Got Diamond Hands? 2 High Risk Stocks Growth Investors Can Buy and HODL

June 14, 2021

The meme stock and cryptocurrency communities are fond of coming up with new terms that go viral.

Although I wouldn’t call it traditional investing, there are definitely useful parallels in their lingo for long-term investors.

Two such terms are “diamond hands” and “HODL”. Diamond hands refers to stock traders who are holding on to their position no matter what.

Meanwhile, HODL is not a misspelling of “hold” and instead stands for “Hold On for Dear Life”, primarily used in crypto circles, in reference to holding through the volatility of massive drawdowns in cryptocurrency prices.

Lessons for the stock market

You might be surprised but as long-term investors we can take lessons from these sayings.

Some of the best companies in the world have seen crazy volatility in their share prices over years, yet if long-term investors had held on they’d be handsomely rewarded.

For example, Netflix Inc (NASDAQ: NFLX) saw its share price crater by nearly 80% in four months back in 2011 after it announced it would spin off its DVD mail order business and focus purely on streaming.

From that low in late 2011, Netflix shares are up over 5,300% as of last Friday’s close. Obviously that return came over nearly a decade of “hodling” and with Netflix remaining a leader as well as executing on its vision.

So, here are two high risk stocks that long-term growth investors (with diamond hands, of course) can buy and HODL. Just be prepared for volatility along the way.

1. Digital Turbine

Digital Turbine Inc (NASDAQ: APPS) is an Austin, Texas-headquartered tech company that focuses on pre-installed apps on smartphone devices.

Partnering with major OEMs and telcos, Digital Turbine installs pre-loaded apps into new smartphones. Based on a user’s age, gender, location and other factors, Digital Turbine automatically installs relevant apps in real time.

Focusing on the “real estate of the smartphone”, the company is hoping to build a relationship with the user from when they switch on their device.

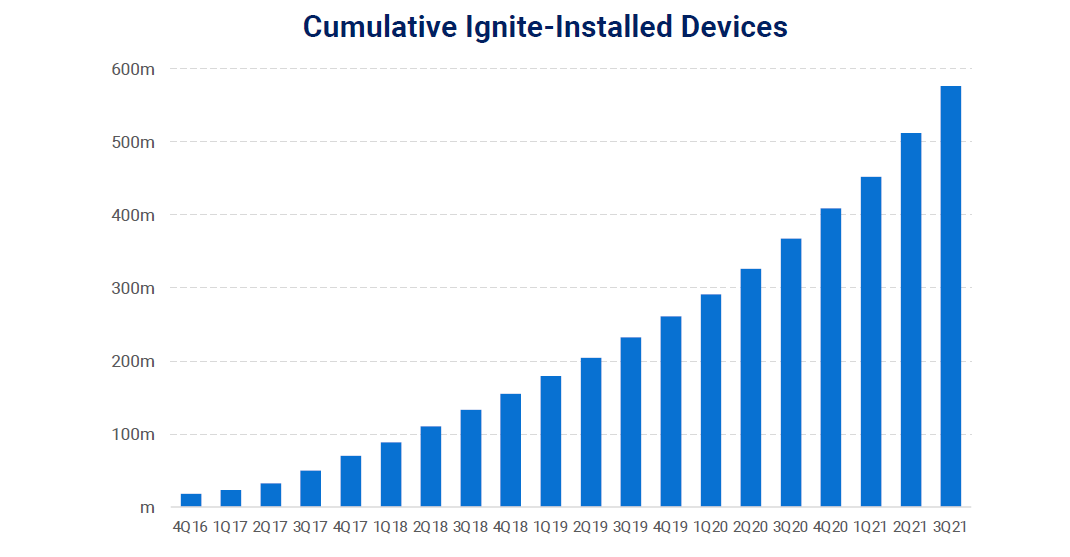

Numbers have been impressive. Although the company’s comprehensive “Ignite” programming has been installed on nearly 600 million devices worldwide (see below), it still has under 20% of the total global Android smartphone market – Ignite is not yet available on Apple iOS devices.

Source: Digital Turbine Q1 2021 earnings presentation

Source: Digital Turbine Q1 2021 earnings presentation

In its latest earnings, Digital Turbine saw revenue growth of 142% year-on-year as its acquisition spree continued apace (it has acquired three companies so far this year).

Helping OEMs monetise their devices over the long term, Digital Turbine’s other recent takeovers have been of firms offering programmatic advertising and targeted media delivery as it looks to round out its offering.

With shares up about 650% in the past year, Digital Turbine is certainly not “cheap” but long-term investors could well be rewarded further.

2. Global-E

If there’s anything we’ve learnt during the pandemic, it’s that e-commerce is here to stay. For Global-e Online (NASDAQ: GLBE), the company provides a platform for brands and retailers to sell across borders.

Effectively, it wants to make e-commerce “borderless” by providing website messaging services in 25 languages and pricing in over 100 currencies while also helping with local tax calculations and shipping/return options.

For the full year of 2020, Global-e saw revenue jump 106% year-on-year to US$136 million. The company also recently released its first-quarter 2021 earnings, which saw the firm grow revenue at 134% year-on-year to US$46.2 million.

Global-e’s gross margin also improved during the quarter, hitting 33.3% versus 29.4% in the first quarter of 2020.

Headquartered in Israel, the company also has a partnership with online shopping giant Shopify Inc (NYSE: SHOP), which recently acquired a stake in the global e-commerce enabler.

Although it’s a recent IPO, having only gone public a few months ago, the potential for long-term growth in the worldwide e-commerce market is strong for Global-e.

High growth but high risk

As relatively smaller companies with high growth rates, both Digital Turbine and Global-e are early in terms of their growth runway.

While they’ve both performed well and operate in exciting markets, it’s important long-term investors understand the level of volatility associated with these types of high-growth stocks that could potentially be big winners in the future.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Shopify Inc.

Tim Phillips

Tim, based in Singapore but from Hong Kong, caught the investing bug as a teenager and is a passionate advocate of responsible long-term investing as a great way to build wealth.

He has worked in various content roles at Schroders and the Motley Fool, with a focus on Asian stocks, but believes in buying great businesses – wherever they may be. He is also a certified SGX Academy Trainer.

In his spare time, Tim enjoys running after his two young sons, playing football and practicing yoga.