All Singapore investors will be familiar with the city-state’s big bank stocks.

DBS Group Holdings Ltd (SGX: D05) is a leading financial services group in Asia with a presence in 18 markets and is Singapore’s largest bank.

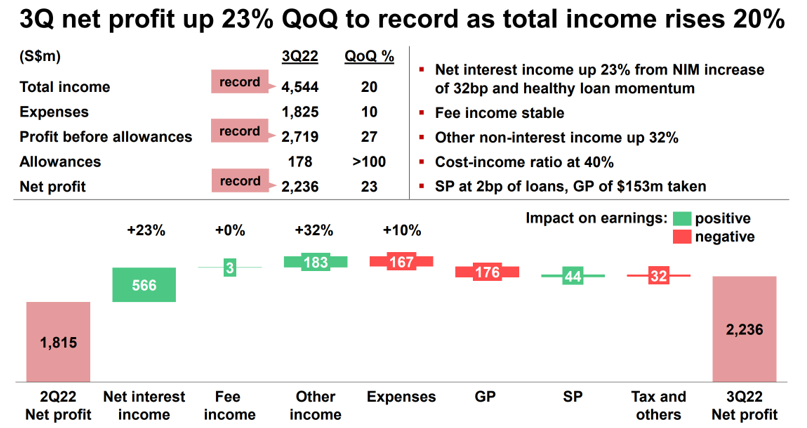

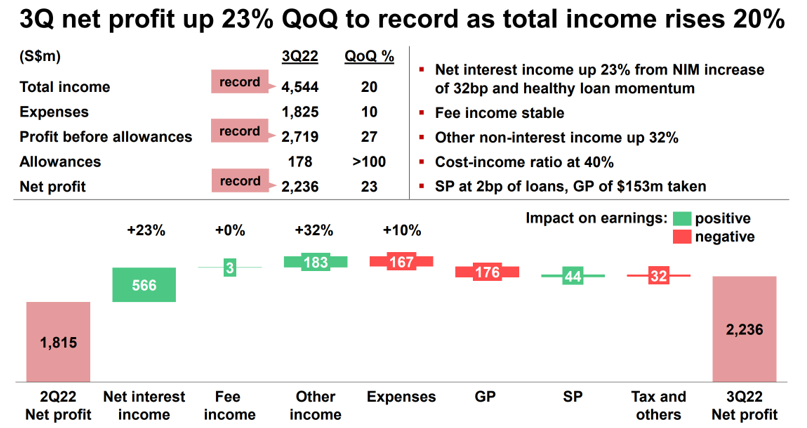

Last week, DBS Group reported earnings of S$2.24 billion in Q3 FY2022, a new record high for the bank.

This represents an increase of 32% from a year ago and easily surpassed the consensus estimate of S$2.05 billion.

DBS also maintained its quarterly dividend per share of 36 Singapore cents, which shareholders will receive on 24 November.

So, here are five key highlights from DBS’s latest Q3 FY2022 earnings.

1. Beneficiary of interest rate hikes

Net interest income (NII) for DBS was up by 23% as compared to the previous quarter as net interest margin (NIM) climbed 32 basis points (bps) to 1.9% during the period.

This is in line with our view that DBS is one of the key beneficiaries of the rising interest rate environment.

