China’s reopening at the beginning of this year could boost the recovery of Singapore REITs and hospitality trusts with the expected surge in inbound visitors from China.

One of the REITs that we believe will benefit from this development is CapitaLand Ascott Trust (SGX: HMN).

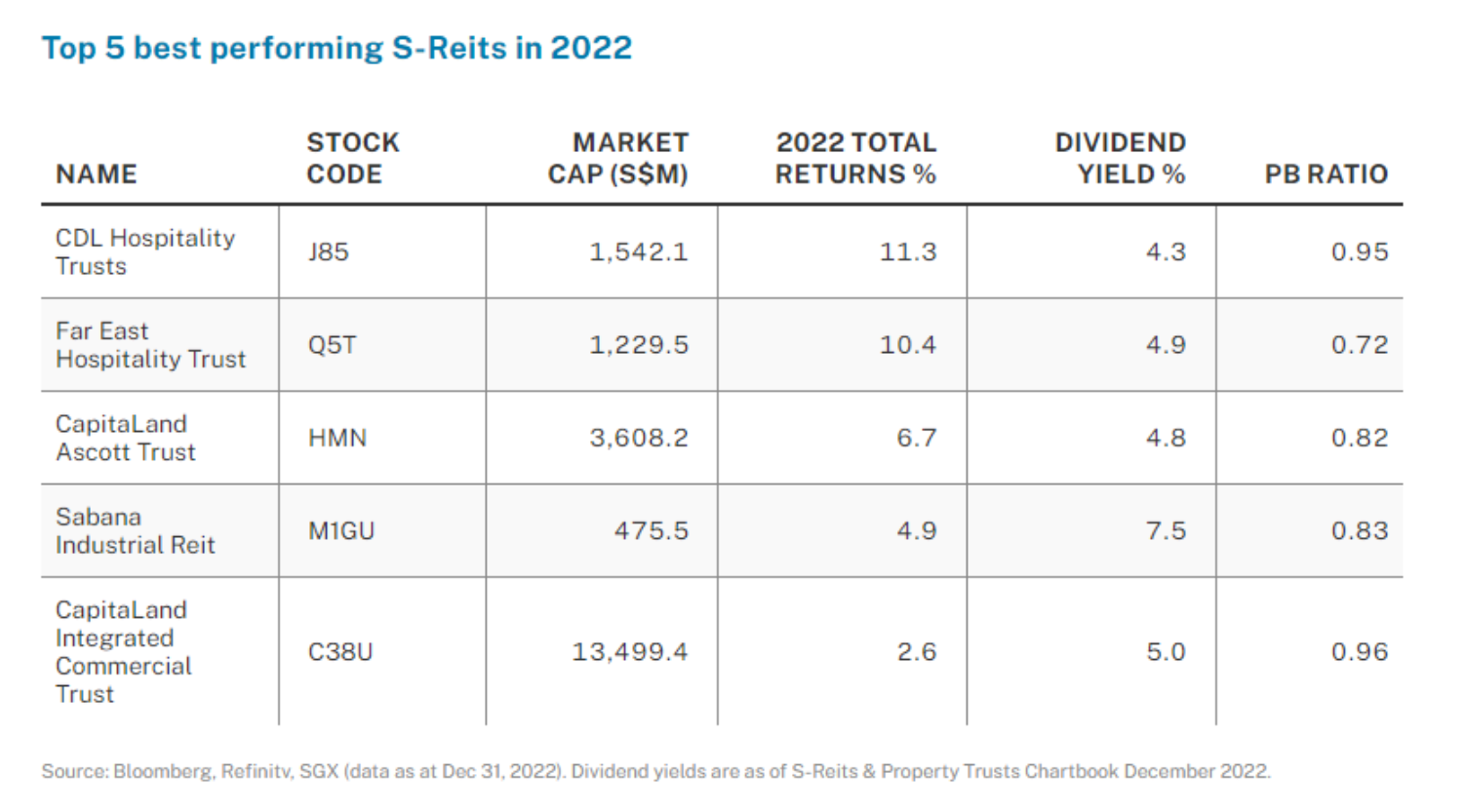

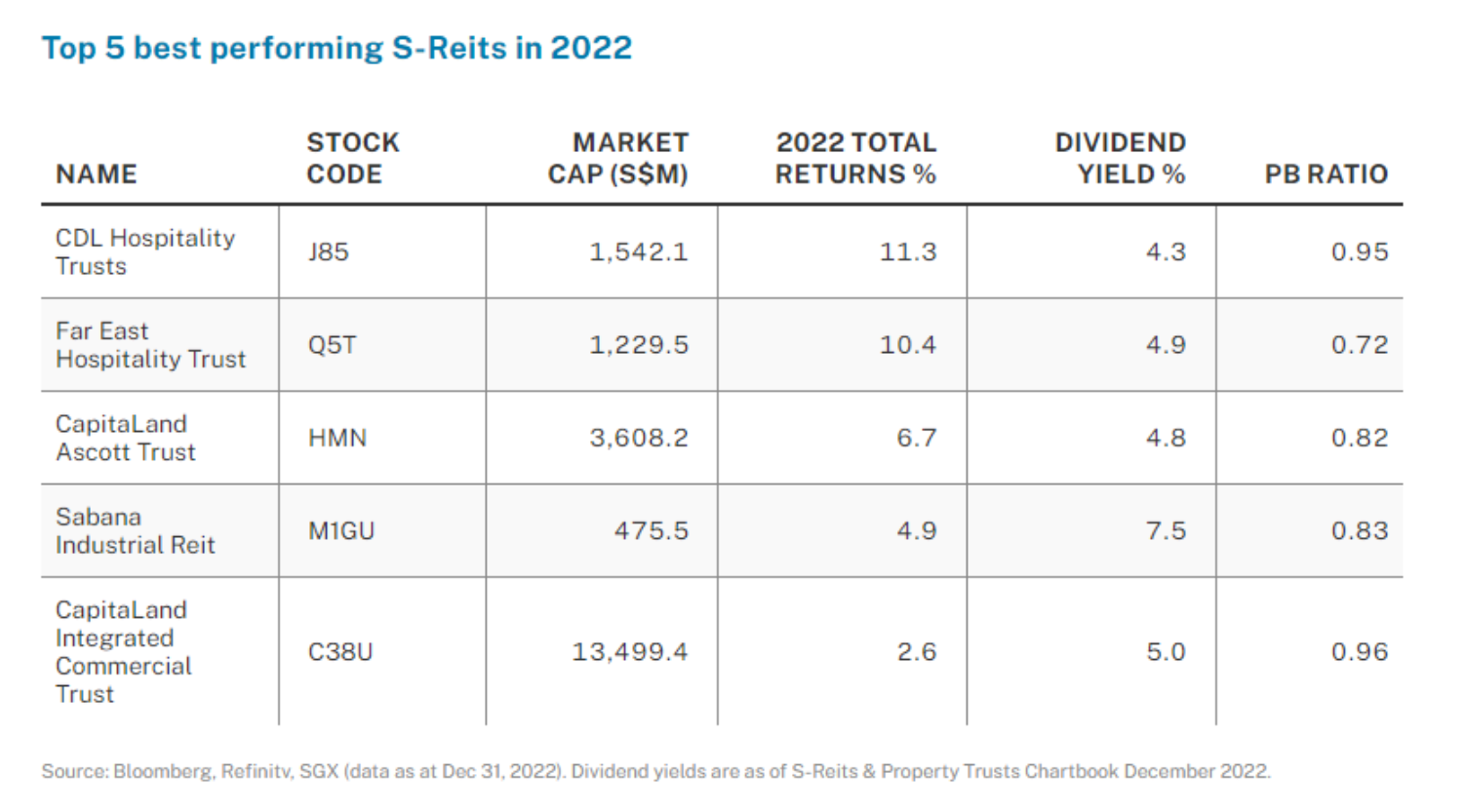

CapitaLand Ascott Trust was among the best performing S-REITs in 2022 despite the challenging year for the sector.

In fact, the total return of CapitaLand Ascott Trust was at 6.7% in 2022, outperforming the iEdge S-REIT Index’s total return of -12.0%.

Investors who are looking to benefit from the recovery of the tourism industry with the return of Chinese tourists should have CapitaLand Ascott Trust under their watchlist.

Here are three reasons why.

1. Q3 Gross profit has recovered to 90% of pre-COVID level

One of the main reasons that investors should look at CapitaLand Ascott Trust is the recovery of its earnings even prior to the reopening of China’s international border.

In fact, the gross profit of CapitaLand Ascott Trust has recovered to 90% of its pre-COVID level during Q3 FY2022, boosted by contributions from its 8 new properties and the 88% year-on-year (yoy) jump in its revenue per available unit (RevPAU).

Even without taking into account the newly acquired properties, same-store gross profit was up by 70% yoy.

With the exception of China, Japan and Vietnam, its 3Q FY2022’s RevPAU has reached 87% of pre-COVID level in all of its key markets such as Australia, France, Singapore, United Kingdom and the US.

2. Strong occupancy level and positive contributions from longer-stay properties

The portfolio occupancy level for CapitaLand Ascott Trust has also recovered strongly in Q3 FY2022 and came in above the 70% level.

