5 Quality Singapore REITs Popular With Both Institutions and Retail Investors

October 5, 2022

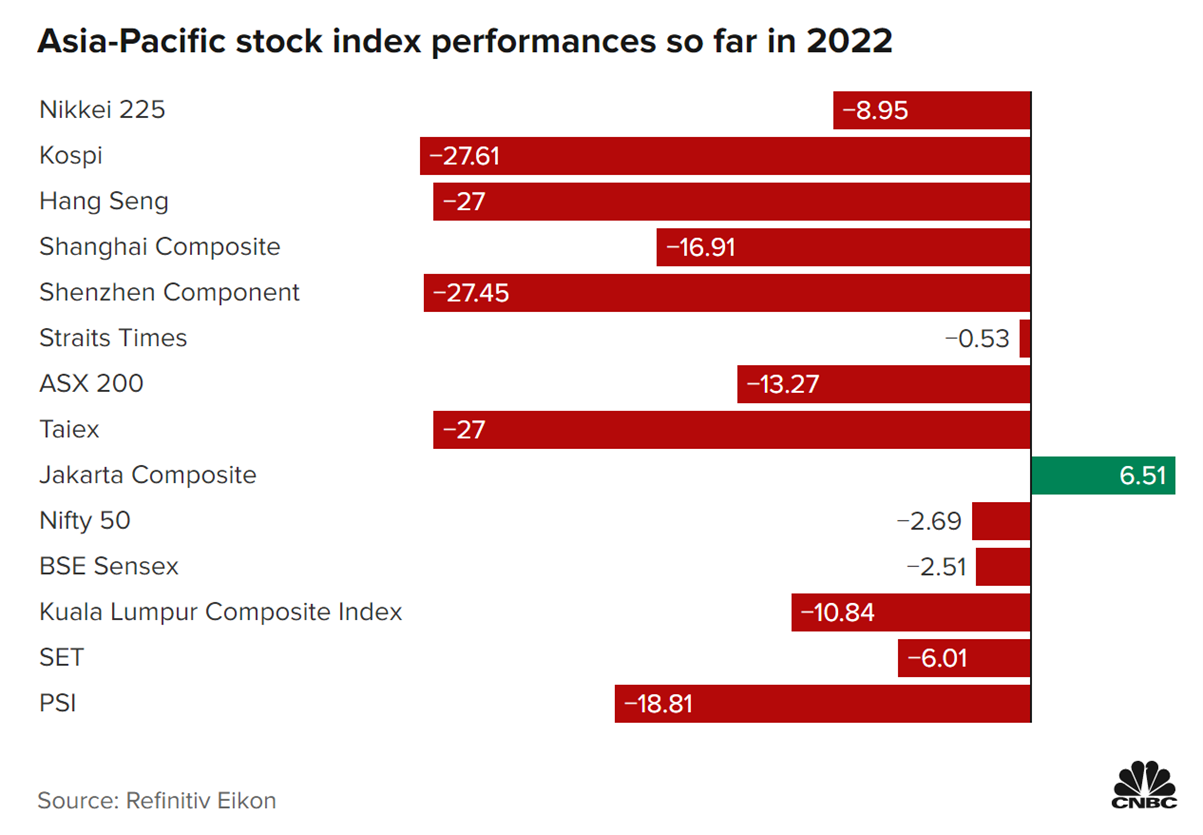

Global stock markets have had a rough year so far in 2022.

Despite the recovery in global stock markets at the start of this week, most stock markets remain deep in the red for the year.

However, Singapore’s stock market could offer a defensive play for investors looking for protection against more volatile global markets.

In 2022, Indonesia is so far the best-performing Asia-Pacific stock market, followed by Singapore’s Straits Times Index (STI).

