Introduction

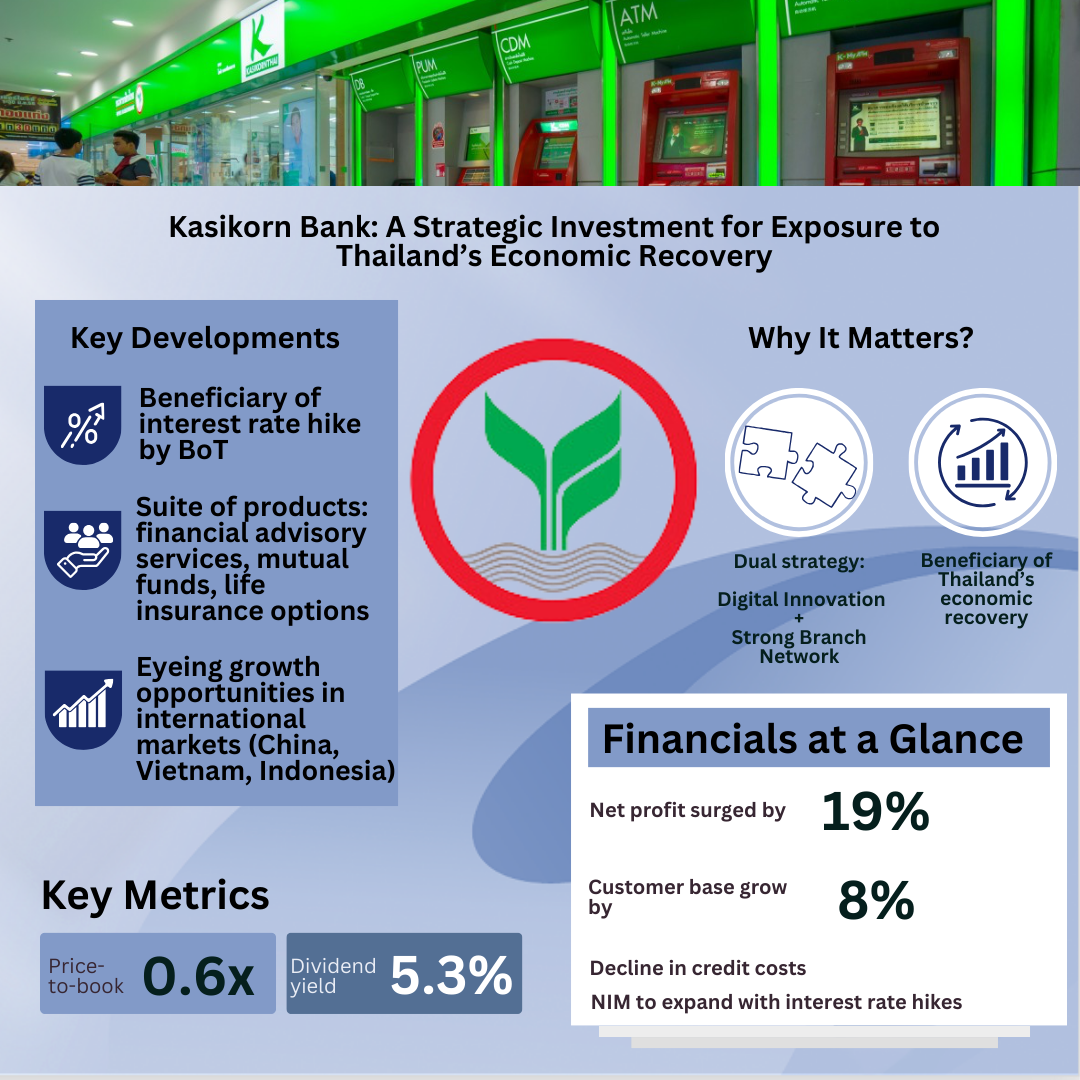

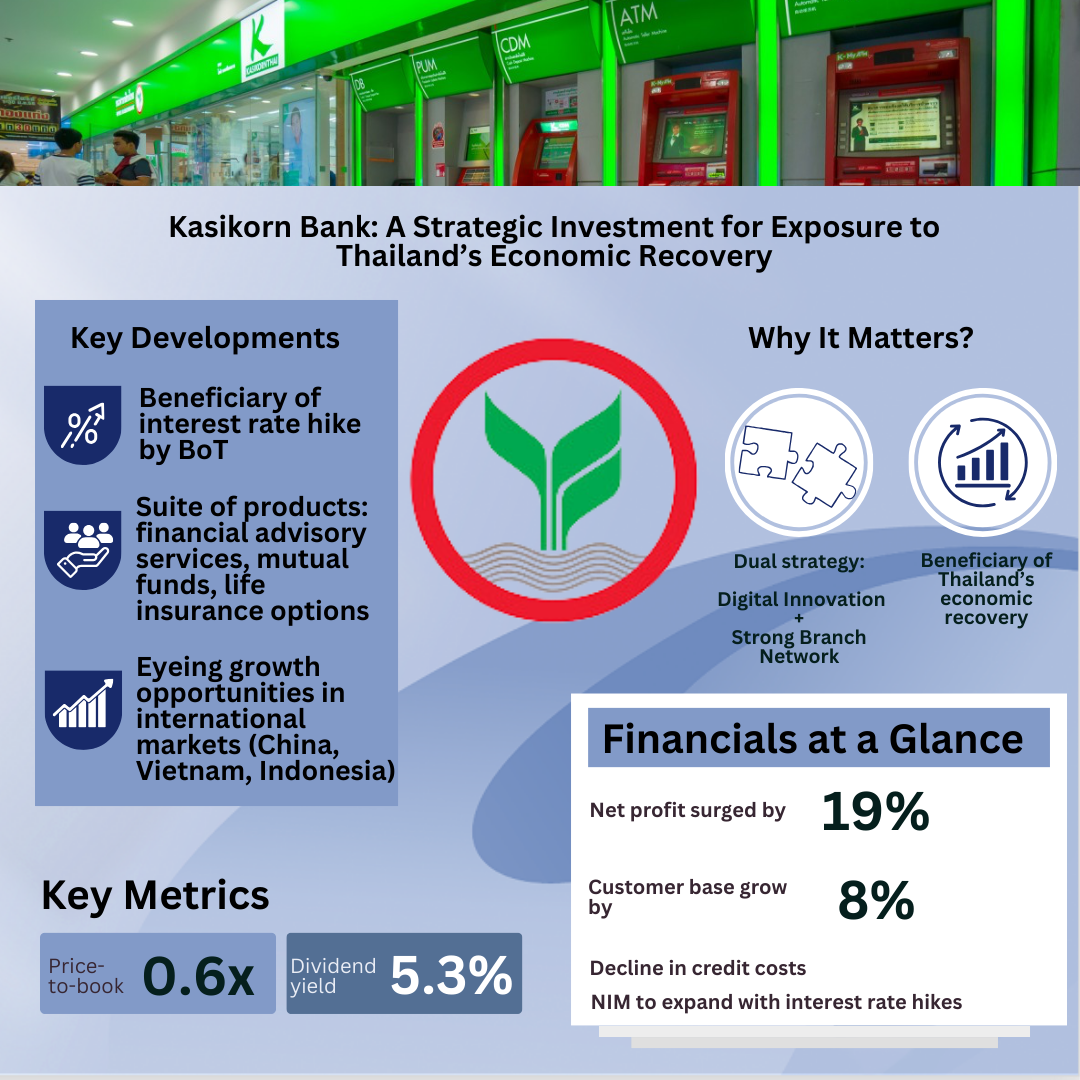

Kasikorn Bank Public Company (SGX: TKKD) or KBank in short, stands out as a strategic investment, particularly for those looking to tap into the country’s economic rebound. With a prudent approach to growth and a responsive strategy to changing economic conditions, KBank is positioning itself as a critical player during Thailand’s economic recovery.

Overview of Kasikorn Bank

KBank has established a prominent role in the Thai financial market, offering a comprehensive range of services that bridge traditional banking with modern fintech solutions. Its growth is fueled by a commitment to customer service and innovation, as seen with its successful KPLUS mobile application and a strong digital banking presence.

Updates on Latest Development

- Recent economic policies, including interest rate hikes by the Bank of Thailand (Sep 2023), have played to KBank’s strengths. The bank has experienced a boost in its net interest margin, a key profit indicator for financial institutions. KBank’s proactive measures in expanding its digital banking services have also set the stage for capturing a larger share of the market as the economy recovers.

- On the investment front, KBank offers a suite of products including financial advisory services, mutual funds, and life insurance options.

- KBank is actively eyeing growth opportunities in international markets, specifically targeting China’s SME and corporate sectors, and is leveraging its full banking license in Vietnam and exploring the Indonesian market.

Why It Matters?

KBank’s dual strategy—leveraging digital innovation while maintaining a solid branch network—ensures that it remains resilient and relevant. This approach positions the bank to benefit from Thailand’s economic revival by appealing to a broad customer base and responding effectively to an evolving market. The bank’s venture into new market also demonstrate its strategic intent to grow beyond its domestic borders.

