Is Frasers Logistics & Commercial Trust a Buy After Latest H2 FY2022 Earnings?

November 11, 2022

In Singapore, real estate investment trusts (REITs) have had a hard time so far in 2022. That’s been down to high inflation and the resulting higher interest rates.

These impact Singapore REITs in that funding costs become more expensive. However, as I’ve written about previously, that has seen some blue-chip Singapore REITs come down to relatively attractive levels.

One of them is Frasers Logistics & Commercial Trust (SGX: BUOU), which reported its H2 FY2022 earnings yesterday (10 November).

Also known as FLCT, the blue-chip REIT owns 105 properties across Singapore, Australia, the UK, the Netherlands, and Germany.

With a portfolio value of S$6.7 billion – as of 30 September 2022 – 97 properties are in the logistics and industrial (L&I) space while the remaining eight are commercial properties.

So, how did FLCT perform in its latest H2 FY2022 earnings report and is it a buy? Here’s what Singapore REIT investors and dividend lovers should know.

FLCT revenue and dividend both fall in H2 FY2022

For H2 FY2022 (for the six months ending 30 September 2022), FLCT saw its revenue come in at S$214.5 million – down 9.7% year-on-year from the same period in 2021.

Meanwhile, the REIT’s adjusted net property income (NPI) for the period was S$162 million, down 10.6% year-on-year.

This was mainly down to its divestment of Cross Street Exchange, in Singapore, and weaker exchange rates. That was partially offset, though, by acquisitions it has made in FY2021 and FY2022.

Distributable income to unitholders held steady in H2 FY2022 at S$139.6 million, unchanged from the prior-year period.

However, because 100% of management fees were paid in the form of units (versus 73.6% in H2 FY2021) and given the Singapore dollar’s relative strength this year, FCLT’s distribution per unit (DPU) actually fell 2.8% year-on-year to 3.77 Singapore cents.

On a full-year FY2022 basis, FLCT’s DPU was 7.62 Singapore cents, down only marginally by 0.8% year-on-year from FY2021.

Solid gearing and portfolio occupancy

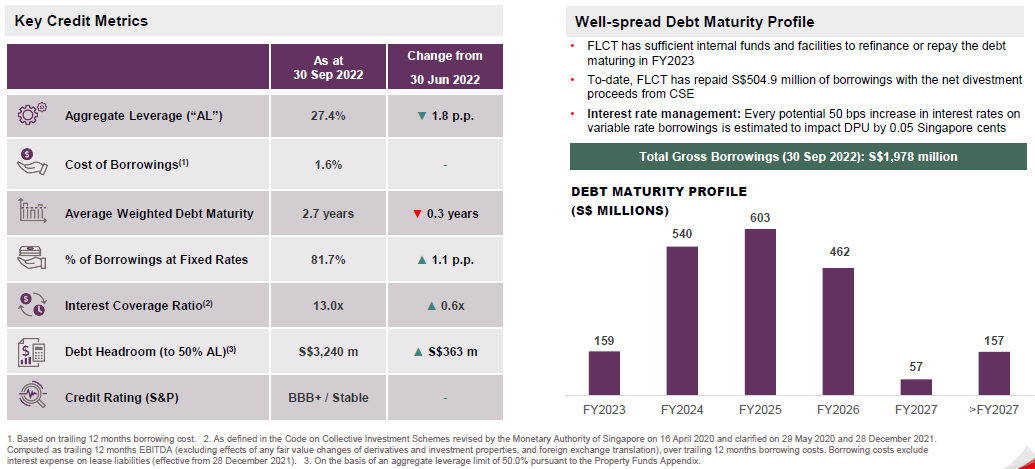

FLCT’s capital management and debt profile looked solid during the latest reporting period. As of 30 September 2022, the REIT has an aggregate leverage (also known as “gearing ratio”) of 27.4%.

On the funding side, its cost of borrowings was a relatively low 1.6% and its interest coverage ratio (ICR) is an extremely robust 13x.

As readers can see below, it also has minimal debt maturing in FY2023 – although in FY2024 there will be more than a quarter of its total debt maturing.

Source: Frasers Logistics & Commercial Trust H2 FY2022 earnings presentation

In terms of interest rate impacts on its DPU, it did state that for every potential 50 basis points (bps) in interest rate hikes on variable rate borrowings, there’ll be an estimated DPU impact of 0.05 Singapore cents.

Encouragingly for the REIT’s shareholders, FLCT’s percentage of borrowings on fixed rates ticked up during the latest Q4 FY2022 to 81.7%.

Overall portfolio occupancy remained stable at 96.4% as of 30 September 2022 and rental reversions were positive.

For Q4 FY2022 rental reversions were up +0.4% (incoming rent vs. outgoing rent basis) and up +9.8% (average rent vs. average rent basis)

Should investors buy the REIT’s shares?

From the latest earnings report, FLCT’s fundamentals look to be on a solid footing. The REIT also has a highly-diversified tenant base.

As to whether investors should be buying its shares, it’s important to understand the macroeconomic risks that FLCT faces.

At its current price, FLCT shares are offering investors a 12-month trailing dividend yield of 6.5%. Understandably, that is attractive.

However, the REIT does have significant numbers of properties in Europe – a region which is facing high inflation and an energy crisis.

How it plays out on the continent’s businesses and industrial giants is still unclear and a deep recession is a possibility. Of course, investors are being rewarded for taking that risk with a substantial yield.

Yet, I believe there are better risk-adjusted options in the Singapore REIT space to look at for long-term investors.

For unitholders of FLCT, the REIT announced that its ex-distribution date would be 17 November 2022 and the payment of the distribution would be 15 December 2022.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips doesn’t own shares of any companies mentioned.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.