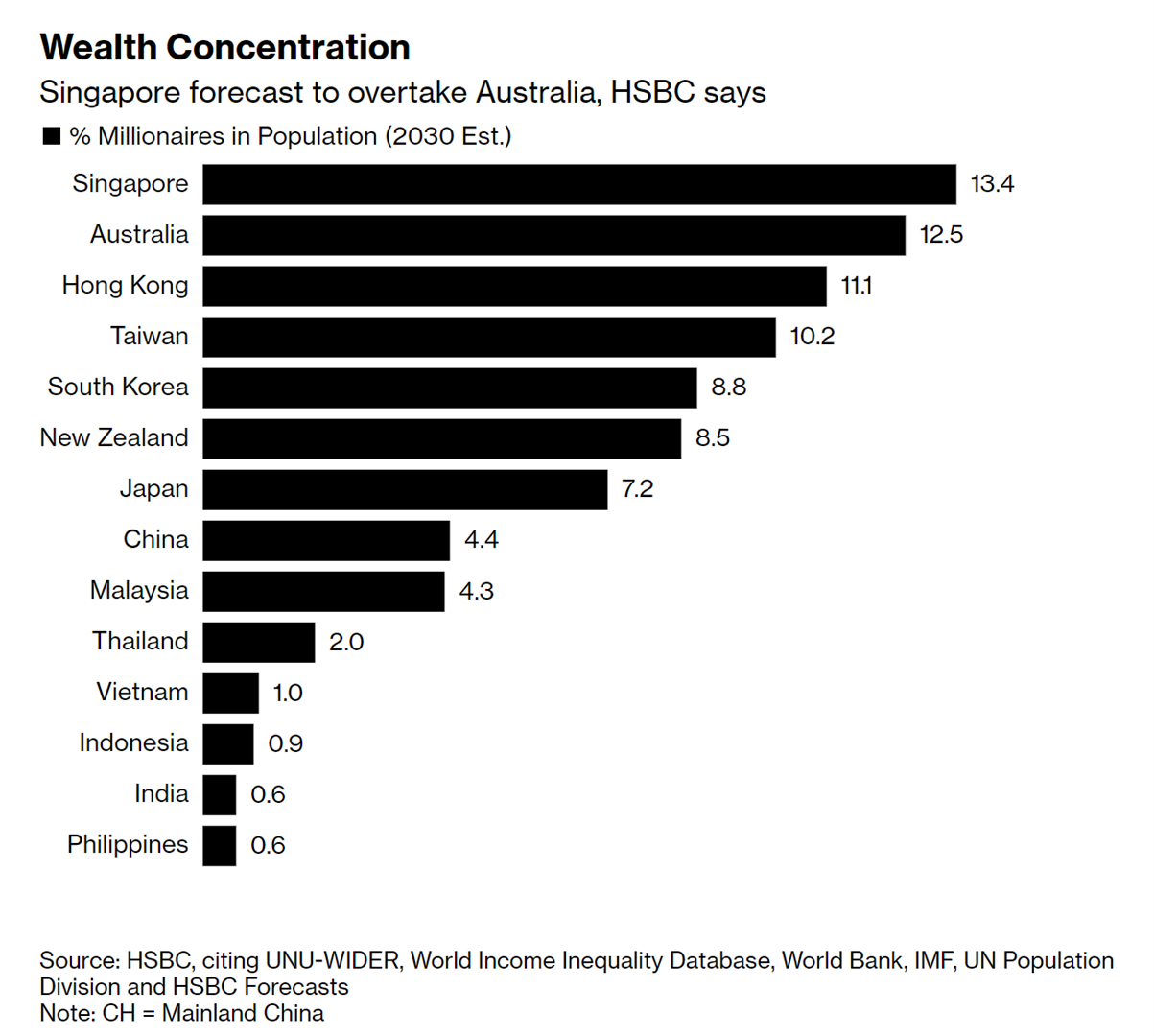

The rise of Asia’s wealth support resilience

According to HSBC’s report on The Rise of Asian Wealth, it said that wealth in Asia excluding Japan could outstrip the US by 2025.

In short, the middle class in the region continues to grow rapidly.

This will drive support for financial services, especially on more sophisticated products such as wealth and pension planning as well as demand for insurance and investment products.

In Singapore, 13.4% of the population is projected to boast millionaire status by 2030, which is a bigger concentration than the US, mainland China or any other economy in the Asia-Pacific region.

The dividend advantage

The stock market is unlikely to avoid a selloff in the event of a recession but Singapore stocks do have a dividend advantage.

As the largest REIT market in Asia ex-Japan, there are plenty of defensive stocks for investors to hop onto amid the current market volatility.

This is especially true for companies that are supported by healthy and structural earnings growth.

Dividend expectations for Singapore corporates continues to remain much more resilient than earnings estimates.

This is a testament to the quality of corporate earnings, cash flows and balance sheets.

S-REITs recover from panic sell-down during the GFC

During the Global Financial Crisis (GFC) in 2008-09, the Singapore market was not spared from the violent sell-off in the stock market.

Even defensive S-REITs were severely affected by the subprime crisis in the US.

Since REITs had made use of the commercial mortgage-backed securities (CMBS) loans during the boom period from 2005 to 2007, REITs had to approach banks to refinance the maturing CMBS loans.

This led to a sharp decline in the share prices of REITs, which lost more than 70% of their market value during the GFC meltdown.

However, investors who held on to their REITs, would have sailed through the crisis just fine while collecting dividends throughout those volatile rides in the stock market.

