DBS Shares: 5 Key FY2022 Earnings Takeaways for Bank and Dividend Lovers

February 14, 2023

On Monday, DBS Group Holdings Ltd (SGX: D05), the largest bank in Southeast Asia, reported a record FY2022 net profit of S$8.19 billion, up 20% from the previous year.

The result was in line with expectations from most analysts as Singapore banks continue to benefit from the rising interest rate environment over the last year.

DBS Group is the first among the three large banks in Singapore to report its earnings.

In line with the strong results, DBS Group also declared a special dividend per share (DPS) of S$0.50. The last time that we saw DBS declare a special dividend was back in 2017.

With such a strong performance during FY2022, here are five key takeaways from DBS Group’s latest earnings for lovers of bank and dividend stocks.

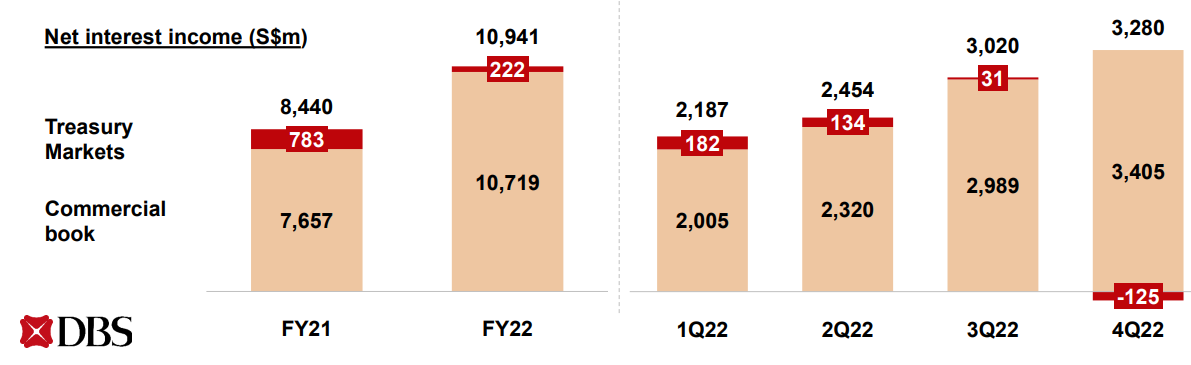

1. Surge in net interest income amid rising interest rates

DBS’s net interest income (NII), which is the difference between the interest earned on loans and the interest paid on deposits, grew by 40% year-on-year (yoy) to S$10.72 billion.

Source: DBS Group’s Q4 FY2022 Financial Results

This was due to loan growth of 4% and an increase in net interest margin (NIM) of 48 basis points (bps) to 2.11%.

The bank’s loan growth was particularly strong during the first nine months of the year.

This was followed by a moderation towards the end of Q4 FY2022 as corporations sought cheaper financing alternatives and repaid opportunistic borrowings.

2. Decline in fee income on the back of weaker market conditions

The bank’s net fee income was down 12% yoy to S$3.1 billion in FY2022, amid a sharp decline in wealth management fees.

This was in line with the uncertain and weak market conditions during 2022.

Card fees, on the other hand, were up by 20% yoy to a new high of S$858 million as overall spending and travel spending recovered following the reopening of international borders.

Loan-related fees were also up by 11% yoy to S$459 million while transaction fees remained stable at S$929 million as higher cash management and trade fees were offset by lower brokerage commissions from institutional clients.

3. Improvement in asset quality

DBS also reported an improvement in asset quality during FY2022. Non-performing loans (NPLs) stood at S$4.76 billion with the NPL ratio at 1.1%, which was down by 0.2 percentage points (ppts).

Meanwhile, DBS Group’s non-performing assets (NPA) stood at S$5.13 billion, down 0.8% quarter-on-quarter (qoq) and 12.4% yoy.

It is, however, noteworthy that DBS Group made loans to the tune of S$1.3 billion to India’s Adani Group, which has recently been struggling with allegations involving stock manipulation and accounting fraud.

Yet DBS Group’s CEO, Piyush Gupta, is not concerned as the bulk of the exposure is in relation to the acquisition of a Swiss construction materials company, which is debt-free.

4. Strong dividend growth track record

DBS Group declared a special dividend of S$0.50 per share and increased its regular quarterly DPS from S$0.36 to S$0.42. That translates to a 16.5% increase in its DPS.

