PepsiCo is Winning the Inflation Battle

July 14, 2022

US inflation has just hit a new four-decade high of 9.1% in June, adding pressure on the US Federal Reserve (Fed) to act on another big interest-rate hike later this month.

However, PepsiCo Inc (NASDAQ: PEP), an iconic beverage and convenience food company, has been able to pass on some of these higher costs to consumers.

PepsiCo reported sales of US$20.2 billion inQ2 FY2022, above analysts’ average estimate of US$19.55 billion.

The higher revenue was mainly due to the increase in prices as volumes remained muted.

Meanwhile, PepsiCo posted an earnings per share (EPS) of US$1.86, which was better than the US$1.74 per share consensus estimate.

Here is what we know from Pepsi’s latest earnings report and earnings call.

1. Consumers willing to buy pricier snacks and sodas

Despite the higher average prices of around 12%, consumers appear willing to treat themselves to relatively affordable snacks and beverages.

PepsiCo has a broad portfolio of products that provide customers with options ranging from premium brands such as Frappuccino, to more value-driven products such as Santitas.

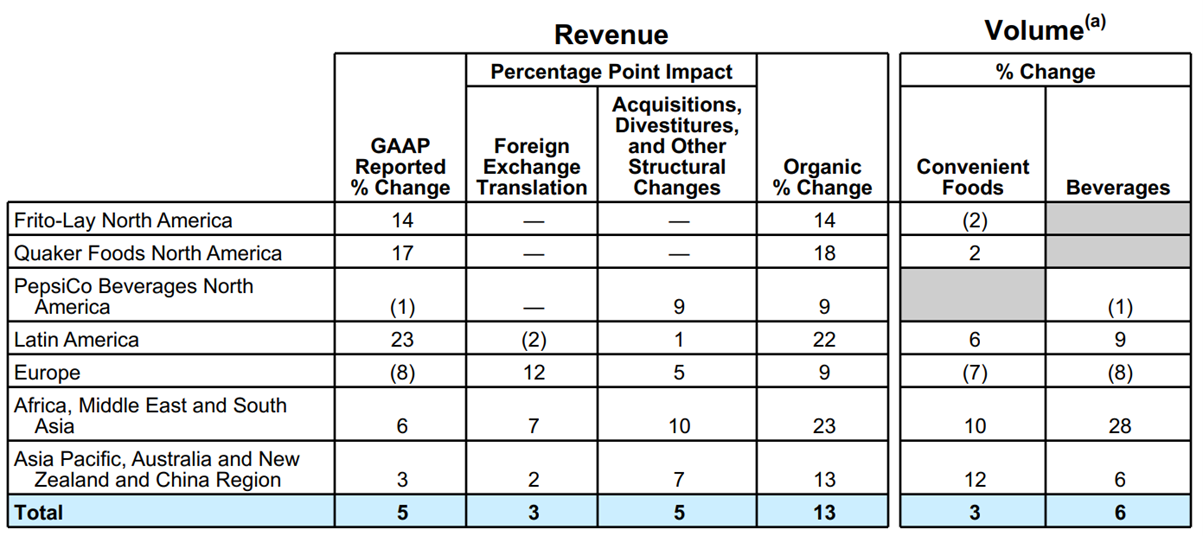

On average, the volume of convenience foods and beverages have also gone up slightly although the impact of the Russia-Ukraine war is reflected in the volume decline in Europe.

Source: PepsiCo’s Q2 FY2022 Earnings

Source: PepsiCo’s Q2 FY2022 Earnings

During the earnings call, Ramon Laguarta, Chairman & CEO of PepsiCo, said,

“The trends are quite stable from what we’ve seen since Q4, and as the gasoline price went up, the consumption on beverages and snacks in that particular channel has been pretty stable. A bit less volume, a bit more price as second quarter versus first quarter, but overall sales has remained stable, a high-single digit bit of a difference between beverages and snacks. Snacks a bit higher than beverages, but stable and that has continued into the last few weeks. So, we don’t see any meaningful consumer behavioral change as gas prices go up.”

2. Improve guidance for revenue despite expectations of higher inflation

PepsiCo has also upgraded their outlook guidance and is now expecting 10% organic revenue growth for FY2022 as compared to the previous 8%.

Meanwhile, core constant currency EPS growth is maintained at 8% for the current financial year.

This is despite the management’s expectation of higher input and operating cost inflation for the remainder of 2022.

In the company’s management remark, it said, “Our updated full-year guidance reflects the strength and resilience of our categories and consumer demand trends, as well as the impact of higher than expected input and operating cost inflation for the balance of 2022.”

3. Resilient to the volatile market

Aside from that, the management has also done a great job to protect PepsiCo from the volatility in the external environment.

Hugh F. Johnston, PepsiCo’s Vice Chairman & CFO, said during the earnings call:

“We have zero floating rate debt, so we’ve insulated ourselves against that. We forward bond commodities, we insulate ourselves against that. We try to do as much as we can to create a predictable work environment so that we have – we can manage our labour costs well.”

This will bode well for the company given the rising interest rate environment.

Without any floating rate debt, this will give PepsiCo an advantage as the rising interest costs will not hurt the company’s financial performance.

4. Reward to shareholders

PepsiCo also has a good track record when it comes to rewarding the shareholders.

For FY2022, the Group continue to expect total cash returns to shareholders of approximately US$7.7 billion, comprised of both US$6.2 billion in dividends and US$1.5 billion in share repurchases.

This will translate to a forward dividend yield of around 2.7%.

It is worth to note that PepsiCo has just joined the Dividend Kings, an elite group of companies that have all paid and increased dividends for at least 50 consecutive years.

In FY2021, the company announced a 7% increase in its annualized dividend, which represents PepsiCo’s 50th consecutive annualized dividend per share increase.

PepsiCo’s recent earnings support its resilient business model

PepsiCo is an iconic brand when consumers talk about sodas and snacks.

Their resilient business model is supported by the recent earnings, which continue to demonstrate growth in the face of high inflation.

Volume was lower in their snack category, but it was primarily due to production disruptions as compared to demand.

With a gross margin of 53%, a 5-year average growth of 4.6%, and an attractive dividend yield of 2.7%, PepsiCo is a good company to add into your portfolio.

It is no wonder PepsiCo is trading at a forward price-earning ratio (PE) of 25 times, which is slightly higher than the company’s 5-year PE.

Disclaimer: ProsperUs Investment Coach Billy Toh doesn’t own shares of any companies mentioned.

Billy Toh

Billy is deeply committed to making investment accessible and understandable to everyone, a principle that drives his engagement with the capital markets and his long-term investment strategies. He is currently the Head of Content & Investment Lead for Prosperus and a SGX Academy Trainer. His extensive experience spans roles as an economist at RHB Investment Bank, focusing on the Thailand and Philippines markets, and as a financial journalist at The Edge Malaysia. Additionally, his background includes valuable time spent in an asset management firm. Outside of finance, Billy enjoys meaningful conversations over coffee, keeps fit as a fitness enthusiast, and has a keen interest in technology.