Aside from that, its longer-stay properties from the newly acquired student accommodation portfolio are also generating positive contributions.

In fact, longer-stay properties have an occupancy rate of 95% and contributed 15% of gross profit during Q3 FY2022.

This helps to strengthen the earnings resilience of CapitaLand Ascott Trust in the longer-term.

3. Low gearing ratio gives room for further acquisitions to boost growth

Another reason to keep CapitaLand Ascott Trust in your watchlist is its strong and resilient balance sheet.

In fact, gearing ratio fell to 35.8% in Q3 FY2022, from 37.5% in the previous quarter.

Even after the acquisition of the nine properties from its sponsor, The Ascott Limited, in the fourth quarter, gearing ratio is still at a healthy level of around 38.0%.

In fact, CapitaLand Ascott Trust still has more than S$1 billion debt headroom before it reaches the 45% gearing ratio limit.

This will provide opportunity for the trust to continue with its acquisition plans to boost growth.

Best of both world

With the return of Chinese tourists, CapitaLand Ascott Trust will benefit from the recovery and boost in the tourism industry.

However, what is even more interesting about it is the resilient earnings of CapitaLand Ascott Trust as 56% of its gross profit in Q3 FY2022 came from stable income sources such as master leases, management contracts with minimum guaranteed income (MGI), rental housing and purpose-build student accommodation (PBSA).

This allows CapitaLand Ascott Trust to enjoy the best of both worlds in the long-term.

At current level, CapitaLand Ascott Trust has a forward dividend yield of 6.4%, which is still very attractive especially when considering the impact of the rising interest rate environment.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.