. Over the past five years, it’s delivered a total return of just 28%, broadly in line with the Straits Times Index over the same period.

Meanwhile, over the past three years it’s actually delivered negative total returns of 7.1% and on a price basis over that period it was down nearly 20%.

Look at the long-term track record

As with any REIT or stock, it’s important to understand what factors have driven returns over the long term. Are these likely to repeat?

With many winning stocks, there’s a strong argument for gains (or relative outperformance) to continue.

While CICT has restructured and is a much bigger REIT today, there are still questions surrounding the REIT’s capital allocation strategy and DPU track record.

For dividend investors who want to seek out consistent income as well as growth, then the REIT space in Singapore offers them much better alternatives.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares in any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.