5 Key Highlights for Investors from NIO’s Latest Earnings

September 9, 2022

The thick of earnings season has now passed for most companies. However, some Chinese companies continue to report their numbers.

One such big name is Chinese electric-vehicle (EV) maker NIO Inc (NYSE: NIO) (SEHK: 9866) (SGX: NIO).

The company just reported a wider-than-expected net loss of RMB2.76 billion (US$411.7 million), up nearly 370% year-on-year (yoy), in the second quarter of 2022 (Q2 FY2022).

The negative results follow a similar rough patch from other Chinese EV makers XPeng Inc (NYSE: XPEV) (SEHK: 9868) and Li Auto Inc (NASDAQ: LI) (SEHK: 2015).

However, NIO actually managed to report better-than-expected revenue of RMB 10.29 billion in Q2 FY2022, which represents an increase of 21.8% from last year. That number beat analysts’ average estimate of RMB 9.8 billion.

With so much to digest, here are five key highlights that I believe investors should look into.

1. Total vehicle deliveries in Q2 meet target

Despite the challenging operating environment – with lockdowns in some of the major cities in China – NIO managed to meet its total vehicle deliveries target for the second quarter.

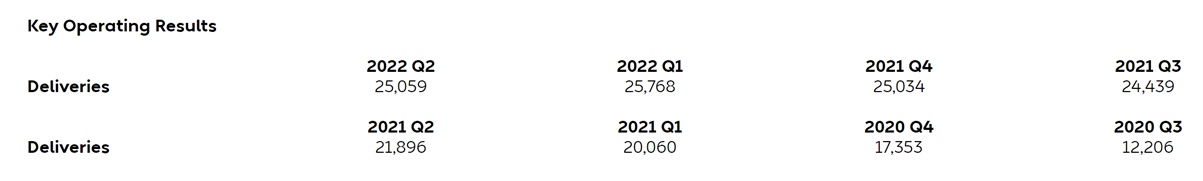

Deliveries of vehicles came in at 25,059 for Q2 FY2022, slightly ahead of the guidance of 23-25k units.

This represents an increase of 14.4% from a year ago although it was 2.8% lower than the previous quarter.

2. Margin hurt by cost pressures

According to NIO’s CFO Steven Wei Fang, the company was affected by “cost volatilities” as it and its suppliers scrambled to keep production running through COVID shutdowns in April and May.

These cost pressures, as well as the increased spending on its recharging and service networks, has dented NIO’s gross margin.

In fact, gross margin in the Q2 FY2022 was down to 13%. This was compared to 18.6% in Q2 FY2021 and 14.6% in Q1 FY2022.

The decrease in gross margin was mainly due to the decrease of vehicle margin and reduction in other sales margin, resulting from the expanded investment in its power and service network.

NIO’s vehicle margin was affected by the increase in battery cost per unit.

3. Production will return to normal in H2 FY2022

NIO’s CEO, William Li Bin, said in a statement:

“The second half of 2022 is a critical period for NIO to scale up the production and delivery of multiple new products.

The ES7, our first mid-large five-seater smart electric SUV based on NIO Technology 2.0 (NT2.0), has become a new favorite of the market with its superior performance, comfort and digital experience. We witnessed a robust order inflow for the ES7 and started its deliveries at scale in August.

We also look forward to starting the mass production and delivery of the ET5 in late September. With the compelling product portfolio and well-established brand awareness, NIO will attract a broader user base and embrace robust growth in the coming quarters.”

With production back to normal, management guided that deliveries in Q3 will be between 31,000 to 33,000.

Meanwhile, revenue generated is expected to range from US$1.9 billion to US$2 billion during the quarter.

4. Demand for EVs remains resilient

Another key takeaway from NIO’s Q2 earnings result is the robust and broad demand for EVs.

While the Group has seen its margin affected by the rising cost of materials and disruption to production due to COVID lockdowns, demand for EVs remains strong.

Revenue and deliveries continue to beat expectations despite the inflationary pressure.

The Chinese also remain supportive of the shift towards EVs, as seen by the extension of tax incentives in early August (although the length of extension was not specified).

Rising fuel prices have also made EVs a more attractive option to consumers.

Recently, the China Passenger Car Association has raised its estimate for EV sales in China to a record 6 million this year.

To put that into perspective, around 2.9 million EVs were sold in China in 2021, indicating that demand could be more than double in just a year’s time.

5. NIO continues to expand its battery charging and swapping network

Currently, NIO has the largest battery-swap network and the EV maker has continued to invest in its infrastructure.

The company has built an expressway power swapping network, covering five verticals, three horizontal expressways and four metropolitan areas in China.

According to CEO William Li, NIO has installed 1,094 swap stations including 285 situated by the expressways. It has completed over 12 million battery swaps for its users.

“NIO is dedicated to putting in place a power system with chargeable, swappable and upgradable experiences, making the recharging experience better than refilling,” Li said.

This will be an advantage to NIO as its battery-as-a-service (BaaS) could potentially offer sustainable recurring income for the Group.

While it is still early days for NIO to build this competitive moat, it is clear that the company is moving forward in this direction.

NIO deserves an allocation in portfolios

The near-term headwinds, such as a potential recessions, China’s Zero-COVID policy, and global inflationary pressure, will continue to weigh on NIO’s share price.

However, China’s government has demonstrated support for EVs and this should enhance the growth prospects of NIO.

The company’s innovation seen in its BaaS as well as its push towards autonomous-driving-as-a-service technologies. It’s definitely an attractive option for investors looking for growth.

While I wouldn’t recommend NIO for investors who are looking for a safe haven stock, its growth prospects mean that NIO is worth a small allocation in a dedicated portion of investors’ portfolios.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.