Golden Opportunities in the Travel Sector as China’s Golden Week Meets Singapore’s Tourism Boom

September 28, 2023

China’s travel market is gearing up for a significant uplift as the Golden Week holiday from September 29 to October 6 approaches.

Over 21 million people are expected to travel by air during this period, coinciding with both the Mid-Autumn festival and National Day break.

The spike in demand, driven by both domestic and outbound travel, has seen a rise in airfares and brought some reprieve to China’s leading airlines, which faced substantial losses due to the pandemic.

A study by data and analytics firm ForwardKeys found that 37% of travelers plan to stay in their destinations for six to eight nights, a 3 percentage point increase from 2019, before the pandemic.

Outbound travel is also finally picking up, with momentum gathering after Chinese authorities lifted a ban on group tours in August.

Thailand, South Korea, Malaysia, Singapore, Australia and the UK are among the most popular overseas destinations.

At the same time, Singapore’s tourism sector is flourishing, with a 204.5% year-on-year (YoY) increase in tourist arrivals, totaling over 9 million visitors from January to August 2023.

Despite a minor dip in August, high-profile events like the Singapore Formula 1 Grand Prix and concerts featuring global stars such as Coldplay and Taylor Swift are set to boost these figures further.

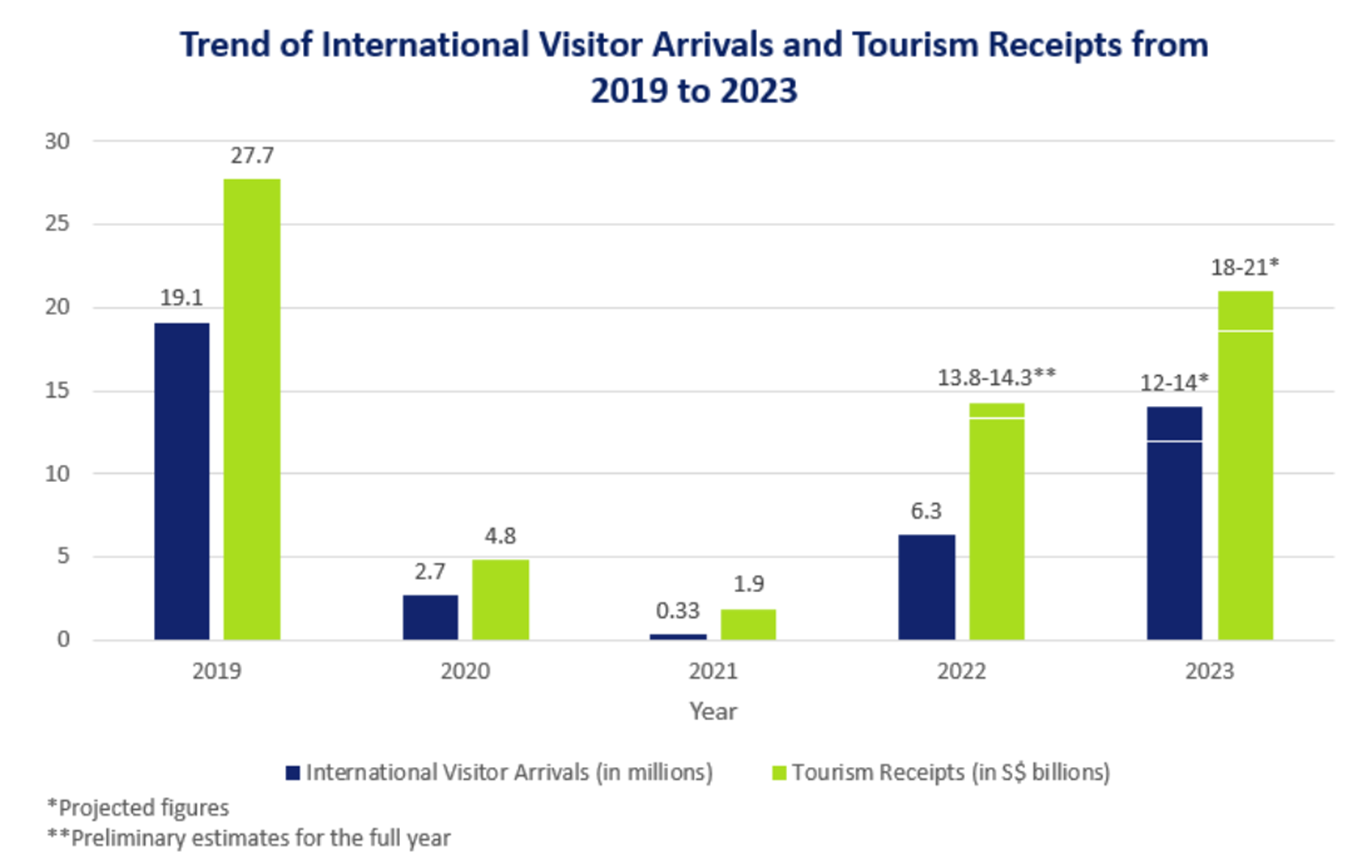

The Singapore Tourism Board (STB) is optimistic, anticipating 12 to 14 million international visitors this year and a complete recovery by 2024.

Source: SGX

This upward trend is echoed by the Changi Airport Group’s figures, showing a 55.1% YoY spike with 5.15 million passenger movements in August.

With China anticipating a significant influx of travelers during its Golden Week, golden opportunities are flourishing in the travel sector, particularly in tandem with a remarkable tourism boom in Singapore.

This confluence of events heralds a favourable horizon for investors and stakeholders eager to harness the increased tourism activities and the ensuing economic rejuvenation across both regions.

Here are some stocks on the SGX that investors can look into as interest pick up: Singapore Airlines Ltd (SGX: C6L), Genting Singapore Limited (SGX: G13), CapitaLand Ascott Trust (SGX: HMN) and Airports of Thailand TH SDR (SGX: TATD).

