Is CapitaLand Integrated Commercial Trust’s Latest Acquisition a Good Buy?

March 29, 2022

As dividend investors probably realise, Singapore’s real estate investment trusts (REITs) have been on a shopping spree.

This acquisitive drive has seen them purchase properties overseas in recent years at an increasingly rapid pace. However, there are still plenty of properties up for grabs right here in Singapore.

One of the biggest REITs listed in Singapore – CapitaLand Integrated Commercial Trust (SGX: C38U) – proved that point as it announced a major local deal at the end of last week.

The deal is a sizeable one for CapitaLand Integrated Commercial Trust, which is also more commonly known as CICT.

Singapore’s largest listed REIT has agreed to acquire a 70% interest in a Grade-A office building at 79 Robinson Road for a total deal value of S$1.3 billion.

But for CICT shareholders, is it a good deal? And will the purchase help boost its distribution per unit (DPU)? Let’s find out.

The deal’s small print

First off, investors should be aware of the deal’s details. Given CICT’s 70% interest in the deal (S$1.3 billion), it will be fronting just over S$880 million.

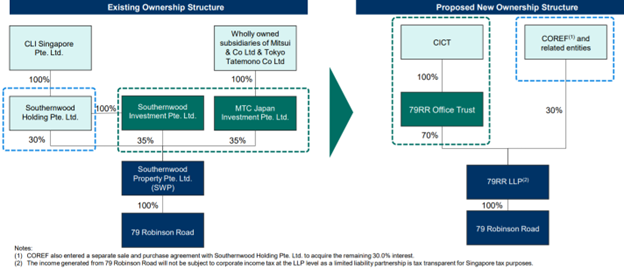

The remaining 30% interest will be taken up by CapitaLand Open End Real Estate Fund (Coref). Interetsingly, the deal will be carried out by both CICT and Coref purchasing shares of the property’s holding company – Southernwood Property Ptd Ltd.

CapitaLand Investment Limited, which owns Coref, in fact currently owns a 65% stake in Southernwood Property (with the other 35% owned by Mitsui & Co and Tokyo Tatemono).

Thankfully, the property was independently valued by a third party and the appraised value was in line with the purchase price.

Post-acquisition, CICT will convert Southernwood Property into a limited-liability partnership (see below) for tax transparency reasons, similar to other REITs.

The property will provide CICT with a net property income (NPI) yield of 4.0% while the REIT plans to fund the deal via proceeds from a recent acquisition as well as debt.

As a result, CICT’s gearing ratio is expected to increase to 41%. Meanwhile, its portfolio’s weighted average lease expiry (WALE) will lengthen slightly to 3.3 years from 3.2 years before the deal.

Source: CapitaLand Integrated Commercial Trust investor presentation, 25 March 2022

Boost to REIT’s unitholders?

At the end of the day, investors should want to know how this deal impacts CICT’s portfolio and prospects going forward.

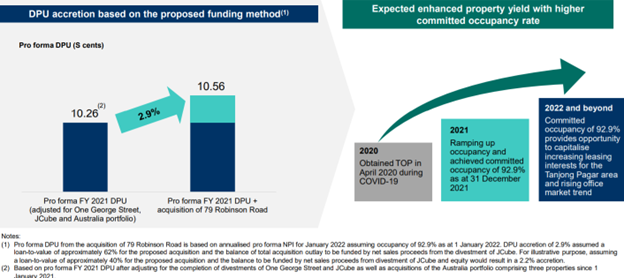

On that front, the acquisition will be DPU-accretive to shareholders, with the uplift on the distribution amounting to 2.9% on a pro forma basis.

It’s also aligned well with CICT’s overarching aim to increase its portfolio’s committed occupancy rates (see below).

That DPU boost is around in line with two of CICT’s most recently announced acquisitions (both deals involving commercial buildings in Sydney, Australia).

Source: CapitaLand Integrated Commercial Trust investor presentation, 25 March 2022

Portfolio makeup

Almost as important is how the overall portfolio will look after the deal is completed – which by the way, is expected to be finalised in the second quarter of this year.

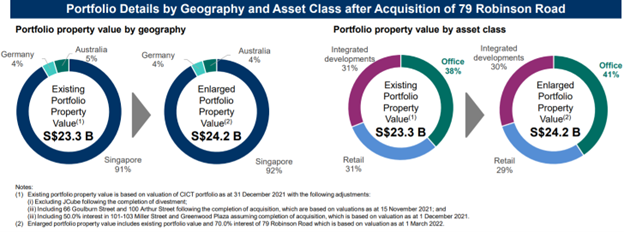

Post-acquisition, CICT will see its portfolio’s net lettable area increase to 11.9 million square feet. That will see 79 Robinson Road provide a substantial boost with its net lettable area of just under 520,000 square feet.

Furthermore, after the deal closes, 79 Robinson Road will see CICT’s office properties account for over 40% of its overall portfolio by value (see below).

Source: CapitaLand Integrated Commercial Trust investor presentation, 25 March 2022

Another Singapore property

Overall, the deal looks to be a decent one for unitholders in terms of the price paid, the fact that the property is a Grade-A office building, and the reasonable DPU boost.

However, I’ve generally not been a fan of CICT and its price performance/DPU track record in the past. It should also be noted that the latest acquisition doesn’t help diversify CICT away from Singapore, with properties in the city state already making up over 90% of its portfolio’s value.

I believe investors should monitor how the REIT’s portfolio develops and if it can sustain a decent run of consistent – and sustainable – DPU increases while also delivering share price appreciation.

On the merits of just this deal, though, they’re on course to add value to their portfolio, and hopefully unitholders, over the long term.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.