It is very normal for investors to look for multi-bagger potential stocks when investing. That’s part of what makes finding “winners” so exciting.

However, it is even more important for investors to build a portfolio that is resilient and offers sustainable, long-term returns.

With that in mind, today I’ll be looking at Singapore Exchange Ltd (SGX: S68) – Singapore’s sole stock exchange operator.

Singapore Exchange, or SGX for short, is also an international, multi-asset exchange with about 40% of its listed companies and over 80% of its listed bonds originating outside of Singapore.

SGX has also just released its full year FY2022 results (for the 12 months ended 30 June 2022. I’ll take investors through what they need to know on its latest numbers.

Revenue at a record high but growth was modest

SGX recorded its highest ever annual revenue figure, at S$1.1 billion, since its listing more than two decades ago.

While it was an impressive feat, SGX only managed to grow its revenue by 4% as compared to a year ago.

Earnings were relatively flat at S$451.4 million for its FY2022, up 1% over the preceding year’s S$445.4 million.

This means that growth has been modest at SGX.

SGX Group’s Chief Executive Officer, Loh Boon Chye, said in a press release on the financial performance:

“Our record-high revenue was driven by higher derivatives volumes across equities, currencies and commodities, as our global customers increasingly used our multi-asset platform to navigate market uncertainties.

Our fixed income, currencies and commodities (FICC) business remains a key growth engine and is expected to deliver mid-teens percentage revenue growth in the medium term.”

On a longer-term basis, I noticed that the 10-year compounded annual growth rate (CAGR) of SGX’s revenue and earnings per share (EPS) stood at a decent 5.4% and 4.6%, respectively.

