5 Top Stocks to Buy in 2022

January 4, 2022

Following what was a surprising year of positive returns in global stock markets in 2020 (when a pandemic hit the global economy), investors could be forgiven for thinking 2021 would be a year of muted gains.

However, US stocks continued on their upward trajectory last year. Unbelievably, they posted 68 new record highs during the year.

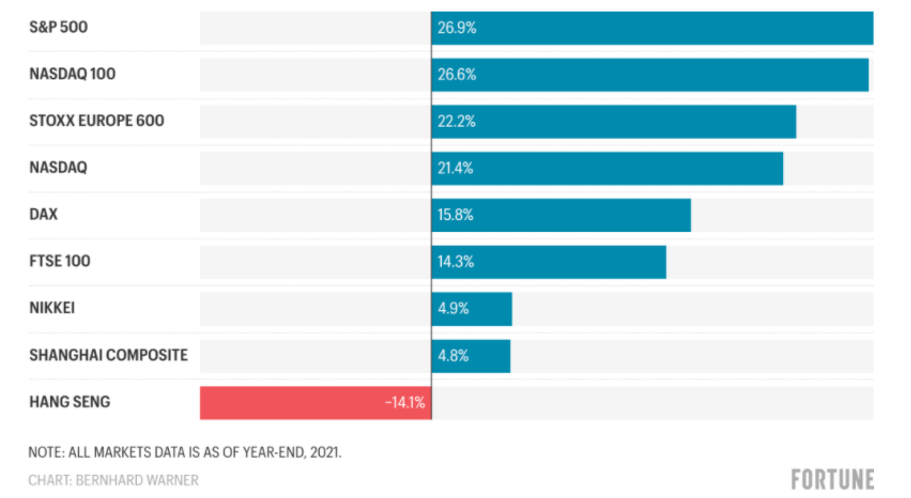

The upshot of that was that investors saw the S&P 500 Index deliver a whopping 26.9% gain in 2021. Meanwhile, the performance of the tech-centric Nasdaq-100 Index was broadly in line as it rose 26.6% during the year.

That was much better than other global stock markets as US stocks pulled away from the rest of the pack (see below).

Yet while the broader market did well, a lot of the index’s gains were driven by “Big Tech” stocks such as Apple Inc (NASDAQ: AAPL), Alphabet Holdings Inc (NASDAQ: GOOGL) and Microsoft Corporation (NASDAQ: MSFT).

So, with the new year already upon us, is this trend likely to continue? Here are five top stocks that investors can buy and hold in 2022.

1. PayPal

Mobile wallet, payments giant and financial “super app” wannabe PayPal Holdings Inc (NASDAQ: PYPL) had a tough 2021, with its shares falling over 15%.

Yet that came after its shares more than doubled in 2020 as “war on cash” digital payments stocks got a boost from the Covid-19 pandemic.

Nothing has changed about the business, though. Its latest third-quarter 2021 results saw its total payment volume (TPV) hit US$310 billion during the three-month period – up 26% year-on-year.

With a 13.3 million bump in net new active accounts (NNAs), PayPal saw its total active accounts grow to a whopping 416 million.

While PayPal’s exclusive agreement with eBay Inc (NASDAQ: EBAY) finished earlier than expected, its partnership with Amazon.com Inc (NASDAQ: AMZN) – that will see its Venmo wallet be a payment option on the e-commerce giant’s website – will be a growth driver over the next few years.

With a goal of more than doubling its revenue to US$50 billion by 2025, PayPal stock is still one to hold for the long term.

2. Costco

If investors think of a stock that characterises the “slow and steady” mantra then it’s discount membership retailer Costco Wholesale Corporation (NASDAQ: COST).

The company is a phenomenally consistent compounder, having delivered a total return of over 730% in the past decade and over 1,800% in the past 20 years.

How it’s done this has been via exceptional management and execution, with a focus on cost discipline. Operating 828 warehouse-style stores, Costco’s low prices and bulk selling have secured a loyal membership base.

In its first quarter for fiscal year (FY) 2022, Costco reported net sales of US$49.4 billion – up 16.7% year-on-year.

