3 Singapore Commercial REITs Yielding Over 5.5%

December 5, 2022

Real estate is always a desirable asset class for investors in Asia, particularly in Singapore. But besides bricks-and-mortar property, we can also buy into REITs.

REITs are great listed vehicles if we want exposure to property, without all the hassles of owning an actual residence.

Yet while low interest rates have been good for Singapore REITs in general, that’s obviously changing. However, that doesn’t mean there’s no opportunities out there for dividend investors. Because there clearly are.

In fact, many of Singapore’s top REITs are now yielding substantially over 5%. Some reliable REITs even yield over 6%. And these can be found in sectors that are experiencing a recovery, like office and retail.

So, for income investors, here are three commercial REITs in Singapore that are currently yielding over 5.5%.

1. Keppel REIT – 6.5% dividend yield

Office-focused Keppel REIT (SGX: K71U) has been around for years in Singapore, having initially listed shares on the Singapore Exchange (SGX) all the way back in 2006.

The REIT owns 11 properties; four in Singapore, six in Australia and one in South Korea.

Over 75% of its total assets under management (AUM) are located in Singapore, with Keppel REIT owning well-known properties such as Ocean Financial Centre, One Raffles Quay and Keppel Bay Tower.

Like many other commercial REITs in Singapore, it has seen an improvement in its most recent earnings. For the first nine months of 2022 (9M 2022), Keppel REIT saw net property income (NPI) of S$132.6 million, up 2.5% year-on-year.

Meanwhile, its distributable income came in at S$165.4 million, an increase of 3.4% year-on-year. As of 30 September 2022, Keppel REIT had a portfolio committed occupancy rate of 96.8%, up from 95.5% at the end of June 2022.

In H1 2022, the REIT actually managed to increase its distribution per unit (DPU) by 1% year-on-year to 2.97 Singapore cents.

Based on its current share price, Keppel REIT offers investors a 12-month forward dividend yield of 6.5%.

2. Lendlease Global Commercial REIT – 6.9% dividend yield

Another commercial REIT with a dividend yield well above 6% is Lendlease Global Commercial REIT (SGX: JYEU).

As investors may already be aware of, Lendlease owns three big properties; 313@somerset and Jem in Singapore, and a collection of three commercial buildings in Milan, Italy that is called Sky Complex.

In Lendlease REIT’s latest FY2022 earnings (for the 12 months ending 30 June 2022), it saw distributable income that was up 55.6% year-on-year to S$42.9 million.

That was mainly down to the completion of its acquisition of Jem in Singapore. It also resulted in the REIT’s H2 2022 DPU increasing 4.9% year-on-year to 2.45 Singapore cents.

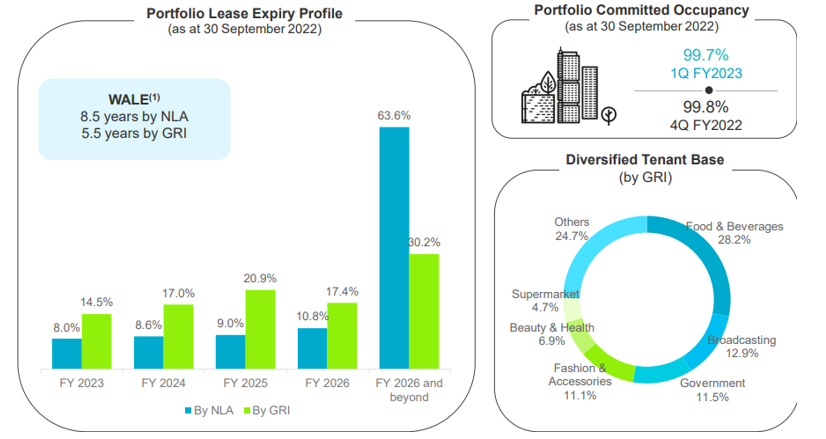

Lendlease REIT’s committed portfolio occupancy was broadly stable at 99.7% as of the end of September 2022 (see below).

Source: Lendlease Global Commercial REIT Q1 FY2023 business update

Source: Lendlease Global Commercial REIT Q1 FY2023 business update

While its retail rental reversion for Q1 FY2023 (for the three months ending 30 September 2022) was around +1%, its office rental reversion was in the region of +4%.

As a result of its H2 2022 DPU, Lendlease Global Commercial REIT shares are offering investors a 12-month forward dividend yield of 6.9%.

3. Mapletree Pan Asia Commercial Trust – 5.8% dividend yield

Finally, there’s retail and commercial behemoth Mapletree Pan Asia Commercial Trust (SGX: N2IU), that owns a host of properties across Singapore, Hong Kong, Mainland China, South Korea, and Japan.

Also known as MPACT, the REIT had a very solid H1 FY2022/2023 earnings report (for the six months ending 30 September 2022).

Indeed, MPACT recorded a higher DPU during the period – of 4.94 Singapore cents – that was actually 12.5% higher than in the same period in FY2021/2022.

This has been driven by a strong recovery in its VivoCity property but also via higher rental reversions from its commercial-focused Mapletree Business City (MBC) properties.

Furthermore, with the potential re-opening of Mainland China (as well as complete re-opening in Hong Kong), the REIT’s commercial properties in those regions could see substantial improvement over the next three to six months.

This should continue to drive positive rental reversions for MPACT, which in turn should help buoy its dividend payout.

Given its current share price, MPACT is giving Singapore REIT investors a 12-month forward dividend yield of 5.8%.

Investing in the right REIT sectors

Given it’s been a mostly horrible year for investors in Singapore’s REITs, there are actually some relative bright spots.

These exist mainly in the commercial and retail REIT spaces. With Keppel REIT, Lendlease Global Commercial REIT, and Mapletree Pan Asia Commercial Trust, investors can buy into some solid dividend yields.

Of course, long-term investors should also monitor whether these REITs can continue to uphold these dividends in the coming quarters but, so far this year, the signs are good.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.