Source: DBS Q3 FY2022 Financial Results

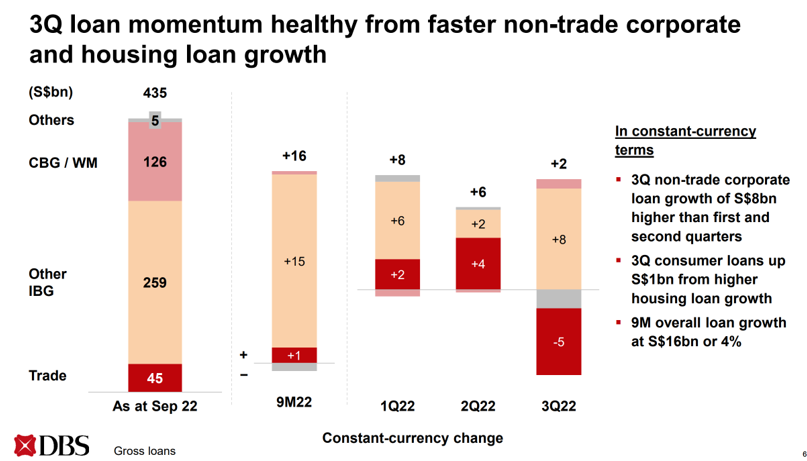

2. Healthy loan growth

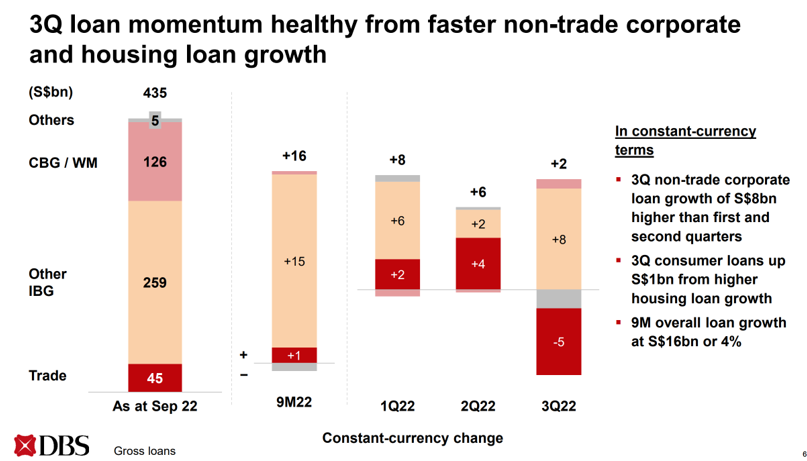

Loan growth momentum was healthy as non-trade corporate and housing loans grew faster than the first two quarters.

Management also guided that its loan pipeline remains healthy and could reach mid-single-digit growth.

This is after taking into consideration a possible moderation in fourth quarter momentum on lower onshore borrowing costs in China.

