Frasers Logistics & Commercial Trust: Is This Large REIT Worth Buying?

March 31, 2022

With high inflation, rising interest rates, and the war in Ukraine, it’s understandable that investors in Singapore have been on edge.

Thankfully, there are some safe havens, including dividend-paying stocks. For Singapore’s income investors, that means real estate investment trusts (REITs).

So, while Singapore REITs initially had a tough start to 2022 on worries over rising rates and inflation, they have in fact rebounded somewhat from their lows in late January.

That’s because as inflation marches higher in the US and Europe, REITs can provide an inflation hedge of sorts given their pricing power and as they hold real (physical) assets.

One of the biggest REITs in Singapore is industrial-focused Frasers Logistics & Commercial Trust (SGX: BUOU), also known as “FLCT”.

With the REIT having provided an update to investors at the end of January, is this relatively young SGX-listed REIT worth buying for those of us who want a steady stream of dividends?

Focus on logistics and “new economy”

FLCT actually started out life as Frasers Logistics & Industrial Trust when it listed on the Singapore Exchange in June 2016, meaning it’s a relatively young REIT.

However, in late 2019 it announced it would be merging with fellow listed REIT Frasers Commercial Trust to form the entity that we know today: FLCT.

As of 31 December 2021, FLCT 102 industrial and commercial properties across Singapore, Australia, Germany, the Netherlands, and the UK.

Given that size matters in the REIT space, the merger has helped it expand its remit in terms of the properties it can acquire.

With the extra spending power and leverage, FLCT got busy acquiring properties last year after its merger was complete in the first half of 2020.

In May 2021, the REIT five logistics and industrial properties, as well as one business park property, in Germany, the Netherlands and the UK for S$548 million.

The six properties were freehold and the pro forma distribution per unit (DPU) uplift was estimated to be 1.8% at the time of purchase.

Recycling assets

Like any responsible REIT, FLCT’s management has been pro-active in recycling or disposing of assets in order to free up cash for higher-yielding opportunities.

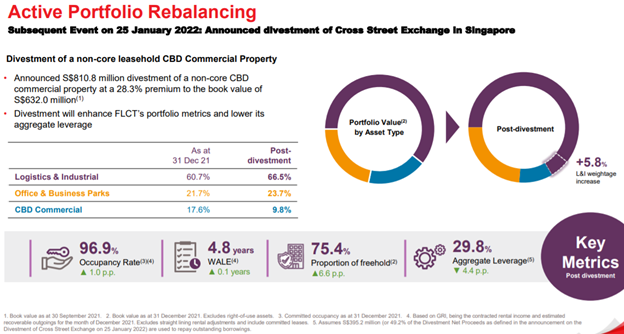

In fact, in late January of this year, FLCT announced that it would be divesting Cross Street Exchange, a 15-storey commercial property in Singapore with a retail element.

The price paid was S$810.8 million, a robust 28.3% premium to its S$632 million book value as of 30 September 2021.

It was a smart disposal and also helped reorient FLCT’s portfolio towards logistics and industrial properties, where the growth prospects are brighter.

In addition, once completed, it will significantly bring down FLCT’s gearing ratio (by 4.4 percentage points) to 29.8% (see below).

That will allow the REIT to pursue other, more attractive opportunities that add value to unitholders.

Source: Frasers Logistics & Commercial Trust investor presentation, March 2022

Fiscal first quarter was solid

For FLCT’s first quarter fiscal year (FY) 2022 (for the three months ending 31 December 2021), the REIT did see negative rental reversions in its logistics & industrial portfolio – averaging -10.2%.

However, management said as remaining leases (at higher rents) in its Australia portfolio roll off then this should moderate.

There was also good news in the REIT’s commercial segment as its UK and Singapore properties saw strong positive reversions of 21.7% and 4.3%, respectively.

Watch for DPU growth

While FLCT has clearly grown in size since first listing, it’s still early days in terms of its track record relating to the growth of its all-important distribution per unit (DPU).

For that reason, it’s important for dividend investors to monitor how the REIT recycles the extra headroom it has generated.

The recently-announced sale of Cross Street Exchange will free up capital for FLCT to deploy so that is something investors should watch closely.

Overall, though, FLCT provides REIT investors in Singapore with another viable option to gain exposure to the logistics and industrial space – with a focus on more developed markets in Europe.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.