NVIDIA Corporation (NASDAQ: NVDA)’s earnings report yesterday not only exceeded Wall Street’s expectations but also significantly bolstered the ongoing bull run, particularly for technology and artificial intelligence (AI) stocks. This performance underscores the pivotal role NVIDIA plays in the AI revolution, a sector that continues to drive the broader market’s optimism.

Earnings Beat Expectations

For Q4, NVIDIA reported a staggering 265% year-over-year (yoy) increase in revenue, with earnings that similarly outpaced analysts’ predictions. This growth was spearheaded by an almost 770% yoy increase in profits, highlighting NVIDIA’s dominant position in the AI and chip-making sectors. The company’s adjusted earnings per share rose 765% from the previous year, a testament to its profitability and operational efficiency during this period.

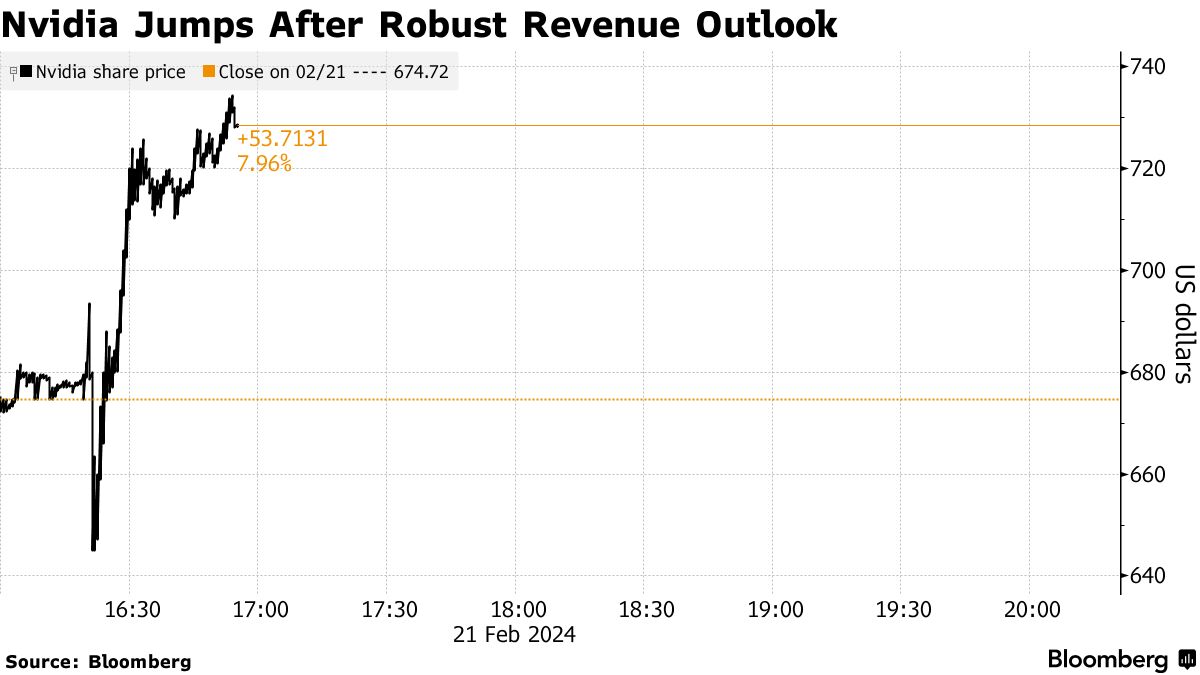

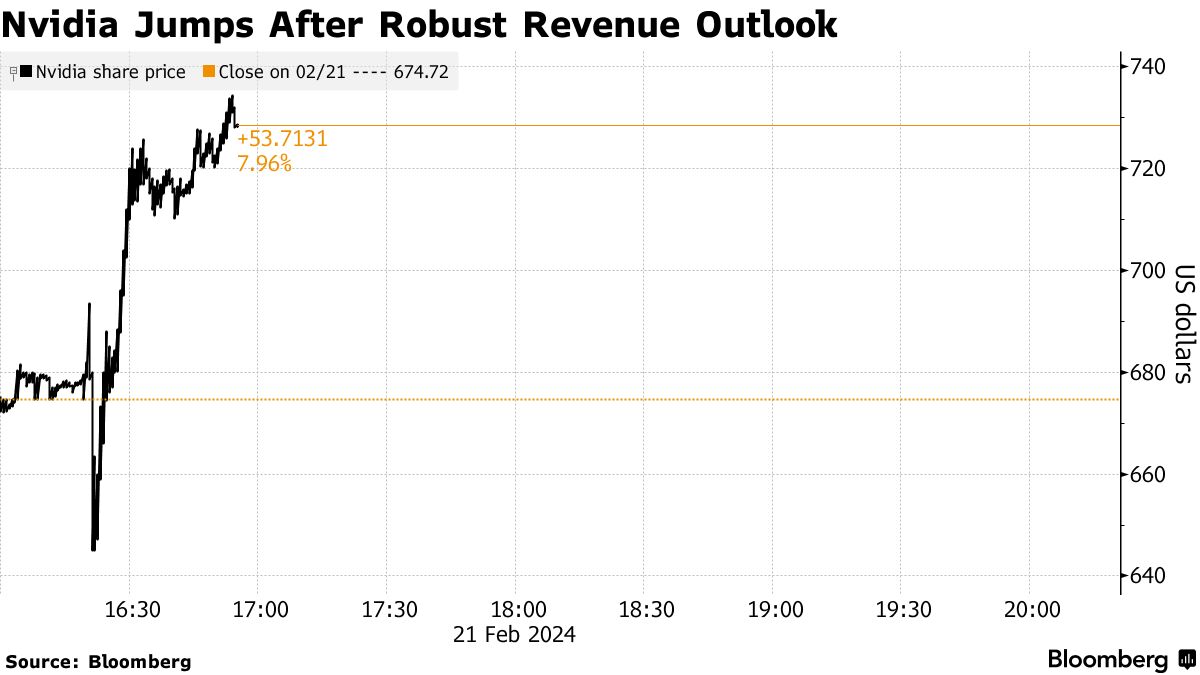

The market’s reaction to NVIDIA’s earnings was overwhelmingly positive, with shares surging by 6.4% in extended-hours trading. This surge reflects not only the company’s robust performance but also the market’s confidence in NVIDIA’s leadership in AI and computing technologies.

Analysts have lauded NVIDIA’s achievements, with some referring to CEO Jensen Huang as “The Godfather of AI,” indicating the transformative impact NVIDIA is having on the industry.

Promising Guidance for the Coming Quarter

NVIDIA’s revenue guidance for the upcoming quarter further reinforces this sentiment, projecting a 233% increase from the year-ago quarter. This forecast beats Wall Street’s expectations and signals continued strong demand for NVIDIA’s AI chips. Such demand is driven by the adoption of AI technologies across various industries, from gaming to automotive, indicating a broad-based growth trajectory that NVIDIA is uniquely positioned to capitalize on.