With strong comparable sales across its various channels, Costco looks like a stock that will continue to win in the post-pandemic era.

3. The Trade Desk

For anyone familiar with the online advertising industry, they’ll know that The Trade Desk Inc (NASDAQ: TTD) is a formidable online platform that aims to help digital ad buyers better target campaigns across various ad formats.

The company saw its revenue increase 39% year-on-year in its latest quarter, hitting just north of US$300 million and easily beating expectations.

There were worries around Apple’s privacy change in third-party tracking but The Trade Desk had already pre-empted this move by pushing a “Unified ID 2.0” initiative with privacy built into its core.

Aiming to promote it as the new industry-wide standard for internet identity in the ad world, The Trade Desk didn’t see any slowdown from Apple’s changes.

As a result, it was confirmation (if any were needed) that the company is leading the charge in the online ad tech space.

With shares up 16% last year – but up a whopping 3,150% over the past five years – The Trade Desk is set to keep winning in 2022.

4. Datadog

Observability and monitoring platform operator Datadog Inc (NASDAQ: DDOG) has been a massive beneficiary of the ongoing digital transformation.

The company has been generating unbelievable growth and was one of the rare breeds of growth stocks that actually saw positive returns in 2021, with its shares up over 80% during the year.

Datadog’s third-quarter results explain why that’s been the case. The firm saw revenue soar 75% year-on-year to US$270 million while the continued robust growth of large customers indicated its stickiness within large enterprises.

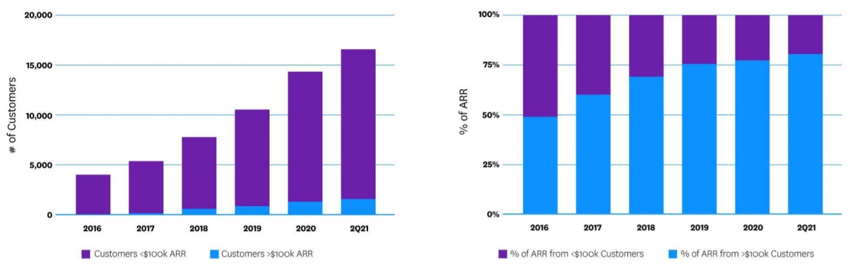

In fact, Datadog now has over 1,800 customers who provide the firm with over US$100k in annual recurring revenue (ARR), a good sign that its large customer base will continue to upgrade (see below).

Source: Datadog investor presentation, October 2021

Datadog is also operating and cash flow positive while it’s nearing profitability too. That’s a rare combination for a high-growth tech stock.

However, that’s also been somewhat baked into its current valuation, with Datadog shares trading at an eye-watering 60x price-to-sales (PS).

For investors who have a longer time horizon, though, picking up shares of Datadog on any dips would be a great strategy in 2022.

5. Pepsi

We all need some stability in our portfolios and consumer staples giant PepsiCo Inc (NASDAQ: PEP) provides that.

While Pepsi shares “only” delivered a near 20% gain in 2021 (underperforming the S&P 500), it also bears remembering that Pepsi has considerable pricing power if inflation continues to remain high.

Like Costco, Pepsi is a reliable stock that also pays a dividend currently yielding 2.5%. As one of the Dividend Aristocrats in the US – stocks that have increased dividends for at least the past 25 years – Pepsi is also a stock that income investors can appreciate.

With net revenue growth up 11.6% year-on-year in its third quarter, Pepsi will also benefit from the continued re-opening of the US economy as large-scale events take place more frequently (where fizzy drinks and snacks are sold).

For those of us who want a consumer staples leader in their portfolio, Pepsi fits the bill in 2022.

Buy best-in-class and sit tight

So, for 2022, whatever happens in the stock market it’s worth remembering that investors should aim to buy and hold the leaders in specific industries.

That’s because it tends to be true that “winners win” in markets as diverse as online advertising and digital payments to discount retailing and snacks.

Disclaimer: ProsperUs Head of Content & Investment Lead Tim Phillips owns shares in PayPal Holdings Inc and Datadog Inc.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.