Singapore Depository Receipts (SDRs) on the Singapore Exchange (SGX) allow investors to buy shares of companies listed overseas — currently limited to blue-chip stocks in Thailand and Hong Kong — through SGX, providing a convenient way to diversify your investment portfolio.

While it’s true that you can also buy overseas stocks via brokerage accounts, SDRs simplify the process by allowing you to trade these international shares directly on SGX, in Singapore dollars (SGD), and during local market hours. This eliminates the need to deal with multiple foreign exchanges, making it a more straightforward option for investors.

How Do SDRs Work?

Imagine you love a particular brand of snacks that’s only available in Thailand. The local store in Singapore gives you a ticket that represents a box of those Thai snacks and keeps the actual snacks in a safe place.

Instead of direct ownership of the security, each SDR represents a beneficial interest in an underlying security listed on an overseas exchange. Beneficial interest means you have the right to benefit from the underlying security, like receiving dividends, even though you don’t directly own the shares.

An SDR issuer buys shares of a company listed in the overseas exchange and issues SDRs that represent those shares. Your SDRs are safely kept with the Central Depository (CDP), ensuring your investments are secure.

These SDRs are then traded on the SGX, just like local stocks. For instance, if you want to own a piece of CP All Public Company Ltd (SET:CPALL) a Thai convenience store business, you can buy the CP ALL TH SDR (SGX:TCPD) on SGX. This SDR acts like your ticket, giving you a share in the company without having to deal with the Thai stock exchange directly.

You can convert SDRs into the underlying foreign shares through a process of issuance and cancellation if you prefer to hold the actual shares. If you hold the underlying securities, you may request to convert them into SDRs for trading on the SGX.