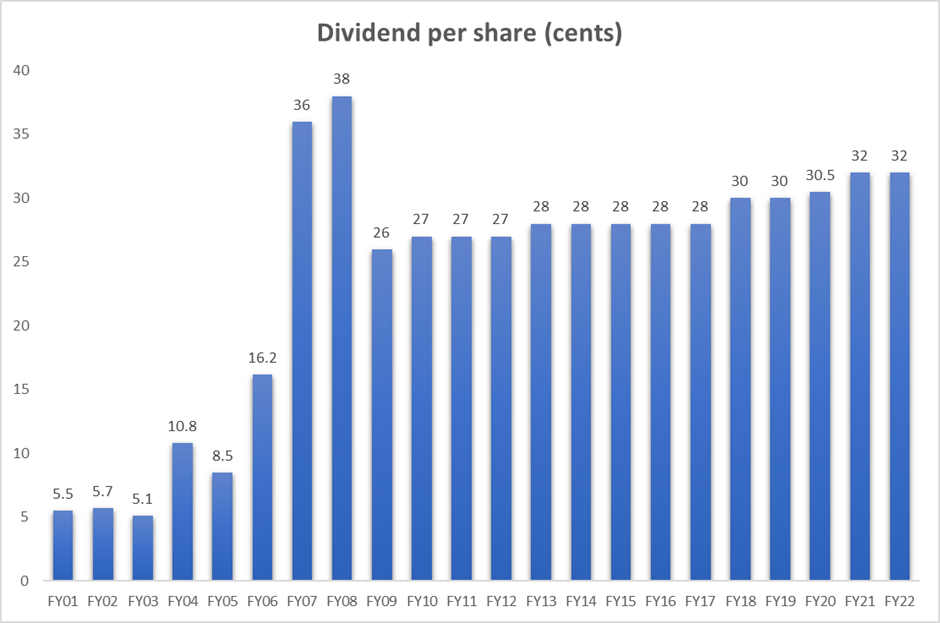

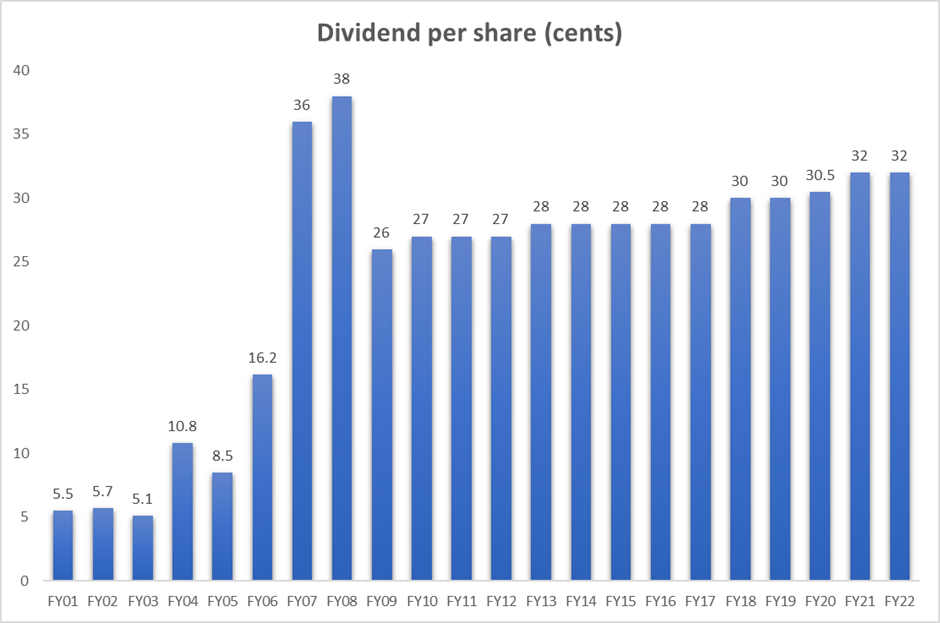

SGX steadily increasing its dividend

In line with the modest growth recorded by SGX over the last decade, we have also seen the firm steadily increase its dividend.

Source: ProsperUs, SGX

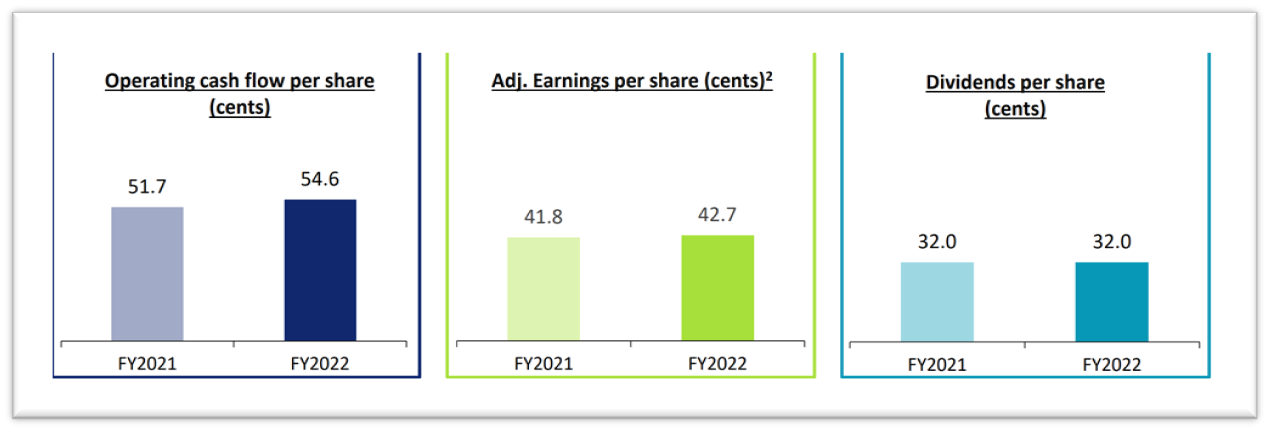

Source: ProsperUs, SGX

In FY2022, SGX will give a final quarterly dividend of 8.0 Singapore cents per share, bringing its total dividend per share (DPS) to 32 Singapore cents.

