Microsoft Stock: Why Did Its Share Prices Rally After Earnings?

July 30, 2022

One of the world’s largest tech companies, Microsoft Corporation (NASDAQ: MSFT), released its Q4 fiscal year 2022 (FY2022) earnings this week.

In response, its share price has rallied. This is despite the company missing Wall Street’s estimates and even falling short of its own revised guidance.

Microsoft reported US$51.9 billion in sales during the quarter ended 30 June, an increase of 12% year-on-year (yoy) and profit was 2% higher at US$16.7 billion, or US$2.23 per share.

According to a Bloomberg survey, analysts had estimated average sales of US$52.4 billion and US$2.29 a share in earnings.

So, the question is why has the share price rallied despite the missed expectations on earnings?

Strong dollar and near-term headwinds hurt earnings

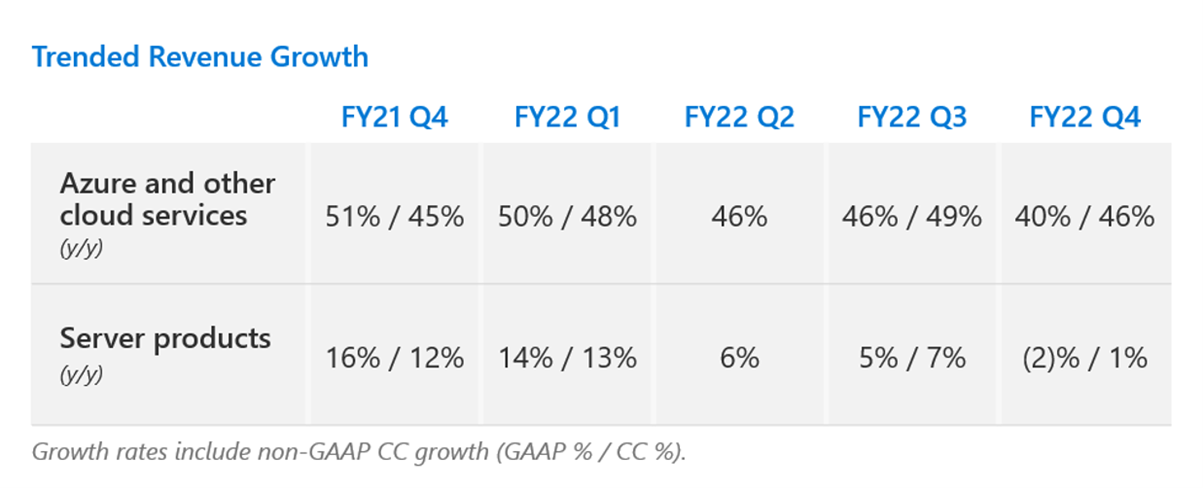

Source: Microsoft’s Q4 FY2022 Results Presentation

Source: Microsoft’s Q4 FY2022 Results Presentation

Microsoft’s weaker-than-expected earnings were mainly due to the strong US dollar.

The strong dollar has impacted revenue and diluted earnings per share (EPS) by US$595 million and US$0.04, respectively.

Excluding the foreign exchange rate impact, the software giant would have met analysts’ expectations for the quarter.

Adding to the near-term headwinds was the US$300 million sales that hit in China due to the recent COVID-19 lockdowns and another US$100 million on reduced ad spending.

The ongoing war in Ukraine also resulted in US$126 million of operating expenses related to bad debt expense, asset impairment and severance.

Meanwhile, another US$113 million was spent on employee severance expense as Microsoft scaled back operations in Russia.

Azure’s impressive growth continues

Despite the impact on earnings in the near term, Microsoft’s Azure cloud-computing services continue to record impressive growth.

Sales grew by 40% yoy in the Q4 FY2022, demonstrating the underlying demand remains robust.

Management’s comments on Azure’s near- and longer-term demand remains positive, citing the increased urgency for the enterprise sector to improve operational efficiency.

Microsoft is also seeing larger and longer-term commitments as Azure won a record number of 100 million dollar-plus and one billion dollar-plus deals during the quarter.