It also means that for FY2022, DBS’s full-year dividend is S$2 per share, assuming that the dividends declared will be approved at DBS Group’s AGM.

What is more important, however, is the increase in its annual dividend from S$1.44 to S$1.68 with the latest dividend hike.

This means DBS shares now offer investors a 12-month forward dividend yield of around 4.7%.

It is also worth noting that DBS Group declares and pays its dividend on a quarterly basis, which makes it even more attractive for income investors.

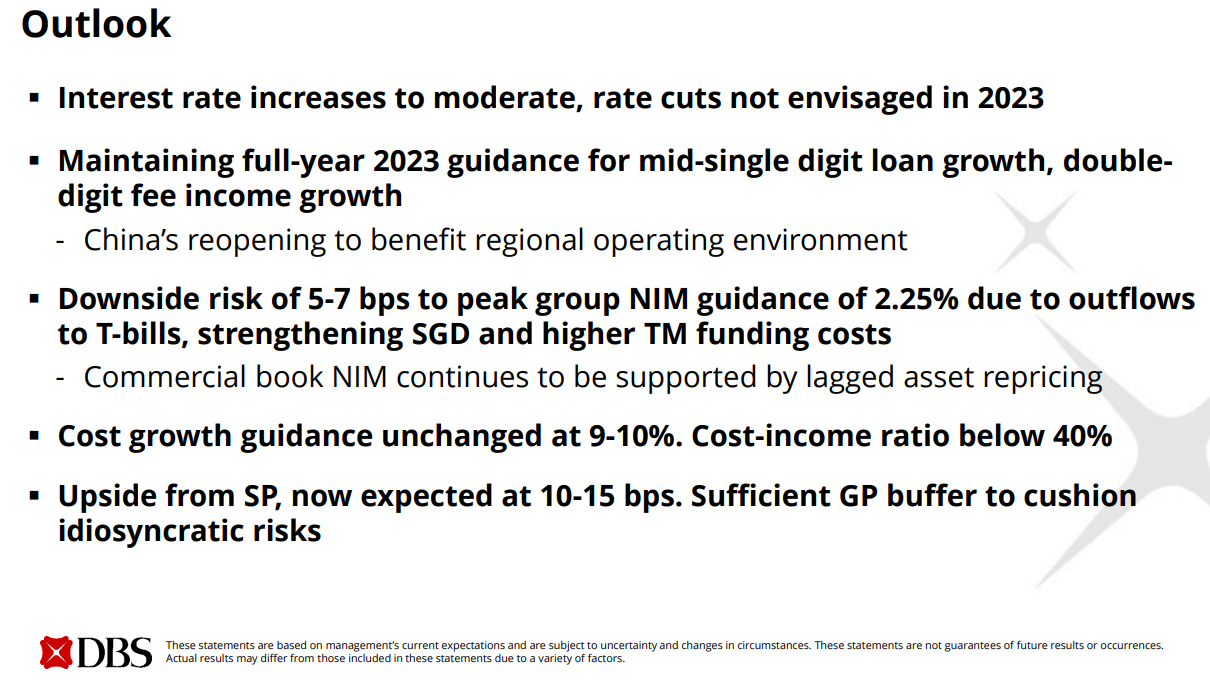

5. Robust outlook supported by reopening in China

While there were concerns on the potential impact on the moderation in interest rate hikes this year, DBS’s management remains confident of a positive outlook for the bank.

Source: DBS Group’s Q4 FY2022 Financial Results

While DBS Group’s CEO, Piyush Gupta, expects the bank’s NIM to peak at 2.25%, there is reason to believe that it will stay above the 2% level in FY2023 as management do not expect to see a cut in interest rates this year.

There is a downside risk to the 2.25% (of about 5 to 7 bps) with the potential outflows of Treasury bills, strength in the SGD and higher funding costs for the treasury market division.

Meanwhile, fee income is likely to see a recovery with management expecting to see a mid-single-digit loan growth and double-digit fee income growth for FY2023.

Further to his statement, Gupta noted the bank’s “healthy” business pipelines, adding that he expects “confidence to return to markets in the coming year as interest rate increases ease and China reopens”.

DBS Group continues to deliver consistent growth across its core markets

DBS Group has benefitted from the rising interest rate environment and could still see further upside in earnings for FY2023.

However, what is more impressive is the consistent performance of the bank over the years, a reflection of the strong track record of the management team.

With a focus on digital transformation and a strong risk management framework, DBS Group is well positioned to continue its growth trajectory in the years ahead.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.