This represents an increase of 18.5% as compared to a dividend of 27 Singapore cents per share in FY2012.

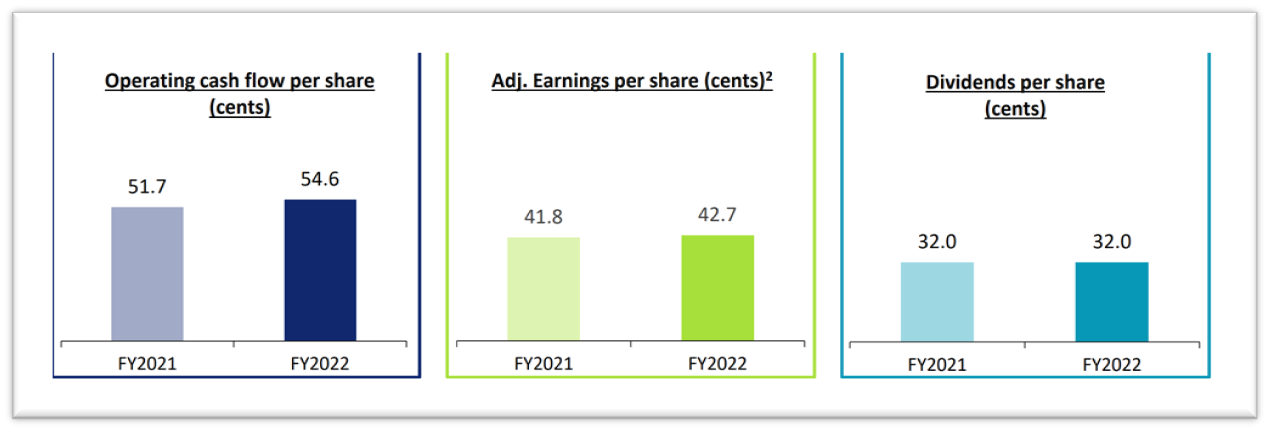

It is also important to note that the operating cash flow and adjusted EPS of SGX are more than adequate to cover the dividend.

Operating cash flow per share has increased to 54.6 Singapore cents per share in FY2022 as compared to 51.7 Singapore cents per share in FY2021.

Source: ProsperUS, SGX FY2022 Results Analyst and Media Briefing

Source: ProsperUS, SGX FY2022 Results Analyst and Media Briefing

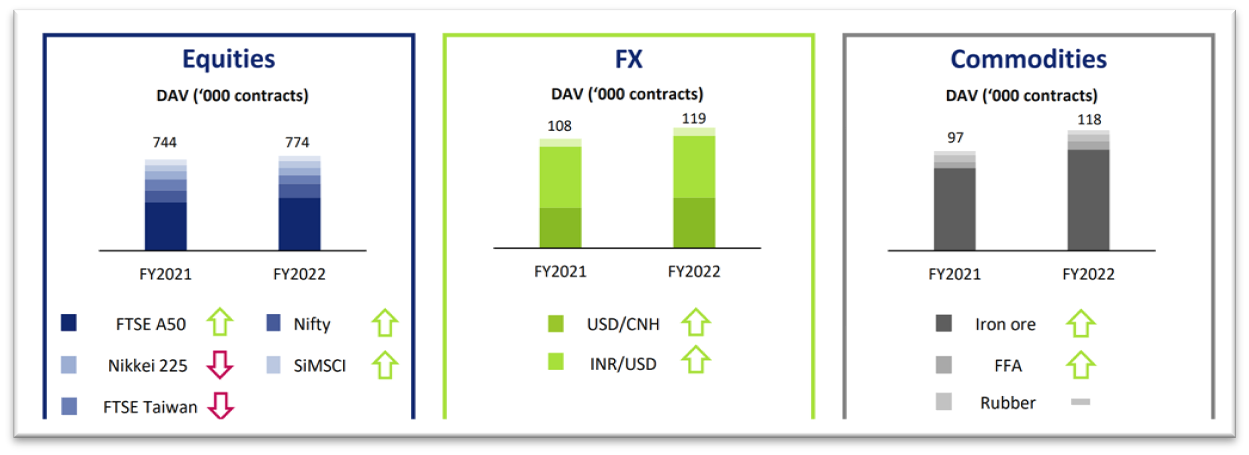

Strong global exchange ecosystem

Looking at SGX Group, we have seen how management has continued to build up its product offerings with the acquisition of MaxxTrader.

