5 Singapore Stocks to Buy Amid a Market Downturn

September 22, 2023

Investing in stocks during a market downturn can be likened to bargain hunting.

The general weakness in the Singapore stock market this week, along with the global stock market, uncovers numerous investment opportunities.

Here are 5 top Singapore stocks that are known for their resilience in the market.

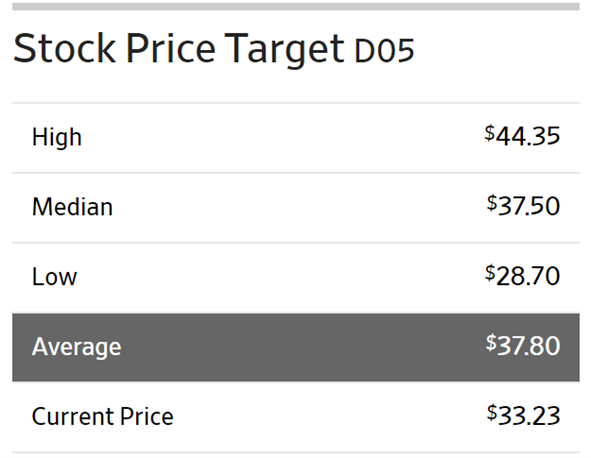

1. DBS Group Holdings Ltd (SGX: D05)

DBS Group is a Singaporean multinational banking and financial services corporation that is the largest bank in Southeast Asia by assets and has a presence in several other regions.

Robust Financial Performance: DBS has demonstrated consistent growth, with net profit reaching a record S$10 billion in 1H 2023.

Dividend Growth: The bank has consistently increased its quarterly dividends, reflecting strong earnings and a commitment to returning value to shareholders.

Stable and Reputable: Being Singapore’s largest bank and significantly owned by Temasek Holdings, DBS offers stability and a solid reputation, making it a relatively safer bet in the financial sector.

Average Target Price: S$37.80 (+13.8%)

Source: Wall Street Journal

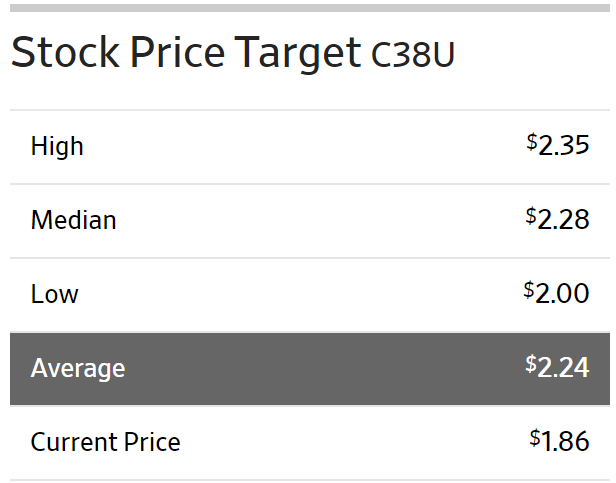

2. CapitaLand Integrated Commercial Trust (SGX: C38U)

CapitaLand Integrated Commercial Trust or CICT for short, is the first and largest real estate investment trust (REIT) listed on SGX that owns retail, office assets and integrated development.

Diverse Portfolio & High Occupancy: With 26 properties across Singapore, Germany, and Australia and a high committed occupancy rate, CICT demonstrates both diversity and demand.

Positive Rental Reversions: The trust experienced positive rental reversions in both its retail and office portfolio in 1H 2023, indicating strong leasing momentum.

Strong Sponsorship: Backed by CapitaLand Investment Limited, CICT has a solid foundation and potential for further growth and acquisitions.

Average Target Price: S$2.24 (+20.4%)

Source: Wall Street Journal

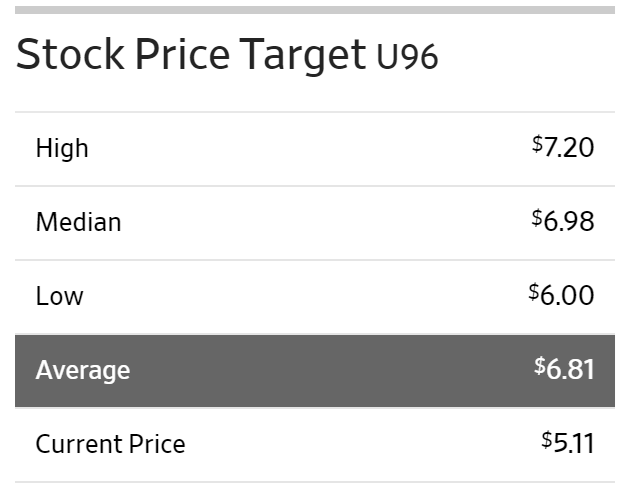

3. Sembcorp Industries Ltd (SGX: U96)

Sembcorp Industries is a leading energy and urban solutions provider that supports the energy transition and sustainable development with its renewable energy and urban development businesses.

