-

The Dollar Index (DXY) has exceeded our target of 105.10 in the Asia hours after Donald Trump is seen leading the Presidential race.

-

The Federal reserve is highly likely to perform a 25 bps cut after the U.S presidential election, given the disinflationary pressure.

-

Major G5 currencies (JPY, EUR, AUD, GBP, CAD) are weakening significantly, with JPY weakening the most.

Trump’s presidency and a strong dollar will continue towards end of 2024

With Trump winning the presidency and a likely support from the Senate and the House of Representative, this suggests a clear Republican clean sweep, which could influence financial markets, particularly the dollar. The FX market has responded with a strong dollar and minor losses among G5 currencies, except for the Canadian dollar, which remains relatively stable due to potential benefits for Canadian exporters and reduced tariff exposure.

In the fixed income and money market, a selloff and bear steepening across the Treasury yield curve reflect inflationary policy expectations tied to Trump’s stance on fiscal and tariff policies. Short-term USD swap rates are seeing a hawkish repricing in anticipation of Fed rate changes, with expectations for a 25bp FOMC cut but an embedded policy rate of nearly 4.0% by mid-2025.

With the Republican majority confirmed, sustained dollar strength is likely and may breach beyond 106.00 and target 109.00 in the near to mid-term.

ECB and BOE rate cut in the near future will likely diverge the currency strength against the dollar.

The Bank of England is likely to perform a 25 bps rate cut before the FOMC and with the surge in the dollar strength, the Pound is likely to weakened to 1.2680 level. The EUR will likely to be weakened as well and the weakening process will be welcome by the ECB in order to boost consumer confidence and external export growth. The EUR will likely head towards the 1.0600 region in the near to mid-term.

Technical outlook on Dollar index – 105.00 breached, 108.00 is next in line

The dollar index has shown strong momentum, surpassing our target of 105.10 after breaking the 103.00 resistance level, as noted in our report on October 7 2024. With this upward momentum, the dollar index (DXY) could continue climbing towards 108.00 in the near to mid-term. Technical indicators are supportive, with the Ichimoku chart displaying a bullish golden cross, and the long-term MACD remaining firmly positive. Price action also reinforces this bullish outlook, with a breakout from the flag pattern and the downtrend line that has held since September 26, 2022, confirming the trend’s continuation.

However, despite this bullish trend, we anticipate resistance for the dollar bulls around mid-January 2025, where levels at 110.58 or 112.00 could act as significant barriers, potentially leading to a reversal. Such a reversal would resemble the post-Trump victory pattern in 2016, which saw a clear bearish shift by January 2017.

