1 Singapore Stock That Will Benefit From the “Great Resignation”

June 29, 2022

Recently, it was reported that 25% of Singaporeans intended to quit their job in early 2022.

According to the latest survey conducted by Michael Page, a recruitment agency, the “Great Resignation” is gaining steam in Singapore.

The survey highlighted the fact that 74% of Singaporean professionals are looking to quit their current job this year in search of more money and better work-life balance.

The local employment situation appears to be able to withstand the pressure from rising inflation globally and companies in Singapore are more than willing to hire.

As a result, one of Asia’s leading recruitment firms that’s headquartered in Singapore, HRnetgroup Ltd (SGX: CHZ), is likely to benefit from this trend.

Here are three reasons why.

1. Strong demand for workers will drive earnings in FY2022

The result of the “Great Resignation” is the need for workers.

While the last two years has seen a shortage of foreign workers in Singapore due to COVID-19 restrictions, the reopening of the economy will drive the return of foreign talent.

To put it into perspective, there was a huge deficit of Employment Pass (EP) and S-Pass holders to the tune of around 200,000 people.

The strong demand for workers is also reflected by the increase in salaries.

For example, about 230,000 civil servants in Singapore will get a pay rise of between 5% to 14% from August of this year.

Similarly, reopening of the economy globally will also spur hiring, which will benefit HRnet, which is operating across 14 Asian talent markets.

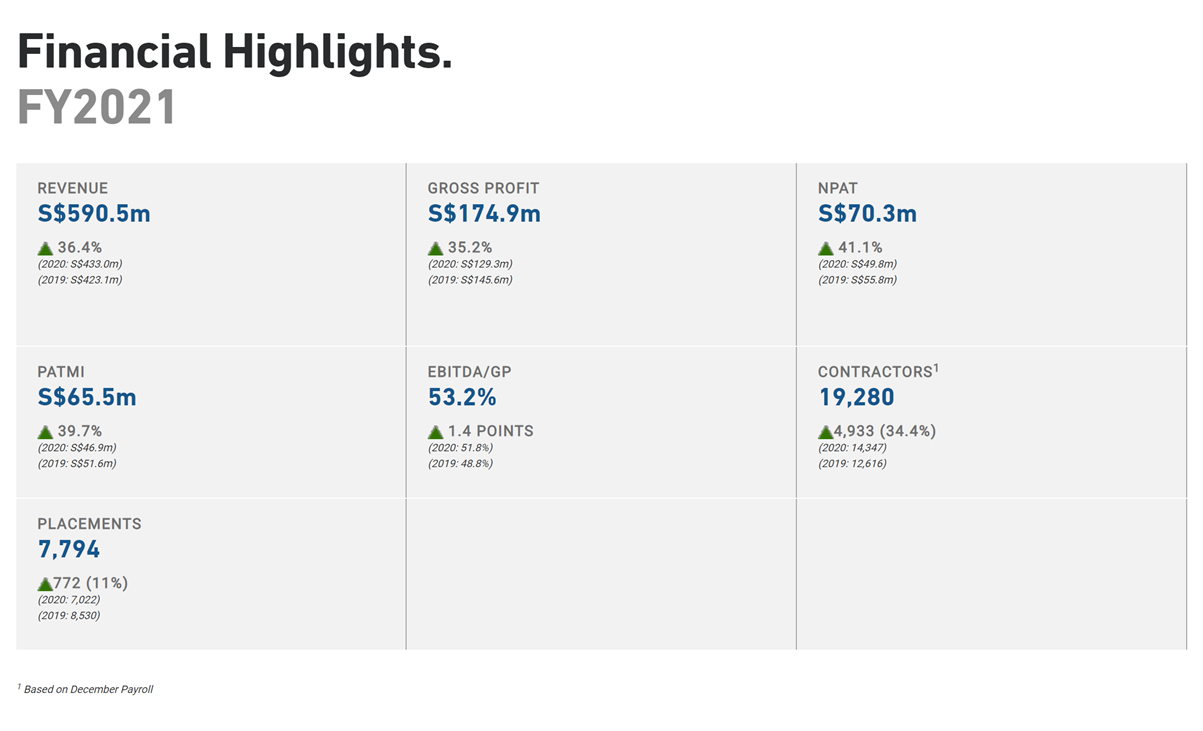

Source: HRnet’s FY2021 Annual Report

Source: HRnet’s FY2021 Annual Report

Among the two business segments that will continue to drive growth are Professional Recruitment (PR) and Flexible Staffing (FS).

As mentioned earlier, salary increments to retain and attract talent have been on the rise while we should see a ramp-up in employment as businesses reopen.

Meanwhile, FS volumes are also expected to maintain its momentum growth from FY2021 as firms are likely to increase demand for temporary workers.

This is especially true for those in the tourism industry while there’s also a broader need for workers due to the lag time to fill vacancies.

2. Strong earnings track record

Moving on to the financials, HRnet recorded a strong FY2021, outperforming expectations on all fronts.

Revenue for HRnet was up by 36.4% year-on-year (YoY) to S$590.5 million while net profit after tax jumped by more than 40% to S$70.3 million.

FY2021 saw exceptionally strong volume growth for its FS business segment.

The flexible staffing business is about supplying manpower-on-demand and given the volatile environment that we’re in, it is very attractive for organisations to be able to hire talent whenever they need.

The number of employees deployed, or contractors engaged, with HRnet’s clients stood at 19,280 in the month of December 2021, representing an increase of 34.4% from a year ago.

Meanwhile, the PR business, which source and select talents for their clients, has also maintained strong growth.

In FY2021, the number of talent that were placed to clients grew by a double-digit percentage rate of 11.0%, representing strong demand in this area.

Since the Group’s fee for its PR business model is based on the percentage of salaries offered to talent, the rise in salaries will also benefit HRnet.

Source: Hrnet’s FY2021 Annual Report

Source: Hrnet’s FY2021 Annual Report

3. Strong cash reserve

I believe the term that “cash is king” is important in a rising interest rate environment.

With a cash position of S$327.1 million, HRnet is in a strong position to expand and take advantage of the market’s growth.

This is seen in FY2021, when the Group funded the additional S$111.9 million in “cost of sales” from the aggressive growth seen in its FS business segment.

This has also helped HRnet to be in a position that enables it to reward its shareholders. The company has a 50% dividend payout policy.

Attractive proxy for labour market recovery

Despite persistently high inflation, we have seen a shift in the labour market trend and employers have to be more proactive to retain and attract talent.

As most businesses are reopening, this will drive the labour market recovery, which is good business for HRnet.

The topic on foreign workers was also part of the address made by Singapore’s Deputy Prime Minister, Lawrence Wong, in his speech on policy recently.

The emphasis on the need for foreign talent to complement the local workforce will also benefit HRnet, as Singapore contributed 55% to the Group’s revenue.

One thing is certain; HRnet is a proxy for the labour market recovery and should be able to successfully ride the “Great Resignation” trend.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.