Alibaba Shares Plunge: Should You Buy Now?

November 4, 2020

Alibaba Group Holding Ltd (NYSE: BABA) (SEHK: 9988), the Chinese tech giant, saw its shares plunge 8.1% on the suspension of Ant’s IPO. Should investors buy the dip?

Tim’s Take:

Fintech giant Ant Group’s dual IPO in Shanghai and Hong Kong was set to be the biggest in the world; at US$35 billion. That is, until China’s financial regulators threw a spanner in the works.

Alibaba shares got whacked hard. The Chinese e-commerce giant owns a 33% stake in Ant, which is the fintech group that owns the ubiquitous AliPay app.

For investors in Alibaba, though, what does the delay mean? Probably not much over the long term. Reasons cited by regulators for the IPO suspension included “disclosure” and “regulatory changes”.

Even though this is where apparently Ant fell short, the suspension was more likely a reaction to Alibaba founder and former CEO Jack Ma’s critical comments recently.

Speaking at fintech forum in Shanghai two weeks ago, Ma took aim at global and local regulators in the financial sector by commenting that they “stifled innovation” and didn’t take enough notice of development and opportunities for the young.

Regulation only thing stopping Ant’s march forward

As I’ve written previously, Alibaba Cloud – Alibaba’s cloud unit – is set to be one of the main growth drivers of the company in future.

Fundamentally, nothing has changed for Alibaba and its prospects on this news. With regards to Ant, the fintech giant is so pervasive in the everyday lives of Chinese citizens that only financial regulators can stop it.

Why’s that? Ant is a perfect example of the “network effect” in action. For tech firms building ecosystems, the more that people use a product, the more value that’s created.

Alibaba’s e-commerce platform has succeeded by doing exactly that. Likewise, Ant has also drawn hundreds of millions of users into its ecosystems that covers payments, insurance and wealth management, among others.

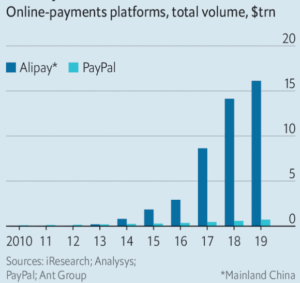

The figures speak for themselves. Ant has 731 million monthly active users (MAUs) and processed around US$16 trillion in total payment volume (TPV) in 2019. As a comparison, the latter is 25 times what PayPal Inc (NASDAQ: PYPL) processed in 2019 TPV (see below).

For Alibaba, being a part of the Ant growth story is just another reason to be invested in it for the long term.

If anything, the suspension is a reminder for investors that in China, regulators hold much more sway over the operating business landscape.

When it does eventually list, I believe demand for Ant shares will still be as strong as it is today. Similarly, for investors looking out over the next decade, Alibaba’s prospects remain as strong as ever.

Finally, investors should take note that Alibaba reports its second-quarter fiscal year 2021 results, before the US market opens on 5 November.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Alibaba Group Holding Ltd.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.