Singapore’s Mapletree REITs to Merge: What Investors Should Know

January 5, 2022

Singapore’s real estate investment trust (REIT) market offers up the best of both worlds – income and growth – to investors.

That’s because large Singapore REITs listed on the SGX are increasingly going overseas to grow their portfolios.

And when it comes to acquiring new properties to drive distribution per unit (DPU) growth (i.e. the dividend) for shareholders, as I’ve previously written “bigger is better” in the REIT world.

In that vein, it was interesting to see that Mapletree Commercial Trust (SGX: N2IU), or “MCT” for short” and Mapletree North Asia Commercial Trust (SGX: RW0U), “MNACT” for short, last week halted trading in their shares before announcing a planned merger.

For investors in Singapore REITs, it’s big news as Mapletree Investments Pte Ltd is one of the biggest sponsor parent firms on the REIT scene locally.

So, here’s what you should know about the planned merger between Mapletree Commercial Trust and Mapletree North Asia Commercial Trust.

Bringing together local and North Asia

For many local market commentators, the announced merger made sense on many levels.

First and foremost, though, the planned merger will see MCT’s five-property, Singapore-only portfolio be expanded to four other Asian markets.

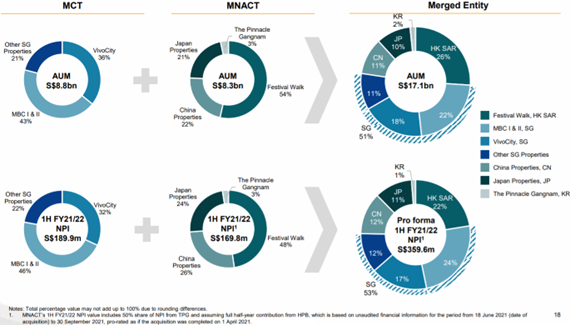

That’s because MNACT has 13 properties across China, Hong Kong, Japan and South Korea. MCT’s assets under management (AUM) totals S$8.8 billion while MNACT’s own AUM is at S$8.3 billion.

Local properties in MCT’s portfolio, such as VivoCity and Mapletree Business City I and II, will be combined with flagship properties from MNACT, including Hong Kong-based retail and office tower Festival Walk.

Combined, the proposed entity – which will be renamed Mapletree Pan Asia Commercial Trust (MPACT) – will be one of the 10 largest REITs in Asia.

What’s the deal for shareholders?

The planned merger will be completed via a trust scheme that will see MCT acquire all the issued units of MNACT.

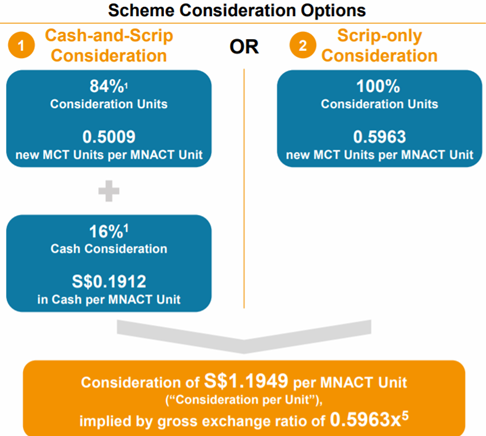

For MNACT unitholders, they’ll be given two options (see below). They can either take a cash-and-scrip combo of 84% in new MCT units with 16% in cash or they can opt for a scrip-only option of 100% in new MCT units.

Source: Mapletree North Asia Commercial Trust investor presentation, 31 December 2021

Either way, the deal sees MNACT unitholders getting S$1.1949 per unit they hold, which is a reasonable near-8% premium to MNACT’s closing price prior to the announcement.

Mapletree Investments Pte Ltd, which owns significant stakes in both as the parent sponsor of the REITs, has decided to receive the scrip-only consideration.

Diversification and size

Perhaps the key driving force for the announced merger was what has happened to both REITs during the pandemic, but particularly MNACT.

That’s because Hong Kong’s civil unrest in 2019 and early 2020 saw its Festival Walk property suffer damage from protestors and had to be temporarily closed.

Undoubtedly, the Covid-19 pandemic then compounded its woes but MNACT’s reliance on Festival Walk for much of its income was long highlighted as a risk.

Similarly, MCT also suffered as Singapore’s economy was hurt by the onset of Covid-19. This saw footfall through its malls and offices fall off considerably.

Like MNACT, a large proportion of its income came from just a few key properties. Post-merger, though, this concentration risk will dissipate substantially (see below).

Source: Mapletree North Asia Commercial Trust investor presentation, 31 December 2021

Additionally, with its combined heft, MPACT will also see its hypothetical development headroom double to S$1.7 billion while its debt funding capacity will be in excess of S$3.7 billion.

That will provide the merged entity with more firepower and better position it to pursue acquisitions as well as asset enhancement initiatives (AEIs).

Fair deal with growth potential

Overall, unitholders in both REITs will benefit. On the MCT side, unitholders will see the merged entity receive a 7.5% pro-forma bump to its existing DPU (assuming all MNACT unitholder elect scrip-only).

Unsurprisingly, REITs in Singapore continue to get bigger as they venture overseas and compete globally for deals on the best properties.

With this latest merger between Mapletree’s two smaller REITs, unitholders should feel more confident in the combined entity.

Meanwhile, potential investors could be more attracted to the prospect of investing in MPACT – once the merger is expected to be completed in the middle of this year.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.