Source: DBS Q3 FY2022 Financial Results

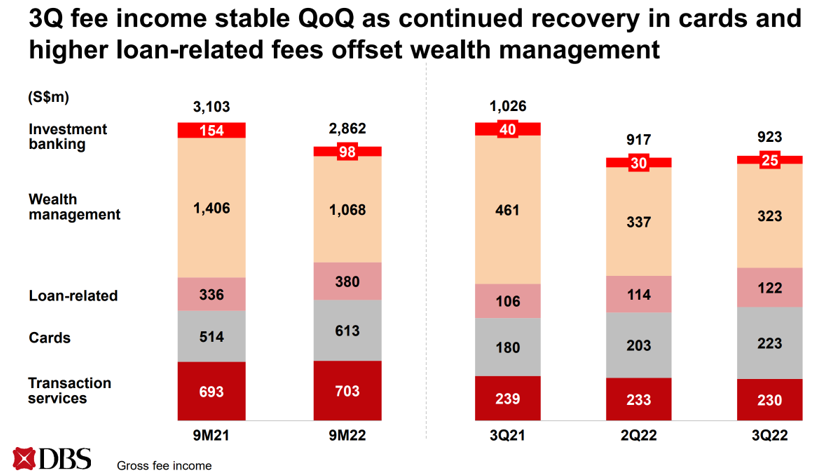

3. Non-interest income boosted by strong treasury income

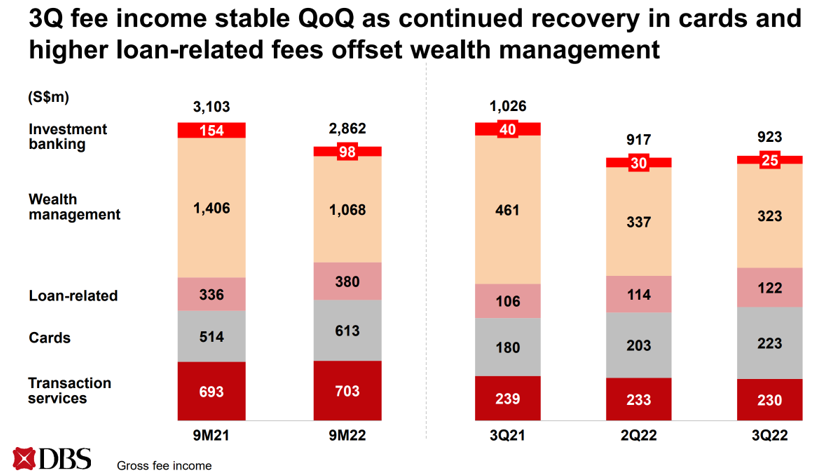

Fee income was stable from the previous quarter as wealth management and investment banking (IB) fees stayed soft due to weak market conditions.

Treasury market income saw strong growth of 32% year-on-year (yoy) which helped to offset the negative areas of non-interest income.

Source: DBS Q3 FY2022 Financial Results

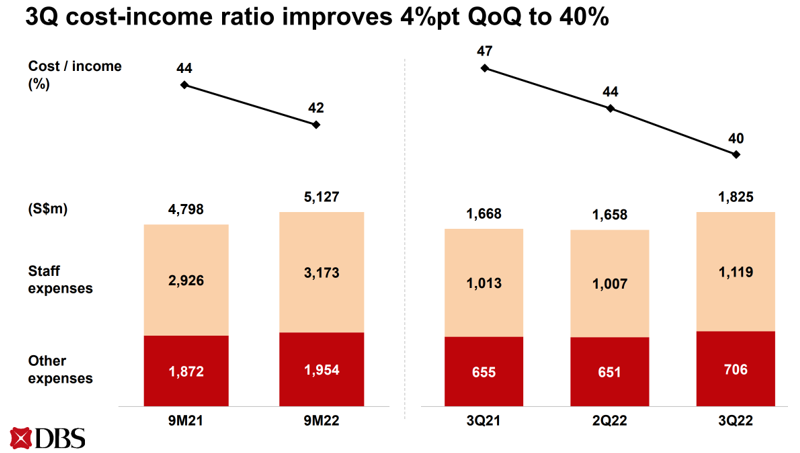

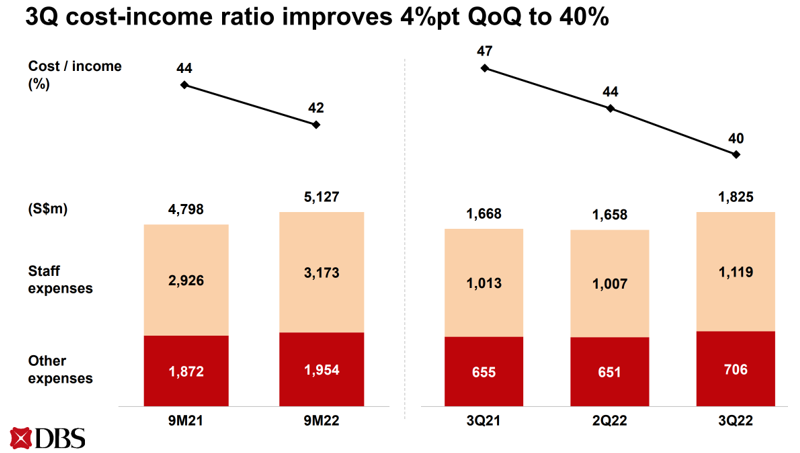

4. Improved cost-income ratio

While total operating expenditure (opex) rose 9% yoy, the stronger top line growth kept DBS’s cost-to-income ratio at 40.2% in Q3 FY2022.

It is a big improvement from the 44% in the previous quarter.