Financials at a Glance

The bank’s non-interest income streams are diversified, encompassing fees and service income, dividend income, and revenues from foreign exchange trading and other transactional services. This diversification has contributed to the bank’s financial health.

Notably, KBank’s net profit surged by 19% year-over-year, coupled with an 8% growth in its customer base, indicating a successful expansion and retention strategy. The bank has also seen a decline in credit costs, with further reductions anticipated, which suggests an improving quality of its credit portfolio.

Moreover, interest rate hikes to a 10-year high are expected to bolster the net interest margin (NIM), contributing positively to the bank’s profitability.

Should Investors Invest?

For investors looking to gain exposure to Thailand’s financial sector, KBank presents a viable avenue. The bank’s focus on expanding its customer base, both through digital avenues and traditional banking, signals a well-rounded growth strategy that could capitalize on the country’s economic resurgence.

With a price-to-book (P/B) ratio of 0.6 and a three-year total return of 28.5%, the bank is also trading at an attractive valuation. As of writing, KBank has a forward dividend yield of 5.3%.

Risks

While KBank’s prospects are bright, investors must navigate risks associated with market volatility. The stock’s higher volatility compared to broader indices like SET50 and STI warrants a cautious approach. Investors should evaluate their risk tolerance in the context of the potential for higher returns as Thailand’s economy makes strides forward.

Kasikorn Bank emerges as an attractive option for those seeking to invest in Thailand’s financial sector, poised to benefit from the country’s anticipated economic recovery. With a solid foundation and strategic growth plans, KBank is well-equipped to navigate the upswing in Thailand’s financial markets.

Disclaimer: ProsperUs Head of Content & Investment Lead Billy Toh doesn’t own shares of any companies mentioned.