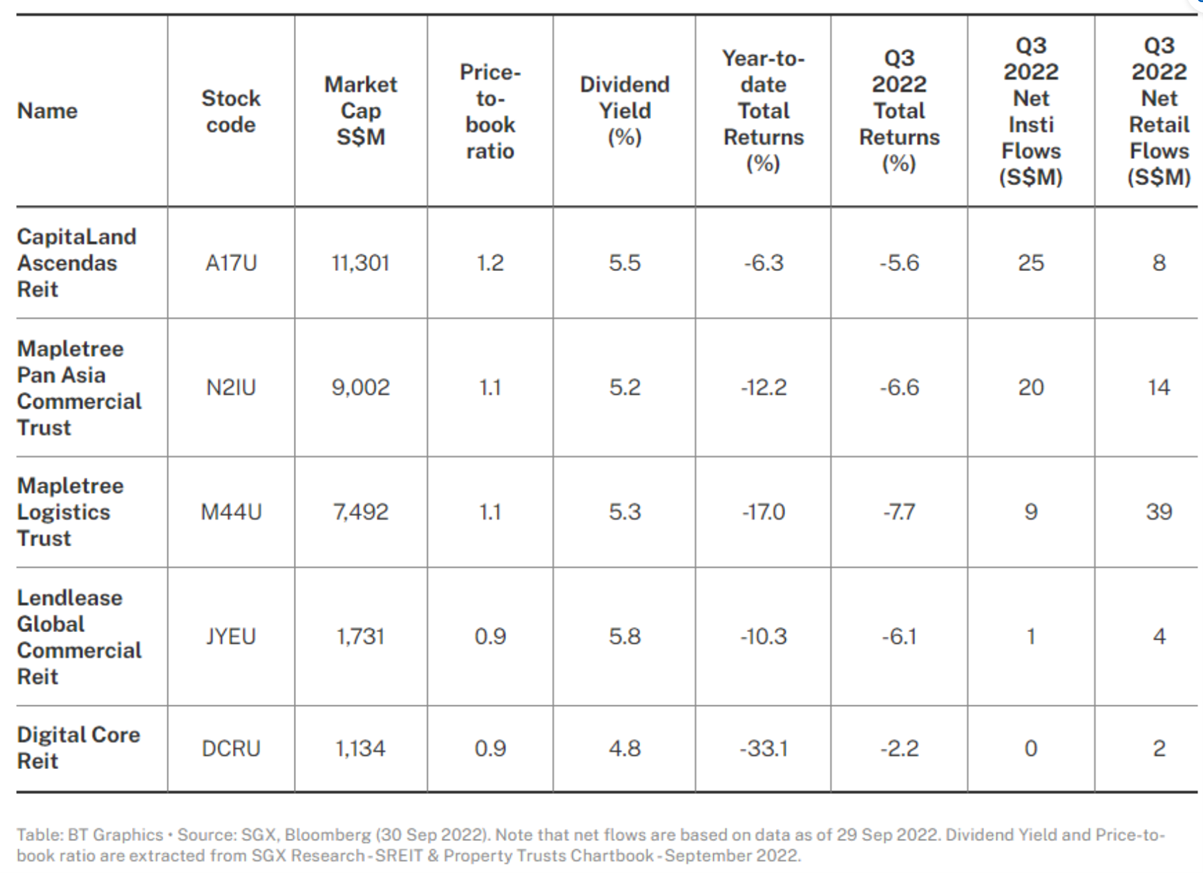

5 S-REITs loved by both institutions and retail investors

Now that you understand why the Singapore stock market is more resilient during a bear market, here’s a look at five S-REITs that saw net inflows from both institutions and retail investors during the third quarter of this year.

Source: SGX

Source: SGX

The five S-REITs are CapitaLand Ascendas REIT (SGX: A17U), Mapletree Pan Asia Commercial Trust (SGX:N2IU), Mapletree Logistics Trust (SGX:M44U), Lendlease Global Commercial REIT (SGX:JYEU), and Digital Core REIT (SGX:DCRU).

CapitaLand Ascendas REIT, which was recently renamed from Ascendas REIT, is optimistic that structural trends will persist.

These include the expansion of logistics capacities by companies and digitalisation of the economy, both of which will continue to drive demand for its logistics and data centre segments.

This is despite of the impact from supply chain disruptions, inflation and rising interest rates on its tenants’ businesses as well as its operating costs.

Meanwhile, Mapletree Pan Asia Commercial Trust is scheduled to announce its first post-merger financial results on 27 October, 2022.

As for Mapletree Logistics Trust, the overall leasing demand for its warehouse space has remained resilient, supported by domestic consumption, e-commerce and inventory stockpiling.

Meanwhile, ESG investors can look into Lendlease Global Commercial REIT, which has recently announced it has achieved its net-zero carbon target ahead of its original target and that this was accomplished through various carbon reduction strategies within its Singapore assets.

A pure-play data centre REIT, Digital Core REIT, is also among those that have seen inflows from both institutional investors and retail investors.

The company has continued to expand its data centres amid the structural shift towards digitalisation.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.