Broker’s Call: CapitaLand Integrated Commercial Trust’s Dividend Up 1%, Maintain Add

August 4, 2022

CGS-CIMB REITs Analyst take

For Singapore’s dividend investors, 2022 marks the 20th anniversary of the listing of the first-ever Singapore REIT on the SGX.

Back then it was known as CapitaLand Mall Trust (CMT), but is now currently trading as CapitaLand Integrated Commercial Trust (SGX: C38U). It’s also commonly known as “CICT”.

The largest SGX-listed office and retail REIT reported its first-half 2022 earnings last Thursday (28 July). The research team at CGS-CIMB Securities maintains our “ADD” call and S$2.57 target price for the REIT.

Here’s what investors should know about the REIT’s latest numbers.

DPU rises less than 1% from year-ago period

For CICT, its first-half revenue came in at S$687.6 million while net profit income (NPI) was S$501.6 million – those figures were up 6.5% and 6.2% year-on-year, respectively.

This improvement mainly came from contributions from CapitaSky and three Australian assets as well as better performance from its existing portfolio.

However, this was partially offset by the divestment of JCube and higher operating expenses.

Overall, its rental reversion was negative for the first half – coming in at -0.5% although this was an improvement from the -1.3% reported for the first quarter of 2022.

Its suburban malls performed well, achieving positive rental reversion of +1.1% for the period.

The best-performing tenants were in trade sectors such as entertainment, shoes & bags, fashion, and sporting goods.

New acquisitions boost occupancy in office

“Back to office” has been the catchphrase for employers in 2022 and that has proved beneficial to CICT’s assets.

For the first half, office revenue at the REIT increased by 11.9% year-on-year to S$214.9 million while NPI for the segment increased 10.8% year-on-year to S$163 million.

The acquisition of CapitaSky (completed in April 2022) and the purchases of three Australian office properties in June helped support growth.

Occupancy also improved to 91.9% during the first half of 2022 with a positive rental reversion of +8.5% year-on-year.

Locally, CapitaSpring’s take-up rate was boosted to 99.5% and Raffles City Singapore saw take-up also rising to 99.4%.

How’s CICT doing on ESG?

Source: CGS-CIMB Securities Research

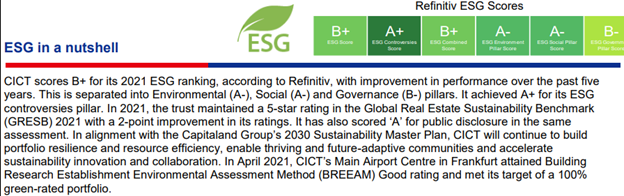

On the Environmental, Social and Governance (ESG) front, CICT scores a “B+” for its 2021 performance as it continues with a range of initiatives (see above).

The REIT targets to achieve 78%, 35%, and 45% reductions in carbon emission intensity, energy intensity, and water intensity, by 2030 – taking 2008 as the base year comparison.

On its sustainability efforts and ESG score, CICT has been consistently improving since 2017 and the “G” of Governance will be one that is key to improving that further in future.

Reiterate our Add rating

For CICT, we keep our DPU estimates unchanged for its FY22-24 and maintain our target price of S$2.57 (shares currently trade for around S$2.19 apiece).

We believe that the REIT is well-placed to benefit from the ongoing macroeconomic recovery based on its diversified and stable earnings profile.

While upside potential could come from more clarity on its asset enhancement plans, investors should remain conscious of downside risks – primarily a slower-than-expected rental recovery outlook.

Disclaimer: CGS-CIMB Securities REITs Analyst Mun Yee Lock doesn’t own shares of any companies mentioned.