The continued focus of SGX to build a strong ecosystem also played to its strength as a leading global multi-asset exchange platform.

Its multi-asset platform offers global participants open access to manage portfolio risks amid the uncertainty in the economic recovery.

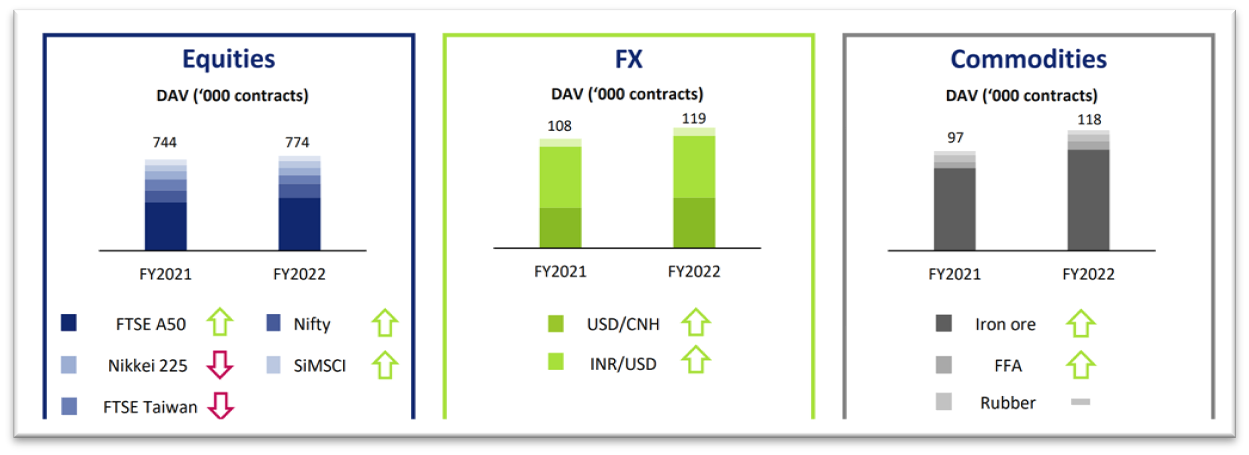

Daily average traded values (DAV) were up 6% to 1.01 million contracts with growth across all asset classes – equities, FX and commodities.

Source: ProsperUS, SGX FY2022 Results Analyst and Media Briefing

Source: ProsperUS, SGX FY2022 Results Analyst and Media Briefing

Boring but safe

SGX’s management has guided that the Group is expected to maintain medium-term revenue growth at a high single-digit percentage range.

It has a strong track record and has expanded its product offerings to become a leading global exchange platform.

SGX will likely benefit from some of the global partnerships that can broaden its product and distribution footprint.

While there is a lack of excitement in terms of earnings growth potential, it has a proven track record.

Overall, with a dividend yield of 3.2% based on a dividend payout ratio of around 80%, SGX is a safe investment option for long-term income investors.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Source: ProsperUs, SGX

Source: ProsperUs, SGX Source: ProsperUS, SGX FY2022 Results Analyst and Media Briefing

Source: ProsperUS, SGX FY2022 Results Analyst and Media Briefing Source: ProsperUS, SGX FY2022 Results Analyst and Media Briefing

Source: ProsperUS, SGX FY2022 Results Analyst and Media Briefing