Investing in Singapore Airlines, or SIA presents a compelling case, considering its strong financial rebound and strategic positioning in the recovering travel industry.

The airline reported a notable 35.6% YoY growth in operating profit in Q1 2024, marking record quarterly net profits, driven by a significant surge in passenger revenue and capacity expansion.

Despite a softened cargo segment, SIA’s forward outlook remains positive, with robust demand anticipated in air travel and competitive resilience amidst increased market capacity.

SIA’s ambition to maintain its global aviation leadership is evident, now ranking fourth in the Bloomberg World Airlines Index.

Companies like Genting Singapore and CapitaLand Ascott Trust are also showcasing robust performances.

Genting Singapore’s net profit was more than doubled to S$276 million in H1 2023, driven by strong performance in its Resorts World Sentosa (RWS) and improved gross gaming revenue (GGR).

Meanwhile, CapitaLand Ascott Trust recorded a 31% rise in gross profit, with revenue per available unit (RevPAU) in key markets, including Singapore, performing above pre-COVID levels.

Beyond local stocks, Singapore’s stock market also offers Security Depository Receipts (SDRs) such as Airports of Thailand PLC (BK: AOT) for investors aiming to tap into international markets.

Airports of Thailand, the world’s largest airport operator by market capitalisation, reported earnings that align with expectations due to an increase in flight and passenger numbers.

China’s Golden Week to boost tourism recovery

The anticipated boost in travel during China’s Golden Week and Singapore’s flourishing tourism sector present potentially lucrative opportunities, especially with the easing of travel restrictions and the diversification of destinations.

Singapore’s travel and hospitality sector, buoyed by strategic investments, high-profile events, and the global travel resurgence, is primed for a rebound.

Investors keen on harnessing this momentum have an array of stock options and instruments, like SDRs, to explore and tap into both local and international market potential.

This upswing in travel and tourism bodes well for investors looking at a diversified portfolio and seeking to capitalise on the anticipated growth in the travel sector in the upcoming period.

Disclaimer: ProsperUs Head of Content & Investment Lead Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.