Bullish Belief: Confidence in AI Stocks Strengthens

The broader market implications of NVIDIA’s performance are significant. The company’s success has been a key factor in the tech and AI sectors’ bull run, contributing to the optimism surrounding these industries. NVIDIA’s growth reflects the increasing importance of AI technologies in driving productivity and profitability, a trend that is expected to persist. This has led to a ripple effect, spurring gains in index futures and rallies in global peers and suppliers, thereby reinforcing the bull market in tech and AI stocks.

Moreover, NVIDIA’s ability to navigate regulatory challenges, such as the US restrictions on exports of advanced AI chips to China, and still post significant growth, is a testament to the company’s resilience and strategic foresight. The company’s efforts to ship alternative chips to China that comply with these restrictions demonstrate its adaptability in a rapidly evolving global market.

In conclusion, NVIDIA’s recent earnings report and the subsequent market reaction underscore the company’s crucial role in the ongoing bull run, especially within the tech and AI sectors. The company’s performance not only reflects its dominance in the AI and chip-making industries but also signals the broader market’s confidence in the continued growth and profitability of AI technologies. As NVIDIA continues to innovate and lead in this space, it is likely to remain a key driver of market trends and investor sentiment in the tech and AI sectors.

Disclaimer: ProsperUs Head of Content & Investment Lead Billy Toh doesn’t own shares of the company mentioned.