Source: DBS Q3 FY2022 Financial Results

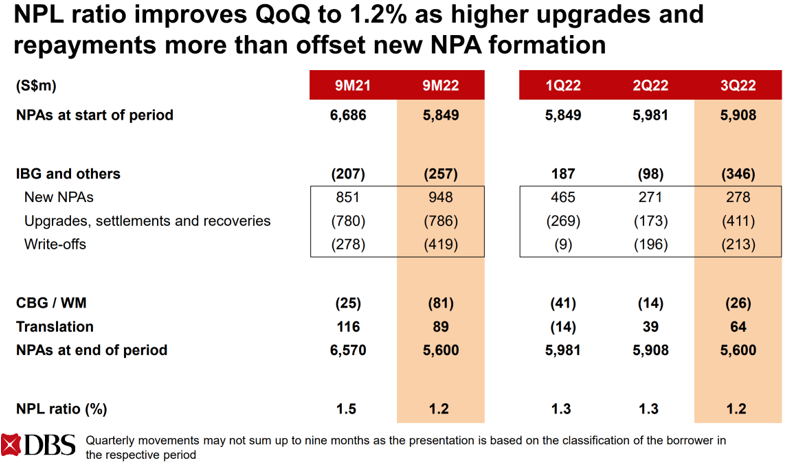

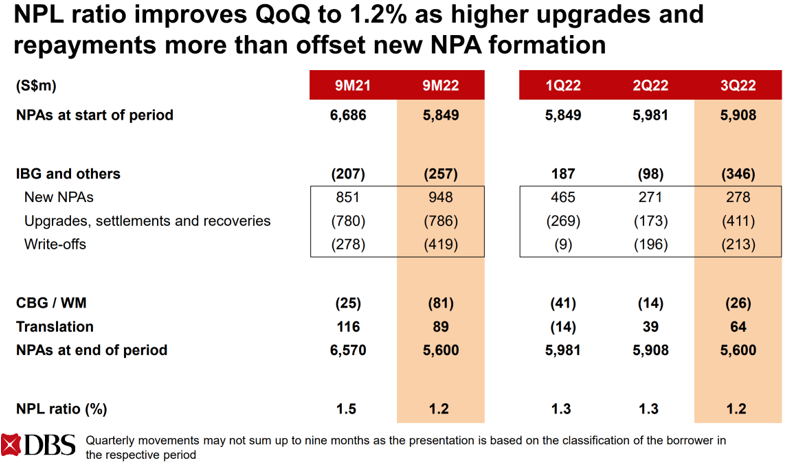

DBS’s non-performing loan (NPL) ratio also improved and eased to 1.2% in Q3 FY2022 as higher upgrades and repayments more than offset new non-performing assets (NPAs).

Source: DBS Q3 FY2022 Financial Results

5. NIM expected to reach 2.25% by mid-2023

DBS Group will continue to benefit from the rising interest rate environment.

According to management, NIM is expected to reach 2.25% by the middle of next year assuming that the US Fed funds rate peaks at 4.75%.

The US Federal Reserve (Fed) has recently increased its interest rate by 75 bps for the fourth consecutive time, bringing the US Fed funds rate to a range of between 3.75% to 4.0%.

There is, however, downside risk to the aggressive rate hikes embarked on by the US central bank, which could potentially trigger a global recession.

On the other hand, the reopening of China will boost DBS Group’s prospects in the near term and support loan growth.

Given DBS’s exposure in the region, the pickup in China’s economy will be an additional bonus to the bank in addition to the improved interest income.

Loan growth momentum sustained with resilient asset quality

We have talked about how Singapore banks will benefit from this and the latest Q3 FY2022 is evidence of it.

However, what is even more impressive is how loan growth is being sustained despite the rising cost of borrowings.

The resilient asset quality of DBS is reflected by the improved NPL and cost-to-income ratios, which also put DBS in a good position to ride through this rate hike cycle.

Overall, I believe that DBS will continue to benefit from this uptrend until we see a Fed pivot away from the rate hike cycle that they have embarked upon.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.