Renewable Energy Focus: With a substantial portion of its energy portfolio in renewables, Sembcorp is well-positioned to capitalise on the growing green energy trend.

Diverse Urban Development Projects: The wide-ranging urban development portfolio across Asia indicates diversification and significant growth potential.

Strategic Agreements and Expansion: Recent agreements and expansion into new markets like Vietnam enhance Sembcorp’s prospects and geographic reach.

Average Target Price: S$6.81 (+33.3%)

Source: Wall Street Journal

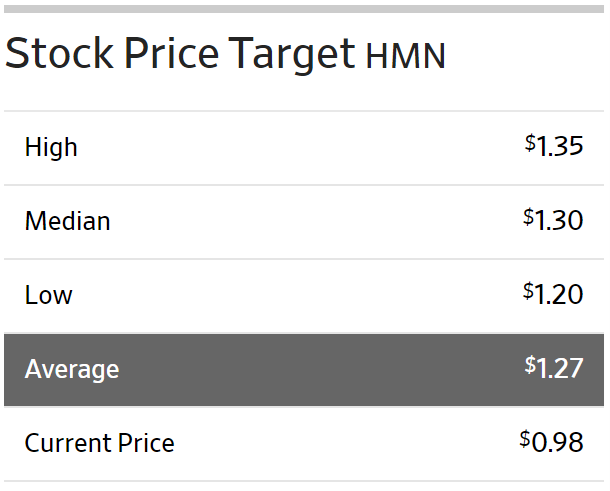

4. CapitaLand Ascott Trust (SGX: HMN)

CapitaLand Ascott Trust is the largest lodging trust in Asia-Pacific, with a portfolio of 95 properties across 15 countries in Asia-Pacific, Europe and the US.

Strategic Acquisitions: The acquisition of assets in London, Dublin, and Jakarta expands the REIT’s portfolio and geographic diversification, potentially driving future earnings.

Asset Enhancement Initiatives (AEIs): The AEIs for properties in Sydney and London are expected to increase property values and yield, contributing to the trust’s overall performance.

Equity Fundraising and Strong Demand: The over-subscription of the private placement indicates strong investor confidence and provides capital for future growth.

Average Target Price: S$1.27 (+29.6%)

Source: Wall Street Journal

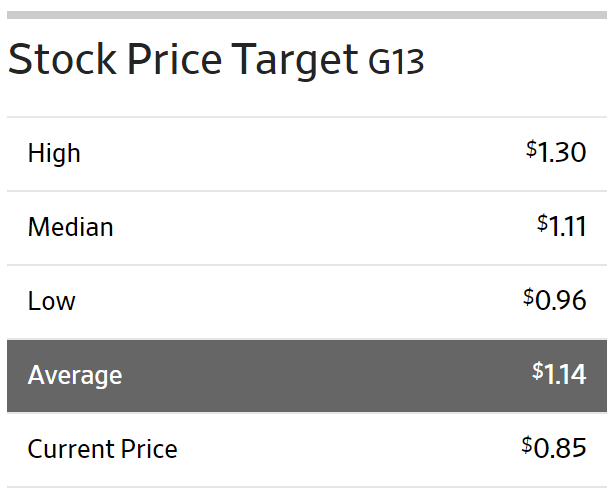

5. Genting Singapore Limited (SGX: G13)

Genting Singapore Limited is a leading integrated resort development company in Asia, operating Resorts World Sentosa, one of the world’s largest destination resorts.

Strong Earnings Growth: The tripling of earnings in 1HFY2023 reflects a strong recovery and positions Genting Singapore as a viable post-Covid-19 play.

Diverse Visitor Base: The return of visitors from various regions, including China and Southeast Asia, indicates a broad-based recovery and less dependency on a single market.

Positive Analyst Outlook: Maintained “buy” calls and raised target prices from analysts suggest confidence in the company’s future performance and potential upside for investors.

Average Target Price: S$1.14 (+34.1%)

Source: Wall Street Journal

Promising opportunities for long-term investors

The current market conditions present promising opportunities for long-term investors.

Each of these stocks showcases strong fundamentals, diverse portfolios, and strategic initiatives that position them well for future growth.

As always, investors should conduct thorough research and consider their risk tolerance before making investment decisions.

Seize the opportunity and consider diversifying your portfolio with these compelling options.

Disclaimer: ProsperUs Head of Content & Investment Lead Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.