Source: Microsoft’s Q4 FY2022 Results Presentation

Source: Microsoft’s Q4 FY2022 Results Presentation

Going forward, Microsoft management largely assured investors during the earnings call that Azure will continue to benefit from a robust demand environment, defying fears of a slowdown.

In addition to favourable secular trends buoyed by robust cloud spending in the enterprise sector, Microsoft Azure has also bolstered its offerings to better capitalise on the opportunities in the cloud computing space going forward.

These include Microsoft’s recent acquisition of Nuance, a “leader in conversational AI and ambient intelligence”.

There’s also the commitment to improving its industry-specific cloud-computing solutions to better address different end users’ needs and expand its addressable market.

Double-digit growth in FY2023

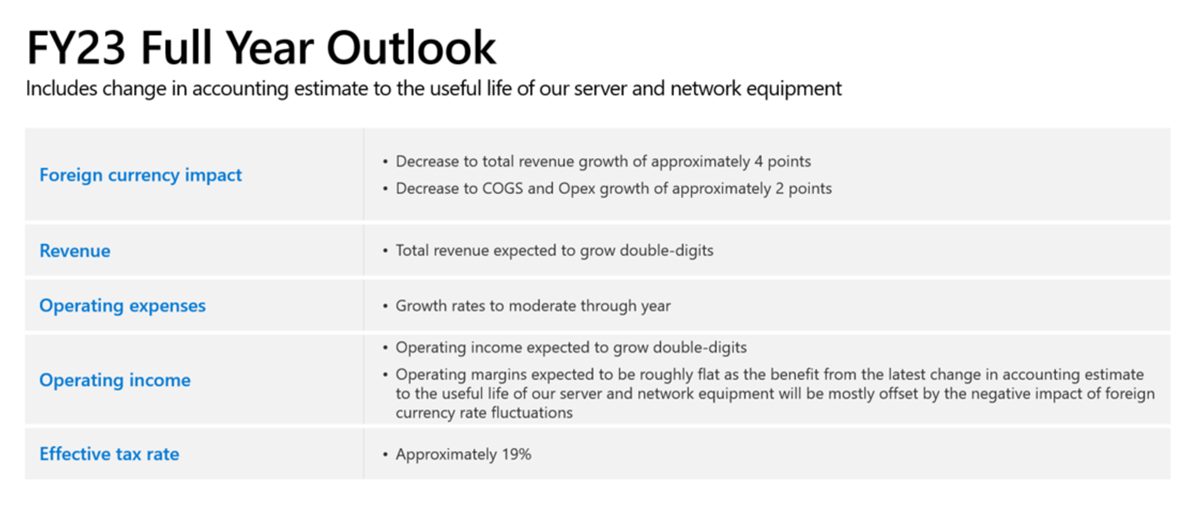

Source: Microsoft’s Q4 FY2022 Results Presentation

Source: Microsoft’s Q4 FY2022 Results Presentation

Management issued their first FY2023 outlook including an expected double-digit growth in revenue and operating income.

However, the guidance could mean only a high single-digit EPS growth in US Dollars given the expected currency headwinds of 4% for revenues and 2% for cost of goods sold (COGS).

The solid forward guidance provided by management has helped to address some of the concerns on growth going forward, especially given the warnings of broad-based demand softening in consumers and markets.

Is Microsoft stock a buy after earnings?

The earnings results have demonstrated the resilient business model of Microsoft, specifically its Productivity and Business Processes segment.

While the recession-prone More Personal Computing (MPC) business segment is expected to see a moderate slowdown, growth will remain supported by Microsoft’s Intelligent Cloud segment, which is expected to be lead growth driver in FY2023.

Downside risks remain with the foreign exchange rate impact as well as the risks of a recession.

But Microsoft’s resilient growth profile and digital moat in the cloud computing space is well positioned to withstand these uncertainties ahead.

At its current price of US$268.74, Microsoft is still hovering around 23% below its recent high of just under US$350.

In terms of its valuation, Microsoft is trading at a forward price-to-earnings (PE) ratio of 24 times, which is about one-fifth lower than its five-year average of 31 times.

While I don’t think the market valuation will show a significant rebound in the near-term due to the mounting macro headwinds, Microsoft at its current level looks to be an attractive long-term investment.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.