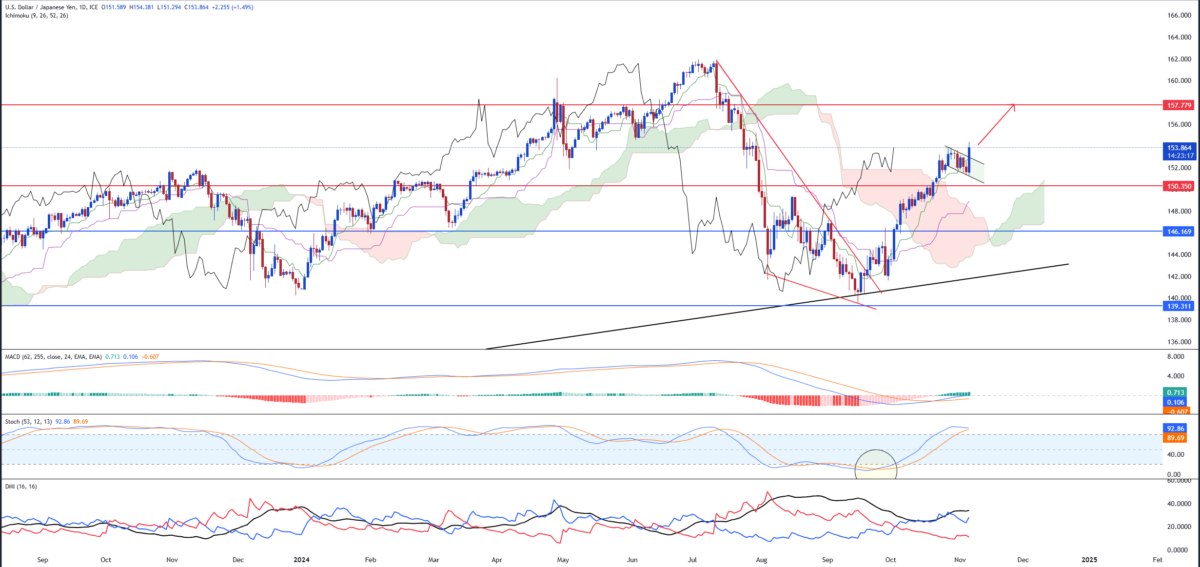

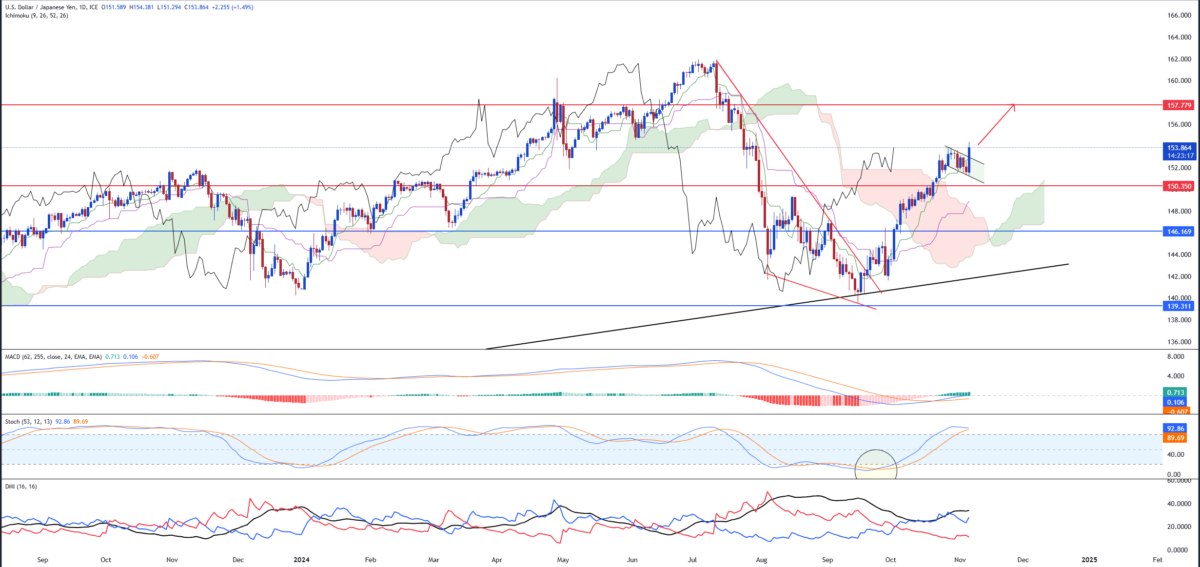

Technical outlook on USDJPY – 157.00 in sight

The USDJPY reached beyond our target at 150.35 based on our report on October 7 2024 and is close to breaking the resistance at 155.00. With this upward momentum, the USDJPY is likely to see the near-term target at 157.00 and should it breaks, the next target over the long-term period will be at 160.00. Below are the key pointers:

- Mid-term Stochastic oscillator saw an oversold crossover.

- Ichimoku forms a three bullish Golden cross.

- Directional movement Index has performed a rebound above the 25-level, with the DM+ showing signs of rally. Furthermore, the ADX is rising.

- Bullish break out of the flag confirms the bullish continuation.

Technical outlook on GBPUSD – Breaking past 1.3000 psychological level, bearish trend in

With the possibility of a BoE rate cut and the dollar strength, the pound is likely to be weakened severely especially it has crosses below the 1.3000 psychological level. Though there is a possibility of a strong support at 1.2869, the rebound may be weak and unlikely to surpass 1.3000 and with all technical indicators pointing to a downtrend, we believe the pound is likely to weakened towards 1.2680 level. Below are the key pointers:

- Mid-term Stochastic oscillator is falling, confirming the bearish downtrend.

- Ichimoku forms a three bearish death cross.

- Directional movement Index as shows clear bearish strength

Bearish bar on Wednesday is strong and may breach below 1.2869 level.

Please refer to the disclaimer here.