Here’s Why Tencent and Alibaba Shares Are Down Over 40%

April 12, 2022

Over the past year or so, investors in Chinese tech stocks have been shocked by the fall in share prices. That’s not been without reason, as a crackdown by Chinese competition regulators have dented investor confidence.

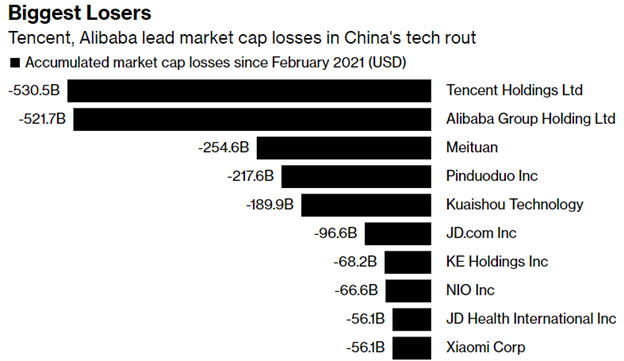

Among the biggest, and previously most successful companies, that have seen their share prices decline significantly are Tencent Holdings Ltd (SEHK: 700) and Alibaba Group Holding Ltd (SEHK: 9988) (NYSE: BABA).

Tencent, which is an online gaming, payments and social media giant, has seen its shares fall by around 41% in the past year.

Meanwhile, Alibaba – one of the world’s largest e-commerce and cloud computing companies – has seen its share price crater by 57% over the past 12 months.

So, why have these two perceived “blue-chip” China technology stocks been so badly damaged over the past year?

Regulatory woes and power games

The seeds of the current crisis in share prices were planted when Alibaba’s planned IPO of Ant Financial – a fintech behemoth that it has a stake in – fell through in Hong Kong and Shanghai in 2020.

Since then, it’s been clear that the Chinese government has decided to get tough with specific sectors in the economy that they view as being “hijacked by capital”.

That has crushed the market values of the biggest Chinese tech firms, with Tencent and Alibaba witnessing the most shareholder destruction (see below).

Source: Bloomberg, as of 15 March 2022

Working into this narrative was the incredible wealth – and power – that tech billionaires had amassed over the past 20 years as China.

This was no more evident than when shares of Meituan Dianping (SEHK: 3690), a large online food delivery and travel platform, plunged in May of last year when its CEO posted a classical poem on social media that was deemed as criticism of the Chinese government.

It was no surprise that Jack Ma – Alibaba’s founder and former CEO – fell off the radar for a substantial period of time after Ant’s failed IPO. Even today, he’s not as prominent in public spheres as he once was.

Meanwhile, on the regulatory side, tech firms in China have been battered by some horrible public relations (PR) disasters.

There was the disastrous IPO in early July 2021 of ride-hailing giant DiDi Global Inc (NYSE: DIDI), where the company was reprimanded by Chinese regulators for lapses in data security.

Today, DiDi shares are down over 80% from where they closed on their first day after the IPO.

Common Prosperity era for investors

Meanwhile, all this has been happening against a backdrop of “Common Prosperity” that is espoused by China President Xi Jinping.

This concept was seen in action when the Chinese government effectively shut down the online education sector, which was seen to be fleecing parents of enormous amounts of money in order for middle-class Chinese to maintain their children’s grades.

Similarly, there were online gaming controls imposed on under-18s in China so that they were constrained to only gaming on Friday, Saturday, and Sunday.

Unsurprisingly, this negatively impacted Tencent, one of the world’s largest gaming companies, and which generates a vast chunk of its online gaming revenue from China.

A suspension in gaming approvals last year (which has just been lifted) also saw sentiment hit for the likes of Tencent and other gaming companies such as NetEase Inc (SEHK: 9999) (NASDAQ: NTES).

Beyond that, substantial fines have also been meted out. In 2021, Alibaba was hit with a US$2.8 billion fine for abusing its market position while Meituan saw a US$533 million fine for its monopolistic practices in the food delivery industry.

Investors should watch actions, not words

If anything has been clear over the past year, it has been that the Chinese government is intent on reshaping “capitalism” in its own vision.

Common prosperity will play a key role in this but the two biggest Chinese tech stocks by market cap – Tencent and Alibaba – will continue to be under scrutiny due to their massive influence on the Chinese economy.

While there is always speculation over whether the “crackdown” is coming to an end, the vast number of agencies involved means the end will only be in sight when President Xi says so.

Until then, it appears as though there is no end in sight. For that reason, investors in Tencent and Alibaba should continue to tread carefully in future.

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.