CapitaLand Integrated Commercial Trust: H2 2022 DPU Rises 2.7%

February 7, 2023

China is reopening and, for Singapore-based investors, the city state is set to be a big beneficiary.

One of the most cited sectors that could benefit from the return of Chinese tourists are retail REIT operators.

And in that space, no Singapore REIT is bigger than CapitaLand Integrated Commercial Trust (SGX: C38U).

Better known as “CICT”, it’s the largest REIT (by market cap) listed on the SGX and has a host of shopping malls located in the downtown areas.

The REIT also provided its latest H2 2022 earnings last week (for the six months ending 31 December 2022).

So, here’s what Singapore REIT and dividend investors should know about CICT’s latest earnings update.

Dividend increases nearly 3%; portfolio occupancy climbs

CICT saw its H2 2022 gross revenue and net property income (NPI) rise 14.4% year-on-year and 13.1% year-on-year, respectively, to S$754.1 million and S$541.7 million.

The REIT’s distributable income for H2 2022 came in at S$355.1 million, up 4.8% year-on-year.

Meanwhile, the all-important distribution per unit (DPU) – or dividend – was 5.36 Singapore cents for H2 2022. This was up 2.7% year-on-year versus the same period in 2021.

Overall, the improved performance was driven by new contributions from an acquired 70% interest in CapitaSky and its Australia portfolio, as well as higher rental income across CICT’s Singapore assets.

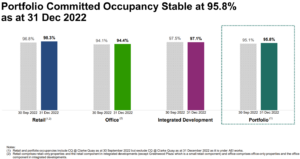

During Q4 2022, CICT saw its overall portfolio’s committed occupancy climb slightly to end the year at 95.8% – up from 95.1% as of the end of September 2022 (see below).

This improvement is occupancy was driven primarily by better occupancy rates for its retail portfolio.

Source: CapitaLand Integrated Commercial Trust H2 2022 and FY2022 earnings presentation

CICT’s retail portfolio shines during H2 2022

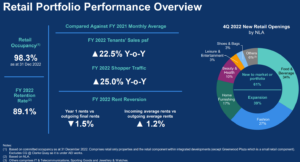

It’s important that Singapore REIT investors remember that CICT derives the biggest portion of its NPI from its retail properties.

In this sense, it was a good period for the REIT as both tenant sales and shopper traffic saw double-digit-percentage increases in excess of 20% for FY2022 (see below).

Rental reversion for the full year was also positive, coming in at +1.2% versus FY2021.

Source: CapitaLand Integrated Commercial Trust H2 2022 and FY2022 earnings presentation

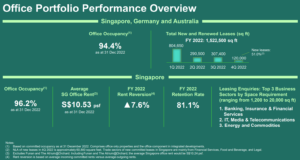

On the office side of its portfolio, CICT saw positive rental reversions of +7.6% for FY2022 and a FY2022 tenant retention rate of 81% (see below).

Its office portfolio’s weighted average lease expiry (WALE) came in at 3.8 years.

Its Australia office portfolio saw a slight improvement in its occupancy rate to 82.2% as of the end of December 2022 – versus 81.2% as of 30 September 2022.

Both its Singapore and Germany office properties maintained occupancy rates above 95% as of 31 December 2022.

Source: CapitaLand Integrated Commercial Trust H2 2022 and FY2022 earnings presentation

Remaining positive for the rest of 2023

Overall, it was a solid performance from CICT for H2 2022 as improving operating metrics is leading to more positive rental reversions.

The REIT is seeing demand from new F&B and fashion offerings as it looks to improve its tenant mix in its retail malls to better appeal to shoppers.

While its average funding cost did tick up to 2.7% as of the end of December 2022, it’s still at a comfortable level.

However, investors should note that the REIT had a gearing ratio of 40.4% as of the end of December 2022.

Management is looking to complete ongoing asset enhancement initiatives (AEIs) at Raffles City Singapore and Clarke Quay to potentially boost returns for unitholders.

Based on its H2 2022 DPU, shares of CICT are offering investors a 12-month forward dividend yield of 5.1%.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.