3 Quick Takeaways from Mapletree Industrial Trust’s FY2023 Earnings

May 3, 2023

Singapore’s sizeable REIT market has both small and large REITs, catering to all sorts of dividend investors.

In recent weeks, Singapore REITs have been reporting their quarterly numbers to the market. Investors have been watching closely to see how higher interest rates have impacted their distributions.

Essentially, what that comes down to is the distribution per unit (DPU), another term for dividend per share.

One of the bigger and more popular trends recently, in S-REITs, has been data centres.

Incidentally, one of the biggest Singapore REITs with data centre exposure actually reported late last week; Mapletree Industrial Trust (SGX: ME8U).

So, here are three quick takeaways – for Singapore’s data centre REIT investors – from Mapletree Industrial Trust’s latest results.

1. DPU falls in both Q4 FY2023 and FY2023

One of the biggest takeaways for investors was the fact that Mapletree Industrial Trust recorded declines in its DPU for both Q4 FY2023 (three months ending 31 March 2023) and the FY2023 (12 months ending 31 March 2023).

For Q4 FY2023, Mapletree Industrial Trust posted a DPU of 3.33 Singapore cents, down 4.6% year-on-year.

Meanwhile, for the FY2023, the REIT saw its DPU decline 1.7% year-on-year to 13.57 Singapore cents.

Part of the reason for this came from an enlarged unit base due to its Distribution Reinvestment Plan (DRP), which saw an uptake of S$184.1 million from Q3 FY2022 to Q3 FY2023.

Distributable income also fell during the quarter, down 2.3% year-on-year to S$171.7 million – impacted negatively by higher interest costs.

2. No major refinancings in FY2024; 75% of debt on fixed rates

While some investors may be concerned about the outlook for Mapletree Industrial Trust, its earnings were actually broadly in line with expectations.

There was some weakness in its business parks and flatted factories in Singapore but this was offset by inbuilt rental escalations in its North American data centre assets.

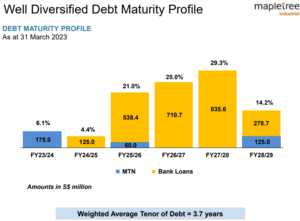

What’s more positive is that the REIT only has 6.1% of its debt maturing in the upcoming FY2024, followed by 4.4% in FY2025 (see below).

Source: Mapletree Industrial Trust Q4 FY2023 and FY2023 earnings presentation

These debt loads seem manageable, even if interest rates remain elevated in the next two years.

Its weighted average debt tenor was also extended to 3.7 years in the latest quarter, up from 3.1 years as of the end of December 2022.

Meanwhile, it has 75.5% of its total debt on fixed rates, versus 74.3% as of the end of December 2022. Its weighted average all-in funding cost rose slightly to 3.5% in the latest quarter, up from 3.3% in Q3 FY2023.

3. Hi-Tech Park @ Kallang Way now completed

Management managed to provide an update on the space at 161, 163 and 165 Kallang Way, otherwise known as Mapletree Hi-Tech Park.

It was a redevelopment of flatted factories into a new high-tech industrial park. Thankfully, it has now been completed and the REIT has secured committed occupancy of 44.1% (by NLA).

Mapletree Industrial Trust obtained the Temporary Occupation Permit for 161 Kallang Way on 23 March 2023 and for 163 Kallang Way on 2 February 2023.

Management stated that it expects income from the committed leases to start contributing progressively in FY2024.

Watching renewals and looking for opportunities

Management of the REIT stated that it would look to strengthen its portfolio through accretive acquisitions and explore opportunities to divest properties too.

While data centres now make up over 53% of its AUM, Mapletree Industrial Trust is looking to raise this number to over two-thirds in future.

For unitholders, though, the completion of Hi-Tech Park at Kallang Way may help ease some concerns over where rental growth may come from in the immediate future.

Mapletree Industrial Trust shares offer REIT investors a dividend yield of 5.8% based on its current price.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares of Mapletree Industrial Trust.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.