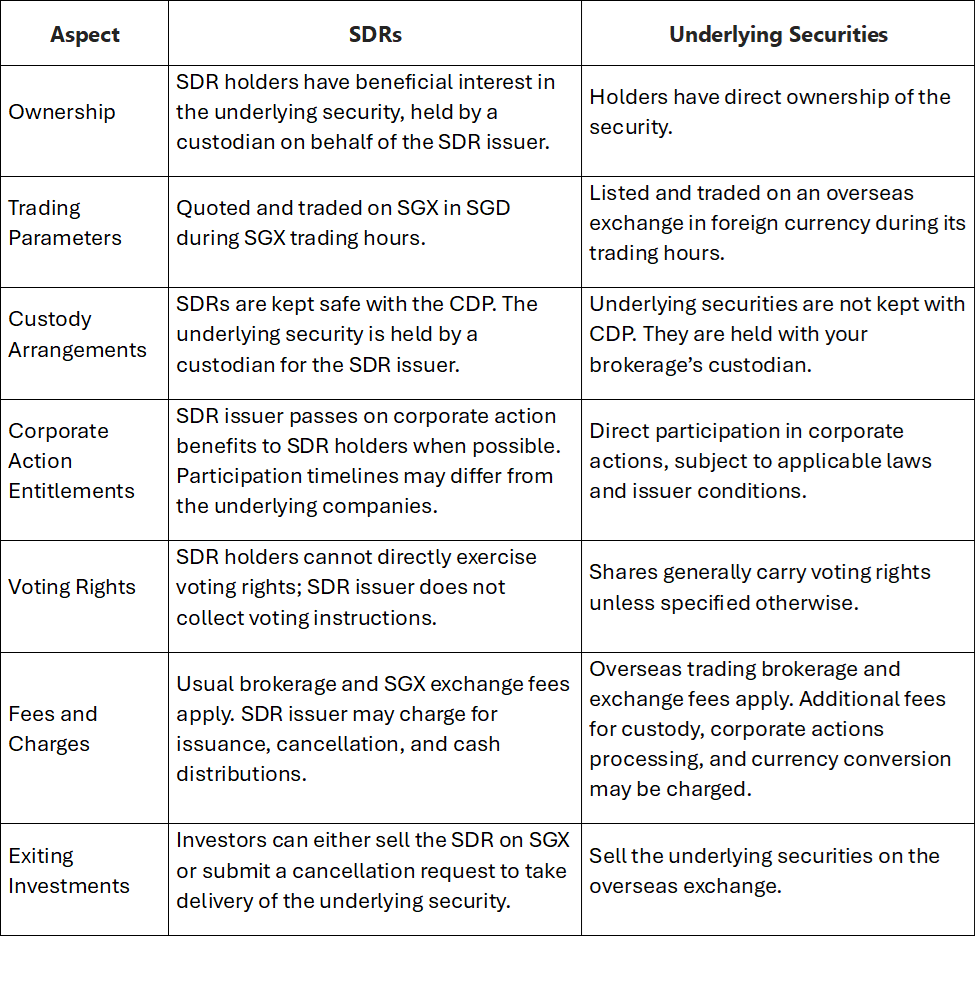

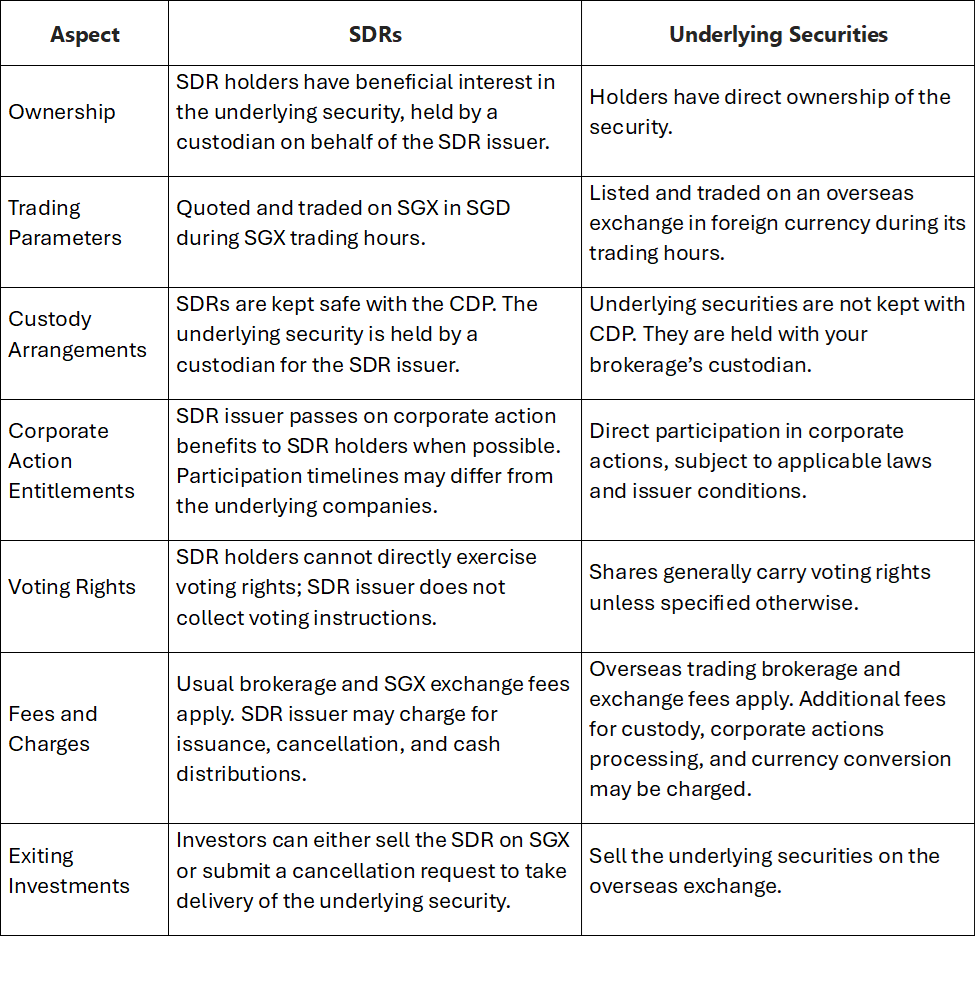

Differences Between Holding SDRs vs. Underlying Securities

Current SDR Offerings on SGX

Thailand SDRs

Hong Kong SDRs

Investing in SDRs can be an option to diversify your portfolio with international stocks while enjoying the convenience of trading on the SGX. SDRs are suitable for investors who are comfortable with a low to moderate risk of losing their principal investment and are seeking generally smaller potential returns.

However, it’s important to be aware that investing in SDRs comes with market, country, and company-specific risks. Additionally, the trading price of an SDR may not always perfectly track the price of its underlying securities in the overseas market.

Take a moment to reflect on your investment goals and see if SDRs could be a valuable addition to your strategy.

Disclaimer: ProsperUs Manager of Content, Hailey Chung, does not own any SDRs.

Reference

Securities Products – Singapore Exchange (SGX)